Bonds

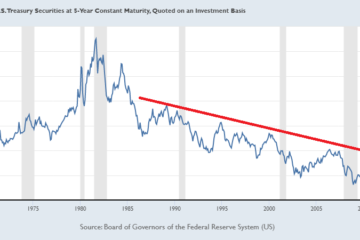

Sometimes, Things Really Are Different: Why Bond Allocations Are Now Radioactive For Investors, and Why You Need To Think Differently About Stocks

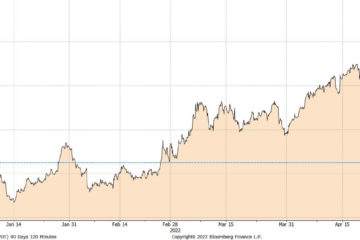

As expected, the Fed hiked rates by 75 basis points on Wednesday, with a 50 or 75-basis point hike on deck as well for July. Whatever the very temporary immediate response of the market, it focuses attention very clearly on the inflation and interest rate trajectory. For the majority of Read more…