Gold

Oil, Inflation, Bank Crises, and Gold

We wish our readers who are celebrating the holidays a joyful Easter and Passover (and in advance, we wish Eid Mubarak to those who will celebrate it later this month). OPEC+ (that is, OPEC plus Russia) made a surprise announcement of production cuts on Monday, bringing the cartel’s total cuts Read more…

Federal Reserve

Markets This Week: Fed Messaging Leaves Market Guessing

The Fed “We still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.” Jerome Powell, Nov 2 2022 By one significant measure, the Fed has succeeded. In the wake of the pandemic fiscal Read more…

Inflation

Inflation, Changing Regimes, and the End of Green Conceits

With the S&P 500 bouncing off very long support at the 200-week moving average, the stage may be set for the bear market to get a breather. Inflation remains a clear problem, but as we have been telling you for some time, inflation will eventually begin to settle back from Read more…

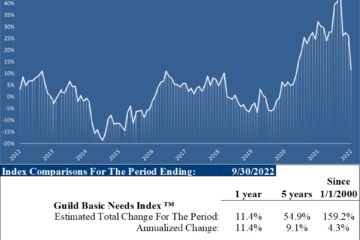

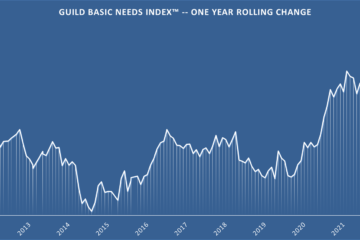

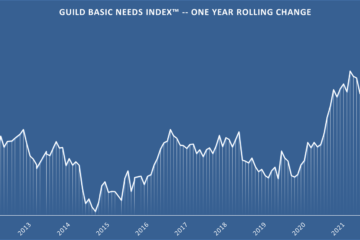

Guild Basic Needs Index

How Much Longer Before This Bear Hibernates?

Fed Chair Powell tried to channel Paul Volcker at Jackson Hole. Insiders report that the market’s reaction to his July press conference was to assume that a pivot to easier policy was coming — so he scrapped his prepared remarks for Jackson Hole and instead delivered a short, blunt message Read more…

Brazil

Currencies: The Last Piece of the Puzzle

First we reviewed the great bull/bear debate; then we gave a rundown of global stocks; last week we described our view of the positioning of the high-level asset classes. Today we’ll round out the high-level tour with some analysis of global currencies. Cash is of course one of the main Read more…

Europe

The Bull vs Bear Battle

We’ve been planning for a few weeks to write a brief rundown of the case to be made on each side of the market, bull vs. bear. The market’s pullback from its recent high, though, which began on August 16, is strengthening the bears’ case. The remarks of Fed Chair Read more…

Inflation

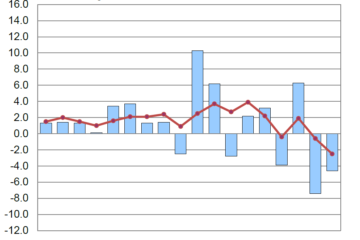

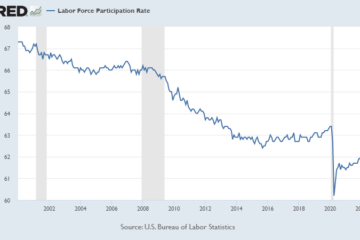

Productivity Crash: What May Be Happening, and Why It Matters

Last week the Bureau of Labor Statistics published its preliminary second-quarter report on labor productivity and labor costs. The headline numbers were worrisome — showing the second quarter in a row of sharp declines in non-farm labor productivity. The decline improved a little month-over-month, but year-over-year it was the sharpest Read more…

Employment

Jobs, Inflation, and Gaslighting

While some economic data — notably year-over-year GDP growth — are flashing “recession,” some other important data are contributing to positive investor and trader psychology, and helping maintain the current counter-trend stock market rally. It can be awhile before reality comes calling… and that means that we wouldn’t want to Read more…