The U.S. Growth Comeback Is In Its Early Innings

Here’s why we’re bullish on U.S. economic growth for the rest of 2017, and probably longer.

The Great Recession was not a standard textbook economic contraction, and the recovery has not been an ordinary recovery — neither in its structure, nor in its strength, nor in its length. The recovery has been weak and prolonged, partly because the downturn was driven by a severe financial crisis rather than the dynamics of a typical economic cycle; and partly because the policy response to the crisis put significant additional tax and regulatory burdens on American workers and businesses. The vitality of the recovery was thus somewhat suppressed. Progress was made, but it was sluggish.

After the Great Recession, the rally in equities from the market’s March 2009 bottom generated skepticism among many analysts who saw the suppressed economic fundamentals and remained cautious.

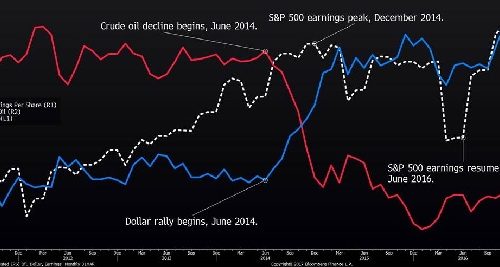

Two other noteworthy macroeconomic events also occurred and contributed to the “stalling” of U.S. corporate profit growth. First, as Europe drastically lowered interest rates to cope with its own economic malaise, the U.S. dollar rose sharply against many world currencies, appreciating about 25% between July 2014 and March 2015. Simultaneously with this sudden dollar appreciation was the collapse in crude oil prices, which between June 2014 and January 2016 fell nearly 60%.

These were sudden and violent moves. The U.S. dollar spike affected exports and the profits of exporters, and the big decline in the profits of energy-related companies affected overall U.S. corporate profits. These were combined with the suppression of business and consumer confidence by policies perceived as negative for growth. The combination impacted U.S. corporate profits, which moved sideways from the first quarter of 2015 until the middle of 2016. As the shock dissipated, though, earnings resumed their rise, and by October 2016, S&P 500 earnings had surpassed their earlier peak.

The plateauing and subsequent sideways movement of profits for S&P 500 companies corresponded in turn with the frustrating, choppy, sideways movement of S&P 500 stocks beginning in early 2015.

And the renewed growth of corporate profits that began in the second half of 2016 has produced a renewed rally in the S&P index. This is part of the reason why we believe that the rally which has followed the 2016 U.S. Presidential election cannot be viewed simply as pricing in optimism surrounding potential tax and regulatory reforms. Instead, it more reflects the relief accompanying the end of a bitter and divisive political campaign and the ongoing emergence from the after-effects of the dollar rally and oil collapse.

After a Lag, the Dollar and Oil Shocks Stalled U.S. Corporate Profit Growth…

…and That Stalled Stock Market Appreciation

Bloomberg, Guild Investment Management

Of course, we continue to watch the development of the new administration’s policies and the difficulty or ease of their progress through Congress. But we continue to believe that the current rally is fundamentally rooted in economics rather than politics.

Since that is the case, we believe that it has further to go. We see three significant factors that can help propel the current economic expansion into extra innings.

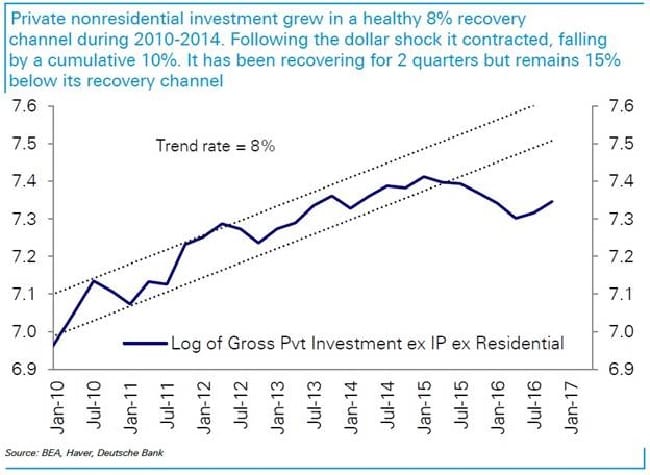

First is capital expenditures. From 2010 to 2014, capex grew at 8%. At about the same time that the S&P 500 index stalled in 2015, capex growth fell sharply out of that recovery growth channel.

Source: Deutsche Bank Research

We believe that capex will continue to accelerate towards its growth channel, which will support GDP growth more robust than anticipated by the consensus — and that in turn will continue to support corporate profit growth.

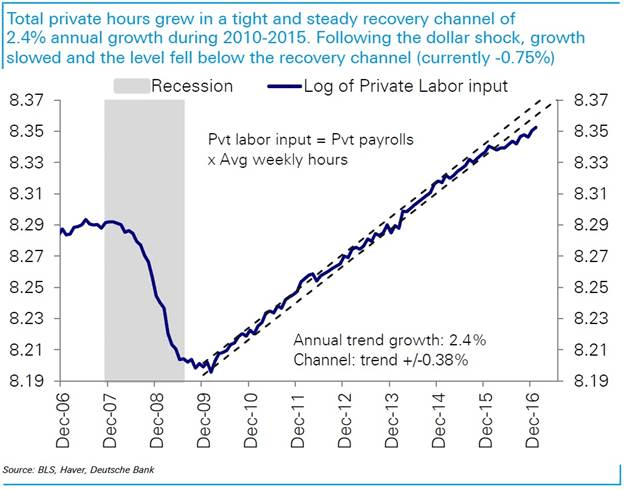

Second is employment. Higher levels of employment are needed to expand the rate of economic growth. Labor market improvement also dropped out of its recovery channel towards the end of 2015, similarly lagging the dollar’s sharp appreciation. It should regain lost ground, with payrolls and wages growing through 2017. We believe this will be supportive for the earnings of companies in the consumer discretionary sector. Although the current U.S. unemployment rate, at 4.8%, is near the level of “full employment,” it is likely that the headline rate conceals many workers who have stopped actively looking for work, but will be drawn back to the labor force by rising wages. The same is true for workers who are underemployed, i.e. those employed part-time when they would like to have full-time work.

Source: Deutsche Bank Research

Third is inflation. We have written about the green shoots of inflation often in the last months. The continued waning of the effects of the dollar spike could remove some pressure that has been damping core inflation. Rising inflation will support corporate profit growth and stock appreciation. It will also strengthen the resolve of the Federal Reserve to raise interest rates, as they begin to perceive how far behind the curve they’ve fallen — and their steadfastness in following their plans to raise interest rates will benefit many banks and other financial companies.

In short, we see convincing reasons why the rebound in growth is real; we believe that it is rooted in economic fundamentals and not just political anticipation; and it can continue through the rest of 2017. We see capex, employment, and inflation all set to gain ground and boost GDP growth, after falling out of the post-recession growth channels they had been in. This view makes us bullish on the U.S. stock market, and particularly on financial, technology and consumer discretionary stocks.

Investment implications: We continue to believe that the rally in the U.S. stock market that began last year is based on real economic fundamentals, rather than simply being a matter of politically driven sentiment. The U.S. faced two major financial and economic “shocks” in the period from 2014 through 2016 — the strong rise in the U.S. dollar from 2014 to 2015, and the collapse in crude oil from 2014 to early 2016. Today, we see several economic drivers poised to gain ground back towards their post-recession growth channels. GDP and corporate profit growth can surprise in 2017, and positive developments in tax and regulatory policy will only enhance the positive developments. We continue to be positive on the U.S. economy and stock market, and we favor technology, financial, and consumer discretionary stocks in particular.