Market Summary

The U.S. Economy and Market: For Now, Fears Are Overriding Fundamentals

The U.S. economic picture continues to be strong in spite of fears about a slowdown. From and economic point of view, strong GDP growth in the third calendar quarter of 3.5% brings GDP growth for the first nine months of the year solidly into to the 3% range. Corporate profits for the third quarter, with 60 percent of companies reporting, are up 23%, bringing first nine months’ profits up about the same amount.

Fears of a slowing of the corporate profit growth rate, and of a global economic problem probably centered in China, are causing the world stock markets outside of the U.S. to be very weak, and causing the U.S. market to correct.

In our view, several forces are working together to cause a lower market.

• Fear of a crisis in China. China’s official economic growth rate has fallen to 6.5%, and investors realize that that official statistics are likely exaggerated. In reality, growth is probably flat to rising slightly. This is not a recession, but it is a fear-creating situation; many other countries which depend on China for growth, primarily the southeast Asian countries which act as a workshop for China, will see economic shrinkage.

• Fear that a tariff battle with China will put China in a position where they cannot react and compromise with the U.S. This may be partly because of turmoil among the Chinese leadership caused by President Xi’s announcement that he was president for life and the internal resistance among the Politburo to this assertion. To put it another way China does not have a good answer to the claims of the U.S. and other trading partners that they have been taking unfair advantage with their trade and industrial policies for decades. Many believe that the Chinese economic miracle has been based on unfair practices which are now ending.

• Fear of the strong U.S. dollar. A strong dollar will make if hard for U.S. exporters to get any benefit from recent trade agreements, because the U.S. costs of production have risen so much driven by a strong dollar.

• Election anxieties. Some fear that the U.S. election will bring anti-growth forces into the U.S. government.

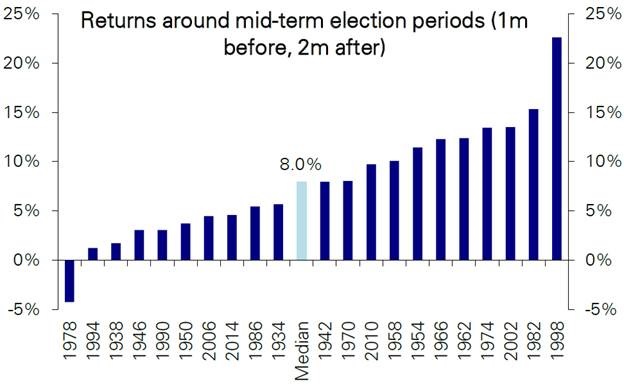

• The historical pattern that the months before a midterm election often brings a stock market correction which is followed by a rally after the election. (However, we note that according to Deutsche Bank’s chief strategist, Binky Chadha, stock market returns in the three months surrounding mid-term elections — one month before through two months after — have been up an average of 8%, with only one down market in this period over the past 80 years. See the chart on the previous page.)

Source: Deutsche Bank Research

We have listed the fears; now let’s mention some positives.

• U.S. stocks in the S&P 500 have seen their price-to-earnings ratio (based on next year’s anticipated earnings) fall from 19.5 in January 2018 to about 15.5 today. This puts the market forward price-to-earnings ratio below the historical valuation average of about 17.

• Corporate profits in 2019 are expected to rise by 5–10%, and that is a respectable earnings growth based on historical standards. This is well below the 23% that corporate profits are rising this year, but well within the range of normalcy. It has been well-known since late 2017 that the benefit of lower taxes, repatriation of foreign earnings, and reduced regulations will not be repeated in the future.

• Good news possibly arriving on Brexit and from China. Britain’s chief Brexit negotiator, Dominic Raab, says there will be a Brexit deal by November 21. Very bullish, if true, for Europe, Britain, and the world markets.

• Xi Jinping made comments this week that some government-owned sectors of the economy have not been performing up to expectations, and that this underperformance will be addressed and rectified. China has recently created liquidity for credit expansion. Such behavior in the past has resulted in economic growth impact in about nine months. China’s efforts to re-stimulate the economy will, in our view, improve the global outlook for Chinese growth immediately.

When the U.S. market begins its rally which may be happening this week, we expect growth companies in many industries to participate. This will be due to rising income per capita for U.S. consumers, and continued growth in technology-oriented sectors and in other sectors where companies are implementing more technology. Our favorite sectors and industries for a market rally of any length include retail, travel, technology related financial services, big-growth tech, pharmaceuticals, medical services, consumer non-durables, entertainment, and media. We are avoiding sectors that are hurt by a strong dollar and by weakening demand from abroad.

The Global Economy and Market

As regular readers know, we have been avoiding Europe, Asia and the rest of the world for many months, and in the case of some regions, for years. We see the current banking crisis in Italy, the unwillingness to have a smooth Brexit, and the outlook for weak growth in China as reasons to continue to avoid markets outside of the U.S. We will notify readers if and when this view changes

Gold

As inflation is heating up in much of the developing world due to the weakness of their currencies versus the U.S. dollar, we note that gold, while not breaking out of its trading range, is moving more towards the top of the range. We will continue to keep an eye on gold.

Cryptocurrencies

A U.S. citizen recently pled guilty to money laundering charges and faces five years in prison for conducting cash bitcoin transactions through the LocalBitcoin.com website. He received U.S. currency, stored it in Mexico, and purchased bitcoins first on U.S. exchanges, then later on Asian exchanges. Another user of the site fell foul of authorities back in June, and was sentenced to a year in Federal prison for similar offences. The rule of law continues to impinge on the crypto wild west, which is good for potential crypto investors.

Thanks for listening; we welcome your calls and questions.