As we come closer to year end, U.S. markets remain, as of this writing, within a percentage point or two of their all-time highs. We have come a long way since the first reports of a new SARS-like virus began to percolate into public awareness in January 2020. The world has certainly changed irrevocably since then. Many economic, financial, social, political, and technological trends have been drastically accelerated. The money supply has expanded at a rate that has eclipsed easing regimes of the past. The Great Recession had reset expectations for supportive crisis response from governments and central banks, but they have exceeded those expectations handily — delivering extraordinary interventions to bolster markets, businesses, and consumers.

These interventions saved the patient — global economies and markets — from cardiac arrest. In the 21 months since the Fed crossed the Rubicon and underwrote the U.S. commercial paper market, and the U.S. government delivered trillions in helicopter money to consumers and corporates, technological resilience and medical science have together brought the patient back from the brink.

In Essence, the Pandemic Crisis Is Over

The long-term effects of the pandemic are still developing, but in a real sense, the “acute” phase has now passed. Some signs: the market’s panic about the omicron variant was brief. Commentary from health officials has been suitably cautious, but many analysts quickly zeroed in on comments from physicians on the ground in South Africa that suggested omicron was more infectious, but less virulent. The alarm did not last long, and markets bounced back quickly. Vaccines have underwhelmed, given the high expectations that accompanied their rollout; they do not prevent infection or transmission, their duration is limited, boosters will be necessary, and troublesome data about adverse events continue to percolate around the edges. But the psychological trend is clear: though there may be some influential figures who for their own reasons would like covid anxiety to persist, the general attitude (particularly in the United States) is shifting towards an acceptance of covid as a nasty, endemic seasonal respiratory virus of most concern to the elderly and sick. Increasingly, the pandemic itself is in the rear-view mirror, even if pandemic fear lingers and vaccines cause controversy.

Focus Shifting to the Fed

That shifts investor attention elsewhere — particularly to the forward path of the Federal Reserve. Market performance since the pandemic bottom has been robust, driven by the potent combination of monetary and fiscal easing. That environment will now begin to change. We believe that while easing in 2020 and 2021 was a rising tide that lifted most boats, 2022 presents a different prospect — likely more volatile and more differentiated among assets, sectors, industries, and companies. It will be a period of “digestion,” and likely one with relatively little forward movement for markets as a whole, but many periods of volatility with dips that should be bought, and ramps that should be sold.

Inflation and Disinflation — The Tug of War Continues

One of the central features of the hangover from pandemic easing policies is obviously inflation. We are now long past the transitory/non-transitory debate: and team transitory lost. However, we believe that extreme views on either side are not tenable.

The inflation impulse from massive fiscal and monetary stimuli will decrease, perhaps more sharply than anticipated as the Fed acts (too late and too quickly, perhaps) to avoid an even more severe “accident” that might transpire if it permitted a wage/price spiral to get out of control. There is some evidence that China is finally stepping into a greater easing mode, lowering reserve ratio requirements for banks and easing the path for local governments to lever up through debt and land sales; this might help blunt the global effects of a stimulus pullback in developed economies.

From a longer-term perspective, disinflationary trends that were already well-established before the pandemic — financial, technological, and demographic — have only been intensified by the events of the past 20 months. The pandemic has pulled forward years of disinflationary technological progress, and governments have engaged in a debt orgy that will, on balance, crimp economic growth moving forward, if history is a guide.

We anticipate that in 2022, while inflation will remain stubbornly high compared to trends of the past two decades, it will moderate significantly from its recent blistering pace, as stimuli are pulled back and as supply chain disruptions are normalized. Neither of these processes will be neat, simple, or easy, and both have the potential to cause significant market volatility.

There will continue to be unanticipated knock-on effects of supply chain disruptions, as a kind of ongoing master class in the intricate interdependence of the globalized economy. Who knew, for example, that the emissions control ingredient now universal in diesel-powered trucks (DEF) is largely comprised of urea, and therefore in competition with fertilizer production? With China producing 30% of the global supply of DEF, and shutting down exports as it faces its own pressing need for sufficient agricultural production, some countries (particularly Australia) might get a fresh reminder of how much our “just in time delivery” system depends on long-haul trucking. This is one example of how the non-core, volatile components of an inflation basket might continue to bite, even while the “core” basket becomes more tame.

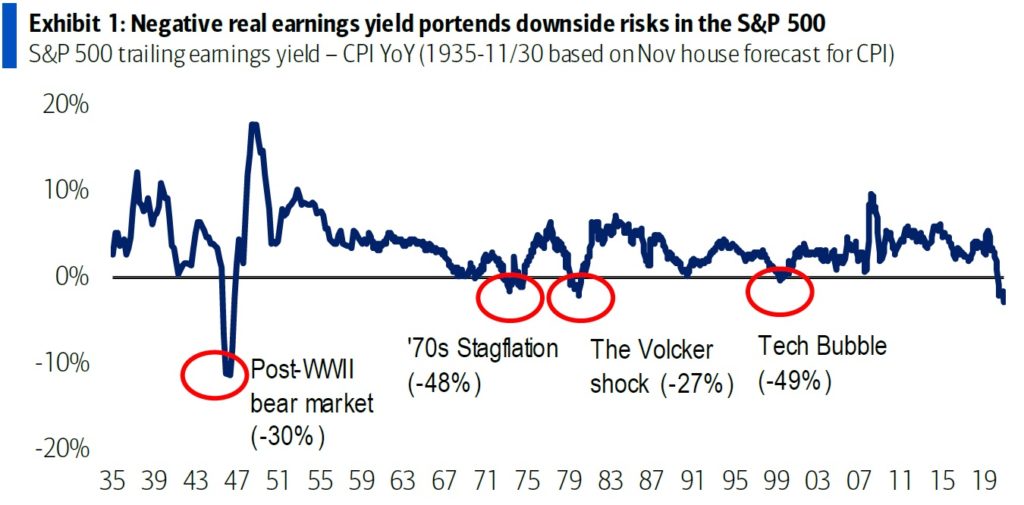

Indeed, any time the real earnings yield of the S&P 500 has dipped into territory as negative as the territory where it now resides, it’s been a signal that volatility is coming.

Source: Bank of America Research

We believe that on the positive side, genuine economic vitality under the hood, and continued positive financial conditions, do help to balance the picture somewhat.

Political Turmoil

Of course, the political landscape presents another reason why 2022 might be less of a smooth ride than the pandemic era rocket sled has been so far. It’s a midterm year, and historically, those are volatile. (You may recall that 2018 was not a kind year for U.S. equity markets as a whole.) The sitting president, like his predecessor, is deeply unpopular, and opinion trends are not favorable to him or to his party. The weak majority of that party may well suffer a rebuke from voters dissatisfied with the economy, and particularly with inflation — which, for volatile non-core items that make up the real basket of household necessities, will continue to hurt lower- and middle-income voters disproportionately. (Our in-house measure of that “real-world inflation basket,” the Guild Basic Needs Index, has been tracking the pain, and we’ll bring you an update soon.)

Cryptos

Another area that we think merits particular attention is the world of digital assets. The current speculative mania in NFTs — so called “non-fungible tokens,” unique digital assets held on a blockchain — is part and parcel of a speculative fervor that is expressing itself in many other venues — from Robinhood [RH] retail traders in options, to online sports betting. “Found money” — whether that is helicopter money delivered from the federal government, the crypto wealth of early adopters, or other speculative windfalls — has proven to be an immense stimulus to further speculation. It seems to be an addictive form of entertainment.

That’s a bubble that will burst. But we note that Bitcoin itself is an unusual bubble, which has seen several bursts, and has recovered from them to move on to further new highs. Here, “buying the dip” might be a wise thing or a fool’s errand depending on your definition of a “dip” and your time horizon.

The Bank of International Settlements — the central bank of central banks — recently published an in-depth critique of DeFi, “decentralized finance,” and the dangers it poses to global financial stability. Notably this analysis immediately followed their October examination of central bank digital currencies — which predictably lacked a parallel examination of the risks to global financial stability that central bank intransigence might pose. Beyond the speculative mania that accompanies such phenomena as NFTs, a deep conflict is ongoing, between the digital vision of the world’s central banks and monetary authorities, and the digital vision of the proponents of decentralized cryptos. That battle will continue to evolve — and will certainly be affected by inflation and by the ongoing ramifications of pandemic-era radical monetary and fiscal policies.

Investment implications and Attractive Investment Sectors for 2022:

We would not be surprised to see economic growth in 2022 return to a rate more in line with history than 2021, and we think that the assets that will grow most in price will be stocks with moderate P/E ratios and solid, visible earnings growth. We favor certain sectors which are enumerated below.

2022 will likely be a year of rotations and volatility. Interest rates will likely rise, and companies which benefit from higher interest rates will benefit. In general, we believe that lingering supply chain issues suggest a bias towards consumer, business or financial services rather than goods. We would therefore use volatility as an occasion to buy our preferred themes in tech — software, business automation, cloud services, cybersecurity — at a more reasonable price, rather than chasing near all-time highs. While the withdrawal of stimulus will challenge price-to-earnings multiples for many of the market darlings that have reached stratospheric valuations, there are still pockets of growth at a reasonable price, and any sharp corrections will create more. Here we’d be attentive to tech-adjacent disruptive themes, particularly in healthcare.

Speculators can trade in cryptos and NFTs while the speculative fervor lasts, but we would be looking for attractive entry points in robust crypto networks that have demonstrated their resilience in the face of significant shifts of hash-power — our favorites are BTC and ETH.

With persistent inflation, real assets — including tech-related materials, some precious metals, and real estate — should be high on investors’ watch lists to buy on dips.

Thanks for listening; we welcome your calls and questions.