The rollout of 5G wireless internet presents an enormous economic opportunity, since it will involve the construction and deployment of hundreds of billions of dollars’ worth of infrastructure, and ultimately enable the creation of trillions of dollars’ worth of economic value. The companies that provide that infrastructure will be some of the prime beneficiaries of the historic shift of the “fourth industrial revolution,” the advance from simple electronics to ubiquitous artificial intelligence. 5G will facilitate the real arrival of the “internet of things,” as it creates the bandwidth and speed necessary for billions of embedded smart devices to get the data they need, even when they’re far from wired internet access. Big themes such as autonomous vehicles will rely on 5G in t heir implementation. When you view 5G through the lens of this revolution, its significance becomes apparent.

On top of the historical and economic significance of 5G is a further layer — its geostrategic significance, which has become more apparent in the current climate of tension between the United States and China as poles of the world order.

China and the U.S.

Capitalism emerged triumphant with the collapse of command economies at the end of the 20th century, and China’s adoption of capitalism as an economic model was a key part of that triumph. In spite of the dalliance of some of the American electorate with “socialism,” it’s only an insignificant minority that really wants anything other than a European-style social-democratic amelioration of the perceived excesses of laissez faire — they are still capitalists at heart. On the other hand, although China embraced capitalism, it did not embrace the liberal political model that has accompanied it in the west. Instead, China has emerged as the chief global proponent of a wholly different form of capitalism — a capitalism hybridized with an illiberal, authoritarian political regime.

The trade conflict that the current U.S. administration has brought to a head over the past few years, beyond the showmanship and grandstanding, has clarified to many observers that these are the choices going forward: Chinese-style authoritarianism, or western-style liberal democracy with all its foibles and failures. (Intelligent strategic thinking on the part of western policy-makers is, and should be, focused on making sure that the superiority of the liberal democratic model is made clear.)

The Place of 5G — and Worries About Huawei

This is the bigger political, historical, and economic context within which the fourth industrial revolution is occurring, and within which its backbone, the 5G wireless network, is being built. There are stark choices to make in the construction of this network, because of the dynamics of technological adoption. The first movers in such a technological shift may be able to set the stage in a way that benefits them in perpetuity — if they are able either to establish standards that later network participants have to adopt, or if they are able to embed a dependence on proprietary technologies into the system’s backbone. Either way, they can create dependence on their own companies and their own supply chains, ensuring that a disproportionate share of the wealth created flows in their direction.

The nature of digital technologies adds a further geostrategic element to this problem. A year ago, we reported to you on the concerns that were voiced by many western analysts about the dominance of China’s tech powerhouse Huawei in the construction of the underwater cables that carry much of the world’s intercontinental internet traffic. We wrote:

“Many intelligence analysts and agencies around the world are concerned that Chinese tech giant Huawei, as it sells hardware, software, and services around the globe, is working hand-in-glove with the Chinese government to further its geopolitical ambitions. These concerns are not limited to the present U.S. administration; even where the U.S.’ developed-world partners seek to distance themselves from current U.S. foreign policy priorities, they quietly concur in worrying about Huawei’s role and influence. (EU officials, acting against U.S. pressure, just decided not to recommend a ban on Huawei’s participation in the continent’s next-generation broadband buildout. But individual European officials have frequently voiced caution.)

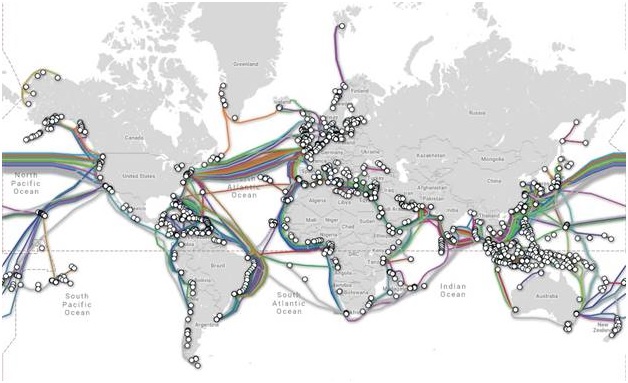

“Now that concern is getting a new focus: undersea cables. Huawei Marine Networks, 51% owned by Huawei, is expanding its presence in the global network of undersea cables that carry 95% of the planet’s intercontinental voice and data traffic.

A Map of Global Undersea Data Cables

“Undersea cables pose several potential security threats. They could permit the company which laid them to install devices which monitor or divert data clandestinely. Readers may recall the case that broke [in late 2018], in which it was alleged that Chinese manufacturers, at government behest, installed nearly undetectable spy chips in servers sold to various U.S. tech leaders, including Apple [NASDAQ: AAPL] and Amazon [NASDAQ: AMZN]. Careful data forensics detected that the hardware was compromised, but the event served to underscore the significance of hardware security (something that can be lost in the public’s attention on software hacks).

“Undersea cables are also significant because they are potentially not just vulnerable to spying, but could be weaponized in the case of a conflict — hampering or perhaps even completely shutting down data traffic to an isolated country. Since the vast majority of data move between continents via undersea cables, the presence of satellite links would do little to compensate for the impact of this kind of attack.

“The problem is set to become more acute in coming years, as the arrival of 5G technology will fuel ever-greater demand for data transmission that will need a lot of cables to be laid. About a quarter of the cables completed between 2015 and 2020 will be laid by Huawei Marine.”

Huawei: Leading the 5G Race

The same concerns that analysts have voiced about Huawei Marine apply to the parent company, and particularly to its role in the global rollout of 5G networks on land.

Thanks in large part to the Chinese government’s patronage, Huawei has achieved early dominance in providing 5G solutions worldwide. This is one reason why the U.S. administration has leaned so hard on its allies to shut Huawei out of their 5G plans. However, it has failed so far in some big-ticket cases in Europe, because Huawei is alone as a provider of comprehensive 5G solutions at scale and at a price better than its unsubsidized western competitors can match. No other single vendor can offer the cost-effective turnkey solution that Huawei can.

The risk seen by western analysts is that the embedding of proprietary Huawei hardware in the backbone of 5G systems will provide an unpredictable intelligence advantage to the Chinese government in its pursuit of geopolitical dominance. Huawei spokespeople have protested strongly that the company is not an agent of the Chinese government, not beholden to it and not serving its interests; but these protests are largely discounted by western analysts. The connections that exist are too close, and the stakes are too high, to rest comfortably in a situation in which Huawei becomes an integral and inextricable part of the next-generation network that powers the internet of things and enables ubiquitous AI to enter every facet of daily life.

Promoting Alternatives to Huawei’s Dominance — And the Companies That Could Benefit

The U.S. and its allies are undeniably behind in this race. Fortunately, there are bipartisan efforts afoot in the U.S. Congress to promote a new approach to the problem. The administration, so far, has floated or backed several approaches that have sputtered. Back in 2018, members of the National Security Council floated the idea of nationalizing 5G, but due to resistance from the Federal Communications Commission and the U.S. wireless industry, that idea was dropped. In 2019, a suggestion was floated by some administration officials to create a wholesale 5G network that all providers could share, but this too fell flat.

Most recently, a bipartisan group of U.S. senators has introduced an act that would provide incentives and support for U.S. companies, as well as western companies generally, to develop a so-called “open architecture” model for 5G that would obviate the need for proprietary hardware, instead virtualizing many network functions in a way that would permit dedicated hardware to be replaced by software. The White House recently announced, through a Wall Street Journal interview with Larry Kudlow, that it was throwing its weight behind a similar plan, getting together a consortium of U.S. tech leaders — including Microsoft [NASDAQ: MSFT], AT&T [NYSE: T], Dell Technologies [NYSE: DELL], and Oracle [NYSE: ORCL] — to accelerate such open-source solutions. The interview did not mention Cisco [NASDAQ: CSCO], but they are another obvious contributor who the plan’s architects should want to bring on board.

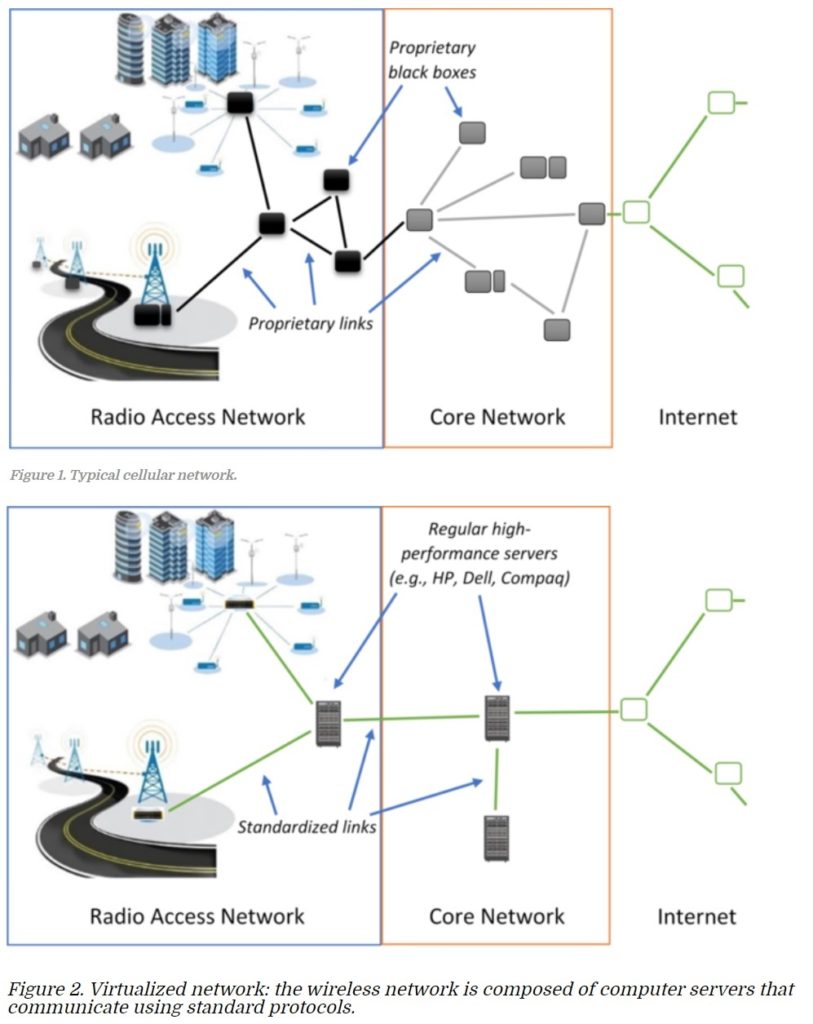

Legacy Networks Vs. Virtualized Networks: No More Black Boxes

On the face of it, this solution is a better competitive option than the previous efforts. It plays to the strengths of western companies, and presents obvious economic and technological advantages. There would still be significant challenges getting the participants to talk to each other, with their very different forms of technical expertise. Western providers of critical hardware elements of this solution, such as Ericsson [NASDAQ: ERIC] and Nokia [NYSE: NOK], will have to integrate their solutions with software architects from the U.S. tech leaders. But the appeal of the project is obvious — not just for the companies mentioned thus far, but for western and western-allied hardware manufacturers such as Qualcomm [NASDAQ: QCOM] and Samsung [OTC: SSNLF].

Currently, Japanese telecom upstart Rakuten [OTC: RKUNY] is preparing to launch a virtualized 5G network in Japan operating on these principles. (The launch had been scheduled for the end of 2019, but was delayed, illustrating some of the technical challenges.) It will be worthwhile to investors to monitor the success of such tests, the progress of U.S. legislation providing R&D support, and the progress of the U.S. administration’s efforts to corral hardware and software leaders into an effort to catalyze a western-based alternative to Huawei.

Investment implications: 5G wireless will be a critical part of the backbone needed for the flowering of the fourth industrial revolution and the penetration of artificial intelligence into our daily lives. The models and the companies that succeed in the race for global 5G dominance will reap huge rewards, and the role of western and Chinese companies in this process will have global geostrategic ramifications. There are efforts underway in the U.S. government to create a winning coalition of western companies to challenge Huawei’s lead in 5G — and investors would be well-served to watch that process closely and study the potential beneficiaries we have mentioned.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. Currently, Guild’s clients own AAPL, AMZN, CSCO, MSFT, QCOM, and T. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.