As we noted last week, we believe that as 2021 progresses, we will have a drumbeat of increasing analyst expectations for GDP growth and economic activity. The past year’s pandemic-driven economic gyrations have been so severe that economists and macro strategists — who as a group are not the most reliable forecasters even at the best of times — are facing a situation which could be described as a “wide dispersion of possible outcomes.” In short, there is more scope than usual for reality to differ markedly from their analysis and expectations. This is especially true for Federal Reserve and government analysts, who are reliably behind the curve under normal circumstances.

We see many signs that reality is outstripping lagging, cautious expectations. For us, the groundwork was laid last year as it became clear to us that a combination of good fortune and rapid medical innovation had taken the worst pandemic outcomes off the table.

Since then, we have consistently seen economic and sentiment data points showing greater strength in the recovery, at the same time that we observed ongoing extraordinary monetary and fiscal stimuli. We have believed that the scope of stimulus was important — but that even more important was its difference from the post-2008 stimulus. Specifically, by underwriting commercial bank lending activity, and by putting stimulus “helicopter money” directly in consumers’ and small business’ hands, the Fed and the Treasury in tandem have caused money to flow much more readily into the “real world,” rather than remaining siloed in the financial markets. (This is, after all, the real goal of stimulus.) We believe it will therefore be much more potent in sparking growth, and eventually, real-world inflation.

Bullish Economic Data

The data continue to bear out this thesis. Here are a few recent points.

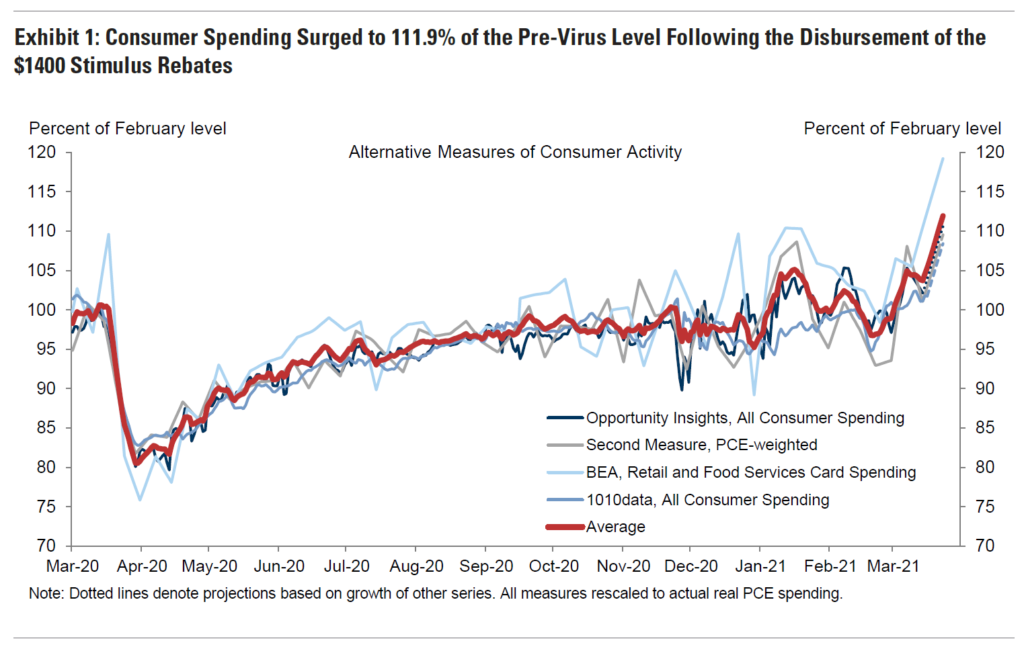

Consumer spending spiked to 111.9% of pre-pandemic level, following the most recent round of “stimmy checks”:

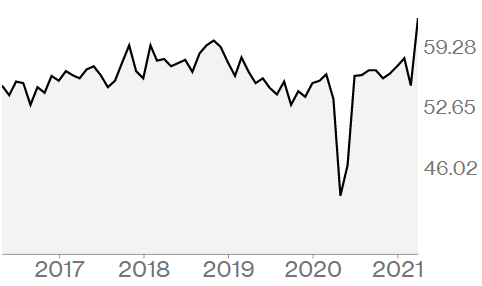

Employment is stable after strong improvement, although total workforce participation remains depressed:

Hiring by small businesses is particularly robust, with 1.1 applicants per opening and a record 42% of small business owners reporting an inability to find skilled workers for particular jobs:

And the ISM services index — a measure of business owner sentiment and expectations in services industries — spiked to 63.7, its highest-ever reading. This is particularly noteworthy because services industries were among the hardest-hit by the pandemic:

California has announced its roadmap to total reopening, and other states will soon also follow the lead of Texas and Florida in reopening, if it becomes apparent that deaths and hospitalizations continue to decline. (California’s leaders are receiving a “nudge” from a disaffected populace in the form of a recall drive to replace Governor Gavin Newsom, but the trend to normalization is nationwide.)

Of course, while economic activity is accelerating, fiscal and monetary stimuli are continuing:

What’s not to like? This is basically a bullish picture, and we are basically bullish. The bullish fundamentals do, to some degree, justify the market’s exuberance, but we note that it is exuberant, and a correction is possible at any time. Those who are tactically oriented should buy the dips.

What could precipitate a correction, or a deeper reassessment by market participants?

Inflation

Inflation of course is one possibility. As we noted recently when we re-introduced our in-house inflation gauge, the Guild Basic Needs Index, inflation statistics are notoriously subject to manipulation. And there are many statistics to look at.

The CPI (Consumer Price Index) is the most common; it measures the change in prices paid by urban consumers for a certain basket of goods. The PCE (Personal Consumption Expenditures Index) is another one that you will see frequently, and one to which the Fed has shifted its attention. The PCE also measures changes in the prices of a basket of consumer goods, but that basket is updated monthly, and thus it represents consumers’ adaptation to price movements with greater sensitivity. That means that it probably understates inflation even more than the CPI, as consumers shift their purchases to items that suffer less from inflation. Besides these, there are surveys to gauge inflation expectations, of both consumers and businesses. Finally, there are analyses of bond and derivative markets which can gauge how market participants believe inflation will develop in the future.

However, given the “wide dispersion of possible outcomes” that we noted above, there is a lot of disagreement about the course inflation will take in 2021. Some analysts, including the Fed’s, believe that inflation will be “transitory,” peaking before the middle of the year and then declining again. We do not believe this will be the case.

Inflation and Redistribution

Inflation is extremely complex, with all due respect to Milton Friedman’s famous dictum that it is “always and everywhere a monetary phenomenon” (i.e., simply a consequence of money creation). Interestingly, inflationary episodes often seem to follow on large-scale wealth redistribution efforts — which was certainly the case in the 1970s, following the launch of many social programs in Lyndon Johnson’s Great Society initiatives. Right now, a strong political effort is underway to take the pandemic relief effort as an opportunity to press redistributionary policy changes. There is remarkably little political appetite on either side of the aisle to resist this siren call. Intuitively, the relationship between wealth redistribution and inflation makes sense, as redistribution permits effective demand to be expressed by a large mass of consumers who otherwise cannot express such demand in a way that affects overall prices. We will see if this pattern holds as current policies unfold.

Of course, if inflation does rise faster and farther than the Fed wants or hopes, investors have options in inflation-sensitive industries and companies. But they will have to be nimble enough to shift the allocation of their portfolios accordingly.

Other Potential Risks

We have noted some other potential risks besides inflation, such as a “tax policy accident.” Under the current circumstances of robust growth and stimulus, we do not think that a tax policy shift is likely to be catastrophic enough to derail markets — but it could precipitate a correction.

Finally, we should note that there are building geopolitical risks. The Biden/Harris administration is facing its first significant foreign policy challenge as Russia builds up forces on its border with Ukraine. While we do not believe that Russia has the appetite — or capacity — to provoke NATO, it seems to have an understandable existential opinion about Ukrainian NATO membership. We hope that the Biden administration can manage the situation effectively. There is also the prospect of unilateral action against Iranian nuclear capability by Israel, which Israeli Prime Minister Netanyahu has put on the table in the event that the U.S. rehabilitates the Obama administration’s nuclear deal. Again, we believe the risk is small, but the impact on markets would be significant.

Investment implications: As difficult as it may be in a polarized political environment in the U.S., and while for many, pandemic anxieties have not been assuaged, investors should resist the temptation to pessimism. Markets are exuberant for a reason: economic recovery that is stronger and faster than most analysts have expected, coupled with ongoing strong stimulus that may be finding its way into the real economy more directly than stimulus efforts in the past. For long-term investors, we suggest “staying the course” with portfolio adjustments to cyclical sectors, and with an increased allocation to inflation-sensitive assets. For tactical investors and traders, we suggest “buying the dips” rather than chasing recent highs.