Last week, on the occasion of the 50th anniversary of our firm, we reflected on the many ways in which current events and trends “rhyme” with the events and trends of the early 70s — from war and energy convulsions, to political turmoil and demographic transformation, to monetary chaos and the advent of world-changing technology. In many ways the events of that decade have shaped the world we now inhabit.

To be clear, as we also emphasized last week, we see events that are merely rhyming — not a blow-for-blow replay that would allow confident predictions about the trajectory of events moving forward from here. Primarily, the comparison is an alert — forces are at work that will result in profound financial and economic changes that are of direct interest to investors.

Investors who were slow to adapt to the changes wrought by the 1970s experienced a lengthy, volatile, and painful period. Those who adapted more quickly prospered.

Drawdowns In 60/40 Stock/Bond Portfolios… Longer and More Frequent Than Commonly Believed

Source: GMO Research

The chart above (which only runs through the end of 2020, and thus does not show the covid crisis and its aftermath) demonstrates a point we have often made. It is true that passive investing — in which an investor doesn’t try to adapt to changing social, political, financial, and economic conditions, but just “stays the course” with a constant strategy — works out in the long run. But it turns out that that “long run” is actually so long — often 20 years or more — that it’s of no real, practical use. The likelihood is very high of life events during those 20 years that will require you to access your passively managed funds during a drawdown — and make the recovery period even longer and more painful (if you ultimately recover at all).

Periods of profound change will have a deep and lasting effect on your investment portfolio — positive if you can harness that change, and negative if you fail to do so. The 1970s were that kind of pivotal period — and we believe the present time is also.

The Second-Order Effects — of Inflation

The world is a complex system, and so the most important effects of an event or trend are higher-order effects — that is, it’s often not the immediate and obvious effects that matter the most. Inflation is a key example. Besides the impact most immediate to consumers — the erosion of their purchasing power — inflation initiates a cascade of deeper effects on the financial system, financial and economic decision-making and outcomes, and business decisions and performance. Today, though, we want to point out some even more intractable and hard-to-predict higher-order consequences of inflation — the political consequences.

The inflation of the 1970s had profound political effects, but they did not unfold as we might have expected. Intense voter anxiety and frustration about inflation and economic malaise led first to heavy-handed measures (such as the wage and price controls we mentioned last week) and then to the election of Jimmy Carter. The Carter administration carried forward an interventionist economic mindset, coupled with an inward-looking gaze — a posture of foreign policy retreat, which emboldened and enabled illiberal regimes to take power in many parts of the developing world. Perhaps the signal humiliation of this era was the victory of Islamist radicals in the Iranian Revolution and the debacle of the U.S. embassy hostage drama in Tehran.

With the U.S. prostrate before the new energy cartel, in retreat globally, suffering from anemic economic growth, and — worst of all — still under the heel of inflation, the stage was set for the next act of the play: the “Reagan revolution.” Although it took a further several years — and a recession — for inflation to be tamed, the frustration of American voters had finally reached the point where they were willing to suffer the consequences of the Fed policy that slew the inflation dragon (thank you, Mr. Volcker). That frustration reached the point where it put an end to the policy trajectory of most of the post-war period, and ushered in a new era of laissez faire. The U.S. was not alone — the U.K. followed nearly the same script under the Thatcher administration.

What followed was extraordinary, and in some respects, created the contours of the investment world we now inhabit. Inflation created voter dissatisfaction. Voter dissatisfaction ultimately led to a mandate for thorough-going reform of the high-tax, high-intervention model of government — as thorough-going as it was practical to implement in the U.S. of the 1980s. That tax reform put more investment capital in private hands, and increased the rewards that would accrue to it. Private capital invested in that decade and in the decade that followed was put to work exactly where the most promising and transformational opportunities were to be found: the mainstreaming of computing technology that had emerged with microprocessors in the late 60s. This accelerated the arrival of the commercial internet.

In these difficult times, where distressing economic, financial, and social trends abound, what higher-order effects might be unleashed by the eventual dissatisfaction of the voting public with dysfunction and stagnation? A new period of inflation is just getting underway, but so far the political response, although quite different from the initial response in the 70s, rhymes with that earlier era. Let’s see if the response that comes in reaction also rhymes with the old melody.

Investment implications: Ultimately, we believe the investment opportunities created by the emerging new inflationary environment are likely to bear resemblances to those that emerged from our last major bout of inflation and economic malaise. In various ways, the voting public will make political demands — of elected officials or of other policy-makers — that encourage and facilitate the development of technology. Investment in technology did not slow after the 70s and 80s. However, we expect a further acceleration in technology spending to occur soon. Some of this effect may occur as it did in the 70s and 80s, when investment capital funded the tech start-ups that eventually gave commercial realization to the technological promises of a decade earlier. Although the immediate market outlook will be tumultuous from time to time, we think this trajectory will prevail and will be critical to investors’ fortunes. We have yet to see anything like a full real-world commercial application of artificial intelligence and the internet of things. Despite near-term volatility, the companies that enable this next wave of digital transformation will be prosperity engines as significant as the tech stalwarts of the 90s.

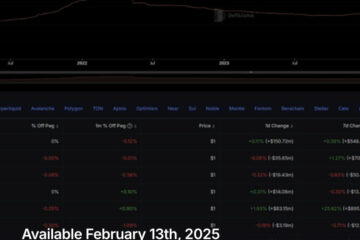

Public demand rooted in inflation is also likely to facilitate further innovation in digital assets: centralized and decentralized cryptos, fintech, and NFTs. (NFTs, or “non-fungible tokens,” are a form of collectibles ownership, typically of digital collectibles, maintained on a blockchain.) Nascent digital assets such as NFTs are likely showing speculative excess, but the technologies underlying them will likely spread and grow, creating significant investment opportunities. In our view, platforms and protocols facilitating the creation and exchange of tokens representing financial securities or real-world non-fungible goods are especially important to watch, and will remain so even if the current run-up in crypto proves to be a speculative bubble soon to pop.