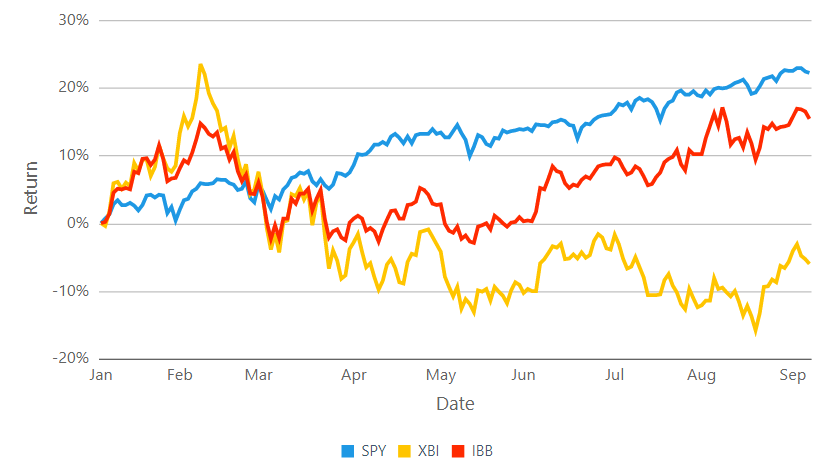

Since it peaked in February, the U.S. biotech industry has endured a slide that has taken it into bear market territory for the year. Retail investors typically approach this industry through two exchange-traded funds: the SPDR Biotech ETF [XBI], which is equal-weighted, and the iShares Biotech ETF [IBB], which is market-cap weighted. Both of these ETFs are now significantly lagging the broad market. XBI is down on the year; IBB’s positive year-to-date performance is accounted for almost entirely by its holdings of covid-vaccine makers Moderna and BioNTech, which together account for more than 13% of its underlying index. In short, after a pandemic-driven explosion last year (in 2020, XBI returned 48.2%, and IBB 25.9%), the biotech industry as a whole has entered a bear market, decoupling from other industries, such as software, with which it has historically tended to trade.

What’s going on? Is this an opportunity for investors to buy valuable innovation on the cheap, while Mr Market is having a hangover — or is there trouble brewing that makes the decline rational and the path forward riskier than some believe?

Biotech Basics

As with many innovation-rich industries, institutional investors who can get exposure to biotech companies before they reach public markets are at an advantage. Public biotechnology stocks are at the mercy of two important phenomena: sentiment and the availability of capital.

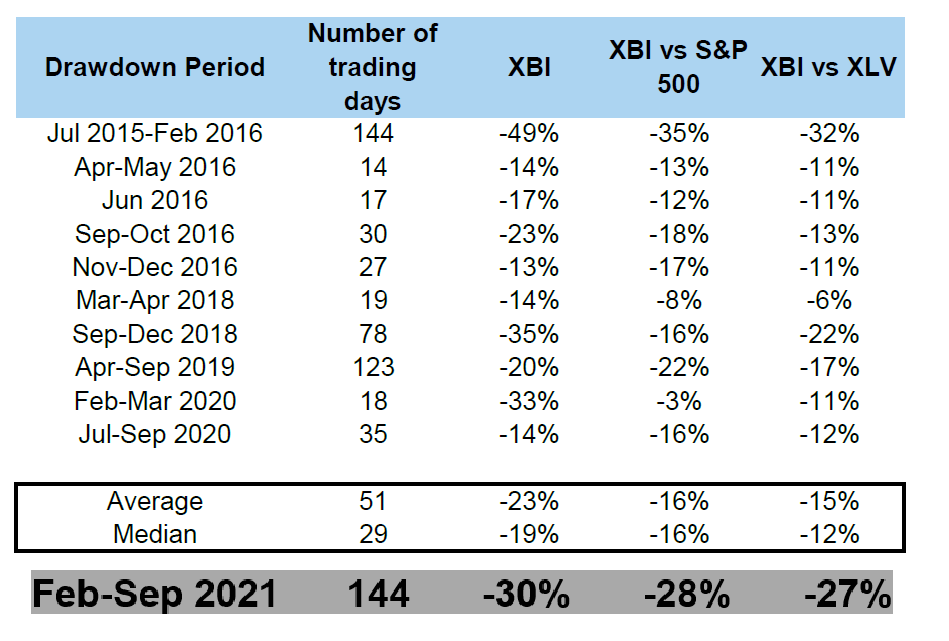

An investor who watches biotech over the years will see that the industry enjoys periodic booms and busts of investor sentiment — and often these seem only tangentially related, if at all, to any identifiable financial or regulatory trends. There are times when market participants are excited about biotech, and times when that excitement wanes. Clearly last year was one of the former; clearly we are now in the midst of the latter (and this time, the connection to real-world events in the form of the pandemic is also obvious). The current souring of market participants on biotechs is a little sharper than usual, however. The chart below, from mid-July, compares the current biotech bear market with similar episodes in recent years. It has been longer and deeper than most — especially in comparison to the broad S&P and to the healthcare sector.

Obviously investor sentiment has soured; what about the availability of capital? Many biotechs, especially smaller and clinical-stage biotechs, burn copious amounts of cash on their way to the hoped-for goal of a therapeutic home run. Pandemic-era policies have ensured abundant liquidity and have boosted risk assets. However, mergers and acquisitions activity, which one would expect to pick up under such conditions, has been muted for biotech. This is a major negative for retail biotech investors, since such buyouts are often big profit-makers for retail investors who buy individual biotech stocks, and bolster the perception of the industry as a whole. What’s causing the M&A slowdown? Some has to do with biotech volatility; buyers are waiting for things to calm down. However, some has to do with increased concern among biotech executives, noted by some analysts, about a more stringent approach to M&A on the part of the Federal Trade Commission. That leads biotech executives to lean towards smaller, bolt-on deals, rather than big, exciting, transformative acquisitions that could help re-spark investor enthusiasm for the industry.

Regulatory Uncertainty

This brings us to the topic of regulation, another big component of sentiment on the biotech industry. There are some other things happening on the regulatory front that are also leading investors to be more cautious. For example, in June, the FDA made a controversial decision to approve a treatment for Alzheimer’s from Biogen [BIIB]. On the face of it, that approval should have improved sentiment around the entire industry; that decision, and some other minor decisions, suggested that the agency was taking a brighter view of a whole class of potential Alzheimer’s treatments. In the end, though, the decision might have been a net negative for the industry, because the agency’s reasoning was considered unclear and capricious by many observers who viewed the data as inadequate and the drug as too highly priced. Other actions taken in 2021 by the agency towards less high-profile drugs were also seen as unpredictable and capricious — and especially in an industry as naturally risky and uncertain as biotech, regulatory unpredictability is a bridge too far for most analysts.

Frustrating the “Generalists”

Biotech stock analysis is a difficult area, where the best analysts have both financial and medical credentials. Even so, for the industry to enjoy a period of good performance requires that “generalists” get on board — analysts with knowledge about equities but perhaps only broad knowledge about biotechnology. Generalists have lately found biotech frustrating and unrewarding… and that has helped keep market sentiment in its downward spiral.

Drug Pricing: The Elephant Coming Back Into the Room

Last but far from least we would be remiss not to mention the issue of drug pricing. Biotech discovery is a risky area; many billions of dollars are often spent by companies developing drugs that ultimately fail. Unless the revenues generated by the successes are enough to make up for it, that research will not occur and new breakthroughs will not be made. In the end, this is a social decision: a trade-off between innovation, and access to the successful drugs for as many as possible. Since it is a social decision, in a democracy that means it is a political decision.

Biotech is now perceived by many in the public as a positive force, thanks to the rapid development of covid vaccines and therapeutics — but the public is fickle and that goodwill is probably already dissipating. Should the Democratic Party decide that drug pricing is a good topic to “rally the troops” into the crucial 2022 midterm elections, the issue will come forward again, and could prove troublesome to biotech again — just as it may have contributed to the industry’s 2015/2016 swoon. President Biden has resisted calls from the more radical wing of his party to make it a signature issue so far — and indeed, he undid one of President Trump’s few successful policy initiative in this area (one that linked drug prices paid by Medicare to prices in other developed countries). However, on the ground, we may already see a battle brewing to include some important drug-price measures (such as Medicare drug-price negotiation) in the Congressional reconciliation showdown over President Biden’s $3.5 trillion infrastructure plan. If this battle intensifies, it will challenge biotech until sentiment turns and market participants decide it has been priced in.

The Positive Case

Biotech can be a difficult and painful industry for retail investors. Everything described above can partly explain why. However, we remain fundamental long-term bulls on the industry, and we view it as one of the key, indispensable innovation industries with excellent long-term prospects, alongside the tech leaders we have been describing for months. Demographics are firmly behind it, and so is the world’s growing wealth. In both developed and developing countries, populations are living longer and will demand more effective treatments for their chronic health conditions. Independently of financial considerations, biotech innovators are working to create those treatments and to deploy extraordinary, life-transforming cures. In recent years we have seen many of them, and the stories told by patients whose lives have been restored to them by cures for diseases like hepatitis C and hemophilia are profound and moving.

The public will demand these treatments; science will make them possible; and private biotech companies will create them. This creative process can be slowed by government overreach, but in democratic countries, we believe, it will not be stopped.

We note also that, like tech companies, biotech companies are relatively unchallenged by the kinds of supply chain disruptions that are troubling other sectors and industries. Covid disrupted some clinical trials, but investigators and manufacturers were quick to adapt and move forward. Further, drug discovery has gradually become a different process over the past several decades. Genomics and data-intensive analytical platforms are continuing to increase the “hit rate” for discovery; in the language of energy exploration, these analytics mean fewer “dry holes.” This is one reason why our own monitoring of the industry is particularly attentive not simply to potentially transformative new molecules, but to the discovery platforms deployed to find them.

For any growth-focused investor, the industry should remain a central portfolio theme.

Investment implications: Whether the biotech industry is currently a buy or not for any individual investor is primarily a matter of risk tolerance and time horizon. The industry has already experienced significant PE multiple compression compared to its history. When sentiment improves, we anticipate that multiples will expand. There is further regulatory uncertainty visible ahead, but the market will likely begin to price in the resolution to that uncertainty before it becomes clearly visible politically — and perhaps before the midterms next year. It may be a early now, but we believe better days lie ahead for the industry and that investors would be wise to begin looking where most professional analysts have lost interest. As usual, idiosyncratic individual catalysts can always cause a single biotechnology company to perform differently from the index, regardless of the large-scale backdrop.