Bitcoin has risen above $10,000 again, and in the context of the ongoing rally in stocks, cryptos are once again getting some attention in the financial press. Although Bitcoin may have left most investors’ minds during the “crypto winter” that followed the bubble burst in early 2018, we note that it has risen more than threefold off the lows it reached about a year later. That sort of behavior for any asset beckons to speculators, and may do so again. Is this the start of another run for “digital gold”? Are there catalysts ahead for cryptocurrencies in 2020? Read on for our summary.

If you would like a refresher on Bitcoin and cryptocurrencies in general, covering the basics of the underlying technologies, please send us an email, and we will forward some of the introductory crypto coverage we provided to our subscribers back in 2018. Guild also conducted a seminar at the 2018 Las Vegas MoneyShow which gave a useful orientation to digital currencies, and you can watch it here.

Crypto In 2019: A Rollercoaster

2018, the “crypto winter,” was a volatile free-fall for crypto assets. While 2017 had been full of talk and hype about institutions adopting digital assets and the transformation of the world by blockchain, 2018 turned into a rout in which the public lost interest, projects lost support, and true believers in blockchain technology and digital currencies retreated into their labs and offices to build their projects while waiting for the arrival of the spring thaw.

Sure enough, that thaw arrived in the beginning of 2019.

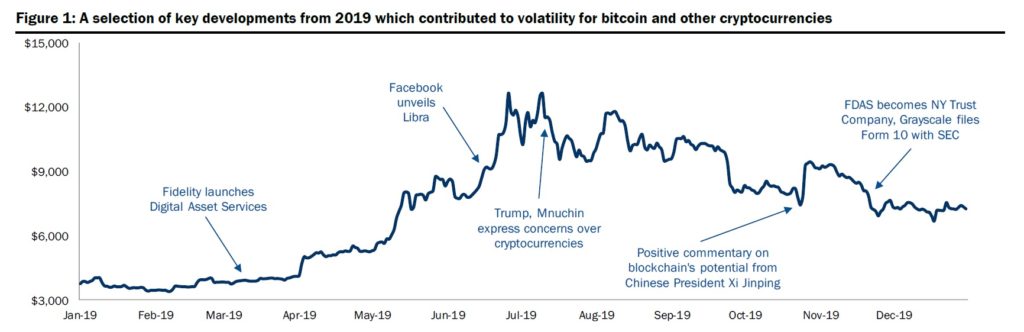

Early in the year, Fidelity launched its Digital Asset Services business, which gradually expanded throughout the year. Facebook’s [NASDAQ: FB] announcement of its own digital currency initiative, Libra, helped create a spike of optimism that briefly pushed Bitcoin to $14,000. We wrote at the time:

“Speculators are betting that the FB initiative will mean that this enormous, deep-pocketed tech company with global reach will now be doing the heavy lifting that creates an onramp into the digital currency space acceptable to the world’s financial regulators. Hundreds of millions — eventually, billions — of consumers who currently lack access to digital assets could now get it. They will buy Libra… and then many of them could easily buy bitcoin… That’s why FB’s announcement has had a galvanizing effect on bitcoin… [The] issue of Libra’s governance [is] a key question, and you can be sure that global regulators are thinking about it too… [The] technical and governance issues will be in the foreground as FB continues to engage with regulators around the world in the leadup to Libra’s anticipated launch next year. FB will meet a lot of skepticism — especially because its past behavior has often seemed to hide a fierce expansionary drive under a veneer of savvy public relations. The socially positive aspects of the Libra project… will probably encounter a wall of public and regulatory cynicism. FB’s leaders have not yet convinced the world that they can be trusted.”

Indeed, that skepticism played out; important key players defected from the Libra project to pursue their own digital currency efforts, and the Libra announcement marked the high point for digital assets in 2019, with Bitcoin falling over the rest of the year. Still, it finished 2019 with a ~92% gain on the year, and has added some ~20% thus far in 2020.

We also note some fateful words spoken by Fed Chair Jerome Powell in July, 2019, as Bitcoin was giving up some of its gains: “They use [Bitcoin] as an alternative to gold. It’s a store of value, a speculative store of value, like gold.” At least there we have a relatively simple and unvarnished picture of how the world’s financial regulators are thinking about digital assets.

By the way, FB has soldiered on with the Libra project, even after losing major partners such as PayPal [NASDAQ: PYPL], Visa [NYSE: V], and Mastercard [NYSE: MA]. It may yet go live in 2020, and though neither the regulatory nor the competitive climate are friendly, we think it would be unwise to count FB’s effort out.

Key Crypto Events in 2019

What’s Coming In 2020

Here are some catalysts and themes that digital asset speculators could pay attention to in 2020.

(The word “speculators” is very deliberately chosen. Digital assets certainly represent a novel asset class and are likely to grow to encompass some portion of total global financial assets. It was on that basis that fantastic “analysis” back in 2017 suggested a million-dollar target for Bitcoin. However, the mere novelty of digital assets as a class means nothing about the near-term prospects or ultimate fate of any particular digital asset — of course, including Bitcoin itself. So we say again: regard digital assets as speculation, not as investment, and if you’re going to speculate, do it only with funds that you would be content to lose.)

Will Institutional Investors Get On Board?

The perennial question. If institutional investors had easy access to digital assets, regulatory clarity, reliable custody solutions, and so on, there might be a flood of money wanting to participate. That’s the thought, anyway. But in the absence of better fundamentals, better momentum, better solutions, and better regulations, it doesn’t look like 2020 is the year when this will be happening. That’s not to say that there haven’t been incremental changes and improvements. Grayscale, the company which manages the Grayscale Bitcoin Trust [OTC: GBTC], filed a Form 10 with the Securities and Exchange Commission [SEC], and intends to become a registered reporting company, which would open GBTC to more investors. There is now a Crypto Rating Council, an industry group which evaluates digital currency offerings on the basis of their development teams, user participation, and compliance metrics. The SEC will be happy to see this kind of industry self-regulation. But it will likely be some time before the needle shifts to the point where large-scale digital asset ETFs get the Commission’s stamp of approval.

“The Halving”

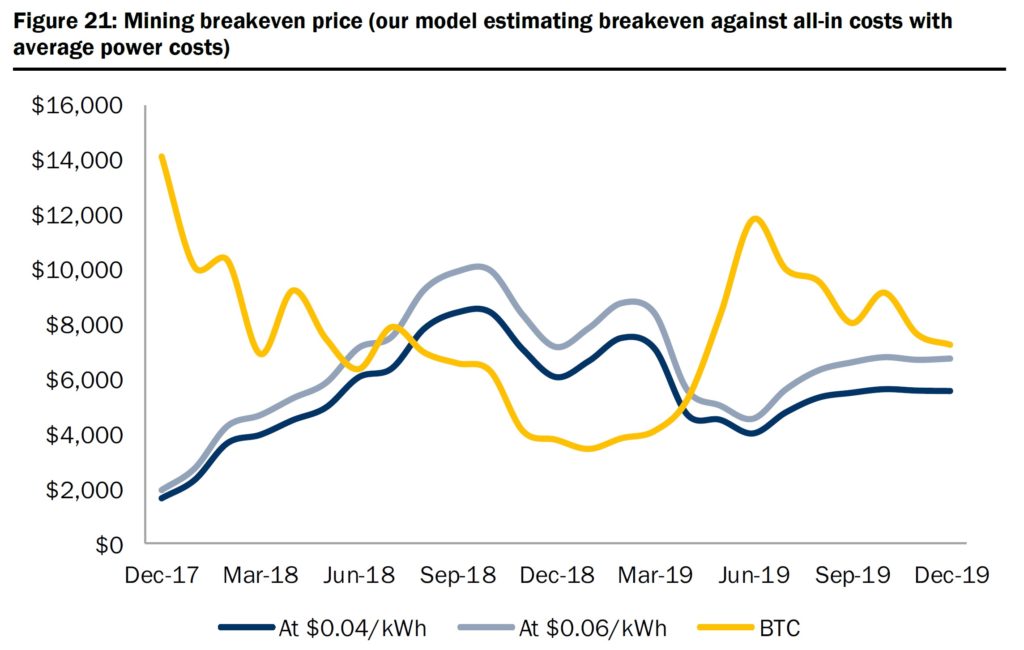

A potentially significant technical event is going to happen sometime in May: “the Halving” (or “the Halvening,” depending on the hipness level of the person describing it). New Bitcoins are created by “mining,” the legwork that ensures Bitcoin transactions are valid. Operators of “nodes” who succeed in validating blocks of Bitcoin transactions are rewarded with newly created Bitcoins, as well as by voluntary transaction fees that users add on top if they want their transactions processed faster. But those mining rewards get halved on a regular basis — which is why, at some point in the future, no new Bitcoins will be created, and miners will have to subsist only on transaction fees. There have been two “halving” events in the history of Bitcoin, and each of them was followed by a year of powerful rally. Again, sometime in May, the reward for successfully validating a block of transactions will fall from 12.5 BTC to 6.25 BTC. That will mean less Bitcoin supply coming on line, and a higher breakeven for Bitcoin miners. (Currently, although there’s a lot of variation, it costs miners between $5,000 and $6,000 to validate a block of transaction, when you include electricity, real estate, and amortized computer equipment.)

We’ll see what happens this time — whether the Halving’s supply crunch sparks another major rally. Of course the whole landscape of global risk appetite will also be contributing.

FB and Libra

As we noted above, digital asset enthusiasts should not count out FB’s Libra project. The company has suggested a 2020 rollout of a beta wallet, which may yet occur. Regulators’ responses are uncertain and the movement is not likely to be a big catalyst — but eventually, it could still be significant.

What Will the Regulators Do?

We come back to the theme we have hammered relentlessly for as long as we have been covering digital assets in these pages: it all comes down to the regulators. In 2020, we don’t see big changes in the regulatory landscape, just incremental ones. We may see progress towards an SEC approval of crypto ETFs, even if it is only incremental clarification of definitions and policies.

And How Will Bitcoin Behave In Volatility?

During recent Mideast tensions surrounding U.S. and Iranian strikes and counter-strikes, Bitcoin showed signs of behaving more predictably like a safe-haven asset, rather than a risk asset. For some time, we’ve been counselling digital asset enthusiasts to watch Bitcoin’s response to such events; eventually, they’ll start to clarify the role that digital assets are taking in the minds of traders. Risk on or risk off? 2020 may give us more opportunity to get clear.

Investment implications: Digital currencies have awoken again as Bitcoin has risen above $10,000 and begun to remind the public that it can rise and maintain its gains. Most digital asset catalysts in 2020 are likely to be incremental in nature, although the “Halving” event that will happen sometime in May produced big rallies in the past (note: this time might be different!). Increased regulatory clarity, institutional comfort levels, improved industry self-management, and the progress of FB’s roll-out of the Libra currency all bear scrutiny.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. Currently, Guild’s clients own FB, PYPL, and V. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.