Buybacks Will Continue To Support Stock Prices in 2019

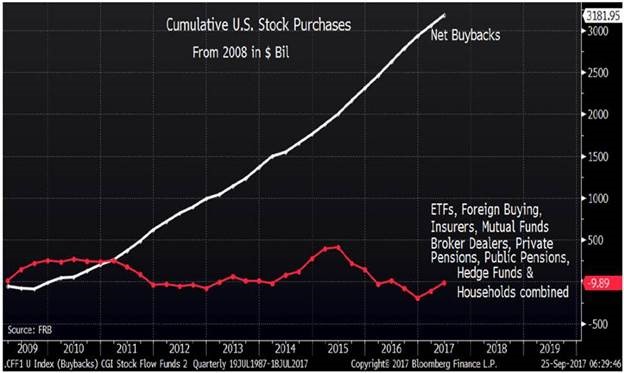

We’ve often noted that one of the major facts of the post-2009 stock market rally has been the role played by companies buying back their own shares. By some analyses, company buybacks have been the largest net buyers of stocks over the past decade.

Source: Canaccord Genuity

From a company perspective, buybacks can be a way to achieve a return of capital to shareholders more flexible than providing a dividend, which once established can provoke a negative market response if it is lowered. Buybacks can also make sense to companies because of a persistent low interest rate environment such as the one that has obtained since 2008; they can fund buybacks in part from very low interest rate debt. It is possible for companies to issue debt and buy back shares in a manipulative way — for example, executives seeking to reach earnings-per-share targets primarily by reducing share count rather than by increasing earnings. Still, we disagree with the view sometimes expressed by progressive critics that buybacks are deceptive as such. They are one tool in a company’s financial kit, and analysts need to look at each company’s behavior individually to evaluate it.

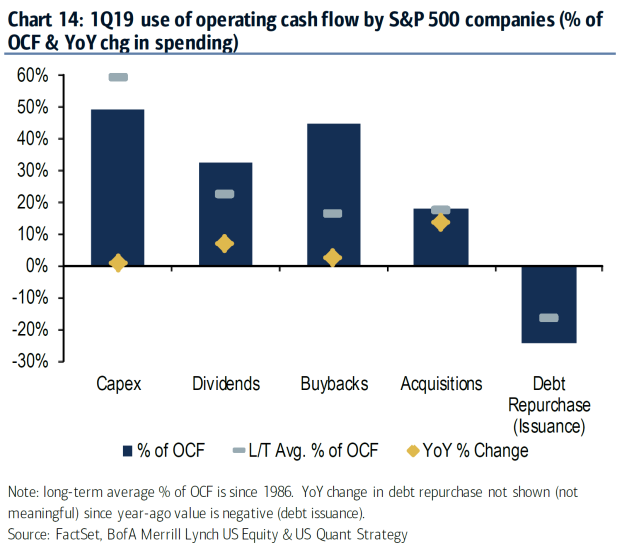

From an investor’s perspective, in aggregate, buyback behavior is positive, and indeed has undergirded much of the market’s performance in the post-crisis period. Important to note now, buyback activity is continuing strong in 2019. A recent piece from Bank of America, analyzing their own corporate clients’ buyback behavior, suggests that the S&P 500 as a whole is on track for more than $1 trillion in buybacks in 2019. Financials and tech stocks have been the largest contributors thus far (comprising 35% and 27% of buybacks respectively). Buybacks accounted for 2% of the 3% year-on-year earnings per share growth for S&P 500 companies, according to Bank of America, and buyback spending accounted for 45% of companies’ operating cash flow. While buybacks have not materially accelerated from 2018, they remain well above their long-term average.

Source: Bank of America Merrill Lynch Research

We note that the U.S. is not the only market where buybacks are significant. They are increasingly so in Japan. Western-influenced shareholder friendliness of Japanese corporates — influenced by increasing shareholder activism from domestic and foreign shareholders — is leading to more buyback behavior, with companies announcing ¥2.3 trillion in buybacks for 2019.

Investment implications: Buybacks have provided support for U.S. stocks market throughout the post-crisis bull market, and that support is expected to continue in 2019. We do not see the conditions supporting buybacks — accommodative financial conditions, ample cash flow, and a desire to return cash to shareholders — threatened by any near-term developments.