China

Recently, developments in China indicate an almost chaotic exit to the country’s “zero covid” policy, suggesting potential opportunities in Chinese equities — which are still highly under-owned by global investors. In our view, as a brief, counter-trend technical euphoria in U.S. markets fades, a recession continues to loom over the horizon, and the trajectory of U.S. earnings remains in question, these events in China suggest the arrival of a period of trading opportunity in Chinese shares. We say a “trading opportunity” simply because the longevity of the trend will depend so much on internal Chinese politics.

Apparently, public resentment towards China’s draconian policies reached a rare boiling point, spreading beyond manufacturing hubs in Shanghai to many regional Chinese cities. In our view, with the Communist Party Congress in the rear-view mirror, President Xi felt free to respond by loosening the restrictions — having used those restrictions preemptively to silence dissent ahead of his election for a third term and his effective anointing as president-for-life. Xi had likely been planning for some time to roll back restrictions after the Congress.

The directional change from the top down has been met by local cities’ rapid dismantling of their infrastructures of testing, tracing, and restricting — and Beijing has not interfered in the process. Very likely, therefore, China will now join the rest of the world in the experience of manageable, endemic covid. (In the meantime, we expect the population will experience a bolus of covid cases, and of covid mortality… but stories about what is really happening within China will be wiped and sanitized by the official media.) It is possible that by spring, internally, China may start to look normal in terms of domestic mobility.

The Chinese economy, however, has sustained real damage from zero covid, and from the trade and technology war with the west. Recovery will not occur in a matter of months.

China must grow for Xi to remain popular, and growth can come from one of two directions. First, a continuation of the housing boom that has lasted for many decades: but this strategy has become very destructive to China’s banking system, and has caused housing prices to rise beyond the capacity of the ordinary Chinese consumer. Or second, an increase in exports: but trading partners in many countries worldwide, troubled by national security concerns and their own growth issues, are objecting to China’s domination of some export markets.

Even though the bounce in Chinese growth in 2023 might make it look healthier than other large developed economies, their economy will be hurt by what looks to be a looming recession in much of the developed world. So this is not a call for a big benefit to the global materials that have typically benefitted from a China boom. It is more a call for benefit to those sectors and industries that have been particularly depressed by zero covid: for example, domestic food and leisure.

Further, foreign investors’ opportunities are limited when it comes to mainland-traded A shares. Foreign-listed shares of domestic Chinese companies, and foreign-traded depository receipts, all remain under a regulatory cloud — the threat of delisting (though we think this eventuality is unlikely, as it has been threatened for years). Like domestic Chinese politics, that is now an inherent risk in the trade. In the case of these shares and ADRs, the situation is worsened by the fact that being “tough on China” is an agreeable way to make political hay whichever side of the aisle a U.S. politician sits on.

ASHR represents one of the few ways to trade for a bounce in China’s domestic A share stock market.

To sum up: the China reopening trade is compelling, and could remain so for a significant part of 2023 — but has significant risk.

The U.S. Landscape

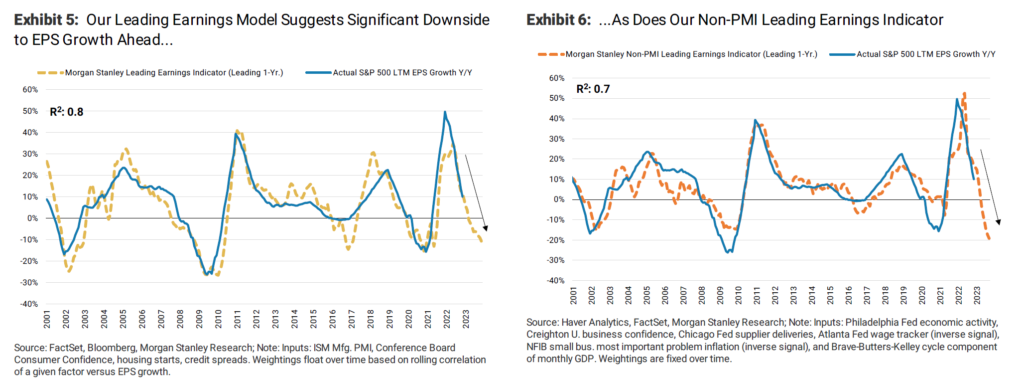

As we’ve been noting for some time, inflation indicators have rolled over, including our in-house, real-world, high-frequency Guild Basic Needs Index, which reflects the more volatile consumer necessities of food, clothing, transportation, and shelter. Thus while the effects of inflation will continue to operate — as we believe inflation will remain elevated well above the past decade’s trend, but well below the recent peak — the psychological impact will abate. However, with the Fed funds rate still rising and thought likely to be sticky, the psychological effects of high rates are really yet to come. As we noted last week, leading economic indicators are continuing to deteriorate, suggesting a double whammy that will challenge index-level stock returns in 2023: declining earnings from recession, and a declining price-to-earnings multiple that the market is willing to pay as rates remain stubbornly high.

Source: Morgan Stanley Research

There will certainly be pockets of outperformance in the U.S. market. Some of those pockets of outperformance are likely to be China-related, as they will be connected to the reshoring trade — the relocation of supply chains and manufacturing capacity to the United States or to allies (“friendshoring”).

Indeed, the U.S. is not going to be the only country getting in on this game: China itself will as well. Much of China’s wage differential has been eroded away by improvements in living standards over the past two decades, and China will likely work to strengthen its export machine by moving manufacturing to cheaper neighbors (as of course Japan has done for decades). We noted recently that Vietnam could be a beneficiary of U.S. “friendshoring” — and ironically, it could also benefit from Chinese “friendshoring” (perhaps they are an Asian manifestation of the Swiss strategy of being friends with everybody).

When it comes to this reshoring boom, we would caution investors at being too enthusiastic about large construction concerns. Those who rely on government contracts can fall afoul of long payment delays and political disruption.

Looking Toward Year-End

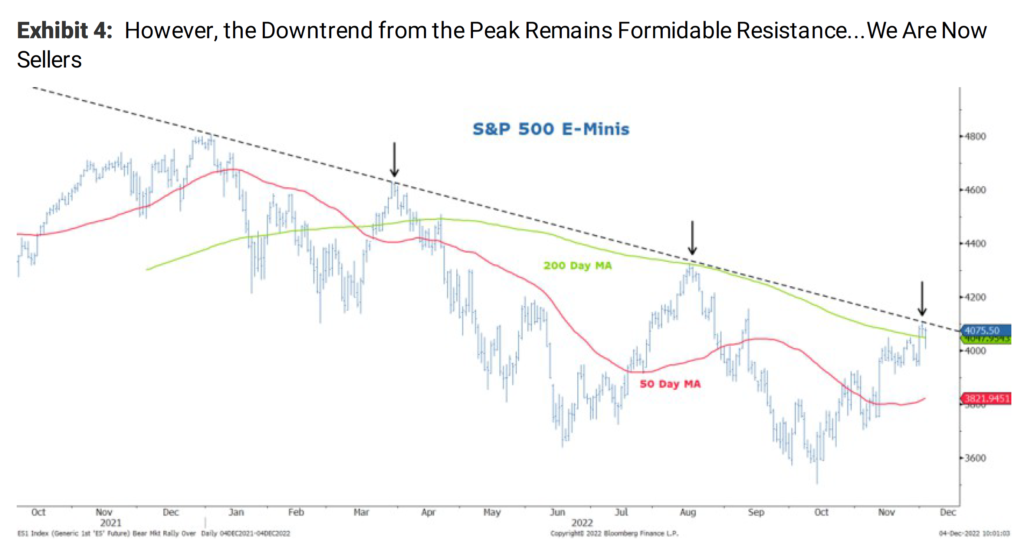

In coming weeks, we’ll offer a year-ahead preview of what we think is in the cards in 2023. For now, we will simply note that on a technical basis, the relief rally excused by a rosy reading of Fed-speak tea leaves seems to have run out of steam.

Source: Morgan Stanley Research

After a year as difficult as 2022 has been across asset classes, we would anticipate quite a bit of tax-loss harvesting to be occurring this month, perhaps pulled forward by the more-or-less consensus perception of a recession in 2023. We do not think signs are there for a continued rally of U.S. stocks into year-end.

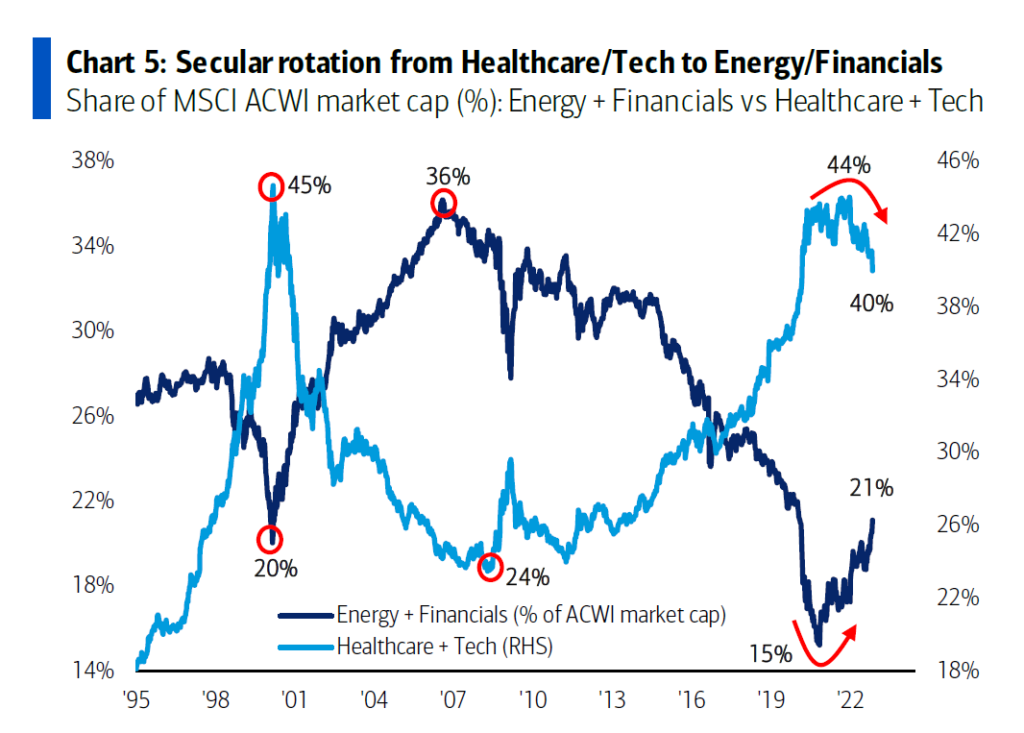

When it comes to stock market leadership in the U.S., the jury is still out — but we do note what looks like a reversal of a long-term trend that saw healthcare and tech outperform energy and financials.

Source: Bank of America Global Research

Blackstone REIT Redemptions

Last week, investment giant Blackstone throttled redemptions from its $69 billion unlisted real estate investment trust which is marketed to wealthy individual investors — a trust which represents about 17% of the firm’s earnings. This is not a catastrophic event, but it illustrates why we have consistently warned our clients that now is not the time to be holding large exposure to vehicles in which their money is locked up — particularly in these “interesting” and unexpected times when the cost of money is rising rapidly thanks to the Fed’s battle to tame inflation. This environment is starting to expose some of the black swans that had been breeding just out of view during the zero-percent interest-rate days. We believe liquidity and flexibility are worth a lot more than the hope for a little extra return these days…even when the purveyor of those returns is a multibillion-dollar firm. Blackstone is not the first, nor will they be the last to gate people’s money. Caveat emptor!

Thanks for listening; we welcome your calls and questions.