But First: What’s That Up There, A Ceiling?

Before we get to today’s main topic, a comment on the debt ceiling. It started innocently as a piece of World War I-era legislation intended to remove the threat of the Federal government running out of cash. But it was weaponized during the rise of the Tea Party in the early 2010s, and has ever since provided the world with a periodic unedifying spectacle of the richest and most powerful country in the world playing chicken with the safe-haven status of U.S. debt. Of course, as everyone from Morgan Stanley’s James Gorman to JPMorgan’s Jamie Dimon has observed, the outcome is a foregone conclusion: the U.S. will not default. What’s crazy is simply the brinksmanship inherent in the theatrical politics that now accompanies these debates — especially since the actors on both sides are all complicit in the endlessly irresponsible spending that keeps bumping the Federal government up against the limit. Markets are good discounting mechanisms in most cases — but they are not so great at discounting extremely unlikely catastrophic events. In any event, we too are very nearly certain that the debt ceiling debacle will be yet another nothingburger — but be prepared for alarming eyeball-grabbing headlines and pearl-clutching in coming months as special measures become exhausted.

China Ready To Be the Counter-Cyclical Flywheel

As markets move higher in the developed world, debate continues about the trajectory of the global economy. By now, the consensus among market analysts and participants for a 2023 recession in the United States is almost unanimous — a unanimity which GMO’s Jeremy Grantham (having long had a bearish view of global markets) comments is enough to make any “God-fearing contrarian wake up with night sweats.” In other words, even though he remains bearish, he’s uncomfortable about how much the market commentariat agrees with him.

We are actually agnostic about the economic outcome for the United States. Maybe we will tip into recession as everyone expects; but even if we do, (1) markets may already be looking ahead to and through that recession, and be discounting it, and (2) there will still be areas of outperformance within the U.S. market. However, with other parts of the world experiencing a much better set-up economically and financially, we would prefer to put our attention there, rather than remain constrained to the U.S.

We noted late last year that if Europe avoided its worst-case scenario, it could rally: it did (at least so far), and it has. There may be even better prospects elsewhere, but we still believe Europe can be owned, particularly northern European banks and some industrials.

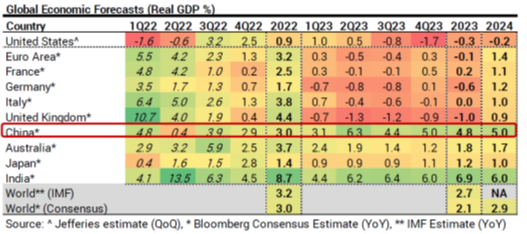

To us, China is at the center of global opportunities. Here is a simple illustration of why:

Source: Jefferies

The change to look at is China’s upshift from the first quarter of this year to the second. That is a massive pulse in the second derivative — the rate of change of the rate of change. Nothing else quite like it is going on anywhere else on the planet. India comes close — but the Indian stock market is already quite expensive, while China’s is cheap.

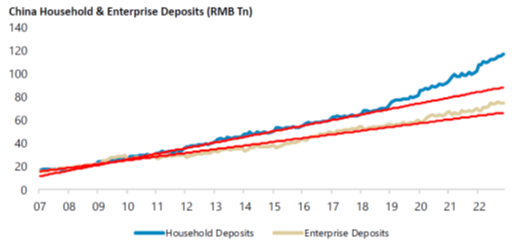

As we noted in the last few letters, China’s exit from zero-covid is extremely consequential. We’ll borrow some charts to illustrate this below. Important to remember: Chinese consumers have been squeezed longer and harder than virtually anyone else on the planet by draconian covid policies (apologies to our friends Down Under, who also came in for some measures that went far beyond anything that should have been tolerable in allegedly democratic states). As a consequence, Chinese consumers have saved a lot of money — since 2020, a chunk of change equal to the size of the German economy.

Source: Jefferies Equity Research

Predictably, when restrictions were suddenly lifted, Chinese consumer sentiment skyrocketed. Further, estimates for Chinese consumer-facing companies have barely started to be revised up. While real access to small mainland consumer stocks is limited, foreign investors do have access to some of the massive Chinese consumer powerhouses, such as Alibaba [BABA].

On that topic, we’d observe that the end of covid zero is happening at the same time as a pressure-release valve has apparently been opened, and after crushing the tech giants for political reasons for years, the government seems ready to release them from detention (so to speak) and enlist them — with their oligarchs appropriately chastened — in the project of getting growth back on track.

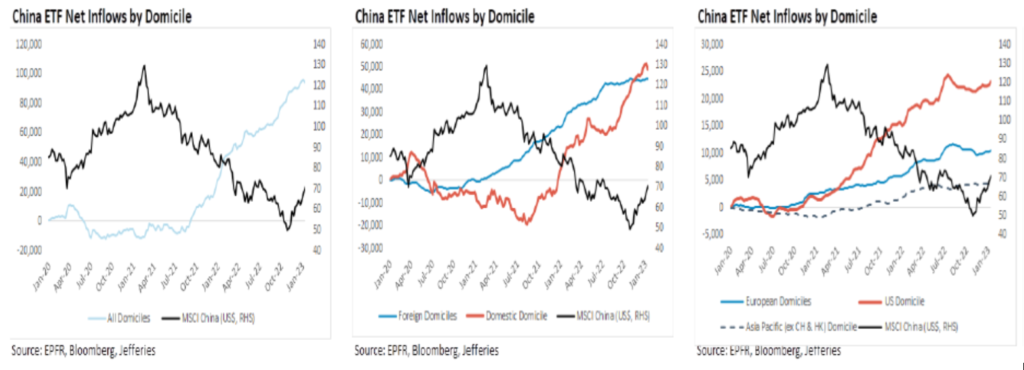

From a market perspective, too, speaking of foreign-accessible stocks like BABA, they have been crushed by covid and trade-war fears and geopolitical skepticism. Foreigners have spent years selling them, and that implies that if and when sentiment turns, there will be a lot of buying needed to correct the current depth of under-ownership.

Source: Jefferies

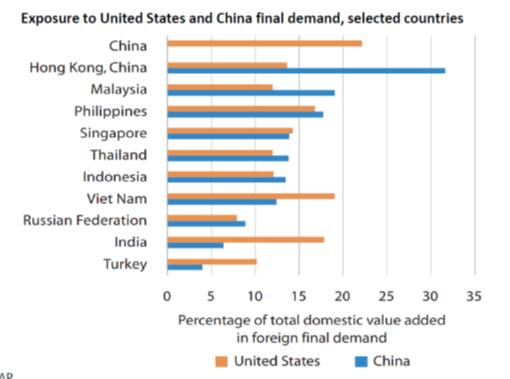

China’s reopening is likely to set up a regional flywheel running counter to the economic gloom that is deepening in much of the rest of the world. Exposure to demand originating from China is high for most of China’s neighbors. Rising demand from China will at least partially counterbalance whatever demand challenges arise from a slowdown in the United States.

Source: Jefferies

One country not noted in the chart above is Japan. We believe Japan is also worth attention from investors because of its exposure to Chinese economic reopening and growth acceleration, particularly robotics, heavy machinery, and precision instruments. Particularly, a stronger yen and weaker U.S. dollar as a result of a softer U.S. Fed in the second half on 2023, coupled with Chinese growth, could set up what has historically been a favorable situation for both domestic and export-focused Japanese companies.

A comment is in order about India. The smoldering trade-war and geopolitical unease between China and the west has contributed to the sentiment that India alone is king of developing Asian growth. India also has superior demographics (this month, India surpassed China as the planet’s most populous country). As a consequence, it remains expensive compared to China — to the point that it is now relatively unattractive. However, we note that periodic flare-ups in Indian volatility do provide occasion entry-points for investors — perhaps the last really good one being Prime Minister Modi’s crackdown on cash. We don’t doubt there will be more such events. We are long-term bulls on India, but in spite of its good growth characteristics, our view is that investors shouldn’t chase it, but should wait for a better opportunity. For now, China, and China’s neighbors and workshop countries, remain our focus of attention in Asia.

The U.S. Dollar Remains Key

We’ve often noted that the attractiveness of foreign markets to U.S. based investors is in large part a function of the growth of foreign companies’ earnings in U.S. dollar terms compared to the growth that’s available in the U.S. The U.S. dollar may soften as the year progresses and the U.S. economy weakens (and the Fed responds). But even more, U.S. companies’ margins have been experiencing a multi-decade expansion — and may begin to revert to the mean relative to foreign markets. If and as this occurs, it will shift the calculus for U.S.-based investors in foreign markets… and foreign investors in U.S. markets.

If indeed the dollar peaked last year, investors should certainly look closely at some easily accessible funds, such as the iShares China Large-Cap ETF [FXI], the iShares MSCI Hong Kong ETF [EWH], the Xtrackers Harvest CSI 300 China A-Shares ETF [ASHR], the iShares MSCI Emerging Markets ETF [EEM], the iShares MSCI All Country Asia ex-Japan ETF [AAXJ], the iShares MSCI Thailand ETF [THD], the VanEck Vietnam ETF [VNM], and the iShares MSCI South Korea ETF [EWY], among others. Depending on the degree of currency risk an investor wants to take, there are both currency-unhedged and currency-hedged funds available for Japan (e.g., the iShares MSCI Japan ETF [EWJ] and the WisdomTree Japan Hedged Equity Fund [DXJ], respectively).

The Road Immediately Ahead

January’s global snapback rally may have a lot to do with improving investor sentiment due to China and the perceived counterweight that China offers to the parts of the world where economic performance is weakening. However, we note that a lot of January’s apparent enthusiasm may have to do simply with portfolio recalibration after a dismal fourth quarter in 2022. In any event, whatever is behind it, the rally is real and should not be ignored.

We want to thread the needle here: investors should not be so bullish that they have no cash to buy the next dip, but neither should they be so bearish that they aren’t ready to buy that dip when it happens. When the Fed finally does release the pressure, it could set the stage for a good rally.

Thanks for listening; we welcome your calls and questions.