While bitcoin launched crypto as an asset class, its primary function is simply that of a digital currency. Currently it seems to be displacing gold in the minds of a generation of investors newly concerned about irresponsible monetary policy and fiat debasement — though of course it is for the moment largely a vehicle of speculation. In the near term, it will probably continue to display the same kind of volatility that characterizes the stock market, but even more intensely. Caveat emptor!

DeFi: The Coming Revolution

We believe that the more disruptive potential of blockchain technology — the kind of distributed database that underlies bitcoin — is in decentralized finance, or DeFi. This is where we can see the genuine emergence of what crypto promoters have called “the internet of money.”

DeFi basically means “smart contracts.” Next-generation crypto projects, such as the Ethereum, EOS, Solana, and Cardano blockchains, are built for smart contracts: contracts which trigger automatically when certain conditions are met, transferring monetary value or performing other functions. In essence, this is the automation, decentralization, and disintermediation of a host of financial exchanges and services currently performed by the banking and financial services industries.

A classic example of this is a dex, or “decentralized exchange,” which permits crypto traders to trade with one another without using a single central party. One of these dexes, Uniswap, already processes more transaction volume than any of the centralized exchanges with which you are likely familiar, such as Coinbase, Gemini, Kraken, or Binance. (Dexes will make it hard, if not impossible, for the authorities anywhere to clamp down on untraceable “privacy coins” such as Monero.)

In the future, DeFi advocates hope, these decentralized platforms could handle your mortgage, your leases, your credit, your professional credentials, your retirement portfolio, and your insurance policies — at lower cost,with lower risk of fraud, and without self-interested intermediaries.

Chainlink: Decentralizing Real-World Data For Blockchains

One critical problem which DeFi faces is that DeFi contracts will rarely be totally inward-looking and rely only on information that resides on a blockchain. Rather, they will depend on data inputs from outside the blockchain — real-world asset prices, retail payments, bank transactions, events such as weather, sporting events, or elections, and so on. Within the universe of DeFi, the source of such real-world data is known as an oracle.

This presents the “oracle problem.” While a decentralized network can be effectively defended from fraud through cryptography and the technical mechanisms to reach agreement among network nodes, relying on a single oracle creates a single point of potential failure or corruption. Should that oracle provide faulty data to a smart contract — whether by error or malice — that contract would fail.

A blockchain platform called Chainlink has set out to address this problem, by decentralizing the collection of data — basically, making a blockchain of oracles.

Smart contract creators specify the data they want, the number of oracles they want, and the required reputation of these oracles. That reputation is determined by the total numbers of assigned and completed data requests, response time, and any penalties assessed against the data provider. (Think of it like a seller’s reputation on an online marketplace like eBay.)

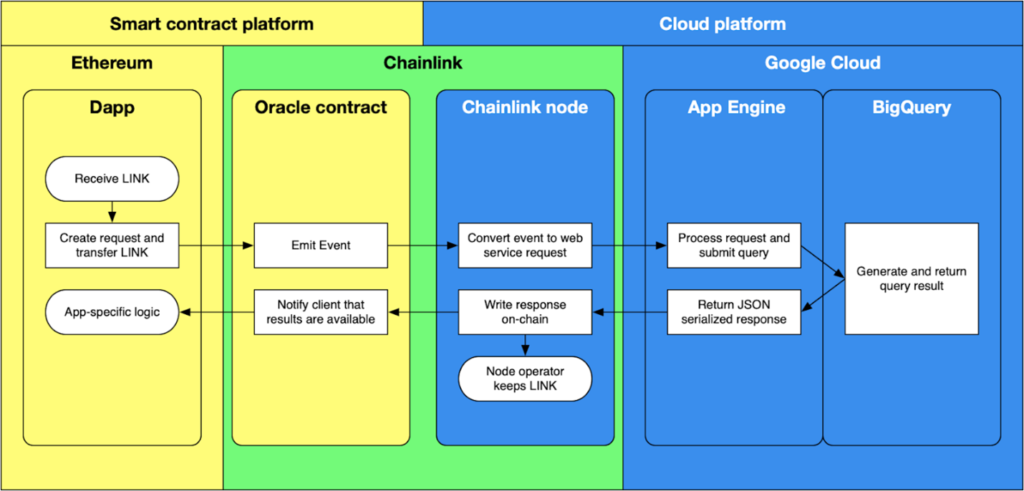

The specified number of nodes return the requested data query and the results are amalgamated in a manner specified in the contract. The chart below illustrates the process by which an Ethereum-based smart contract queries an oracle (in this case, data housed in Google Cloud’s BigQuery) and returns the results to the contract, generating specific result (for example, a financial payout).

Source: chain.link

Chainlink functions on a native currency, LINK, which is paid to Chainlink nodes as remuneration for their services; node operators can also stake LINK as collateral to guarantee the integrity of their service (nodes can be penalized for poor data). LINK is an Ethereum-based token; unlike mined tokens, the entire supply of one billion tokens was created at the LINK initial coin offering in 2017. Thus, the token’s value will ultimately depend entirely on the demand for services that the Chainlink network offers.

Chainlink is the first and currently the dominant entrant in an area that will become more and more important as DeFi grows. It remains to be seen whether its early network effects, and its ability to interact with Ethereum competitors, will allow it to maintain its position. (Chainlink is blockchain agnostic.) Notably, Chainlink’s initial coin offering had characteristics that have been flagged by the SEC with regard to other tokens, and so the risk remains that the token will be classified by the Commission as a security. Needless to say such an action would not be constructive for the price of LINK. Of course, a contrary judgment, if made, would be bullish.

Investment implications: This is the first of a series of brief notes on crypto projects of interest to us, primarily focused on projects with strong technical credentials and real-world use cases. All are in the extremely speculative stage, and are potential zeros as a result of competition, technical error, or regulatory action. Still, they may be of interest to speculators and to those who wish to monitor the crypto and DeFi space for innovation. We are confident that digital currencies and DeFi will be rising in prominence and that investors should be vigilant for new developments.