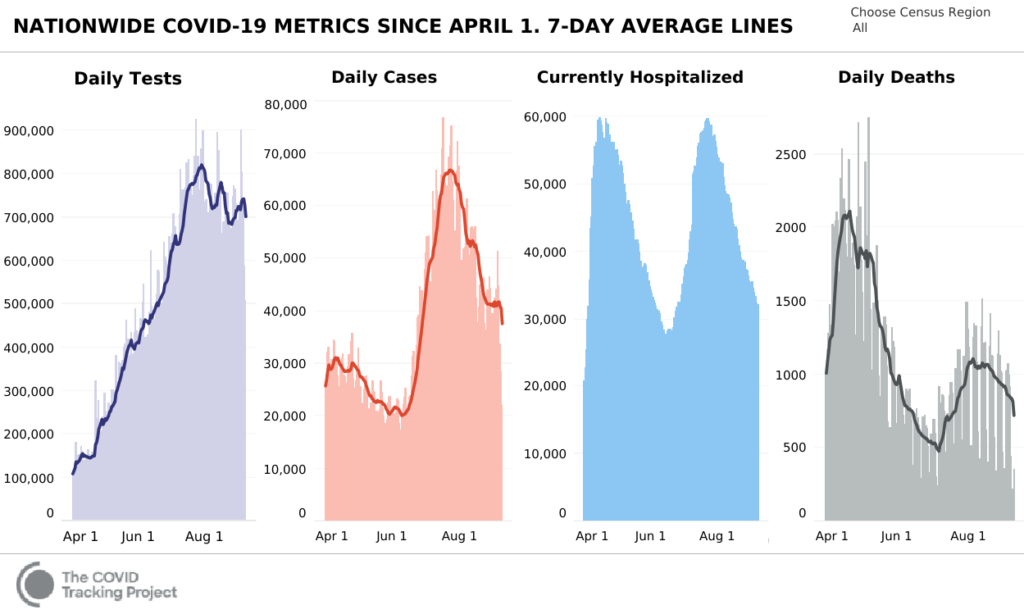

For a few weeks we’ve been explaining our optimistic view of the waning SARS-CoV-2 pandemic in the United States. Data suggest that vaccine or no vaccine, the pandemic is already beginning to fade. Positive tests, hospitalizations, and deaths are all continuing to fall, even as life continues to return to normal.

Some media have shown concern at the covid-related death of a participant in the early August motorcycle rally in Sturgis, South Dakota — an event that drew 400,000 participants. To us, this seems like straightforward alarmism (how many traffic fatalities were related to this event?) and in our anecdotal view, the public is beginning to experience “alarm fatigue.” As the reality sinks in that covid is simply not what was feared back in March and April when data were scarce, many parts of the population are becoming increasingly vocal in their demand for a faster return to normalcy. In our view, attempts to suppress this groundswell of sentiment will prove counterproductive.

While the public’s demands may be somewhat emotionally based, epidemiological data are becoming clearer which show the negative health effects of the lockdown — particularly from delayed medical treatments and from psychological stress. The pressure for a return to normalcy will reinforce what we believe is likely to be a stronger-than-anticipated economic recovery from the lockdown recession.

This Week’s Case For Optimism: India

Last week we took a break to make a heartfelt case that investors need to step back from the pessimistic mindset inculcated by the 24-hour news cycle, and embrace an optimistic view that is capable of seeing and capitalizing on positive long-term trends in culture and economics.

One of the bright spots for these positive trends is India. For years since the political shift that brought a more business-friendly government to power in India after decades of inept socialist rule, we have been telling you about the great potential of India as a manufacturing and consumer power. The changes have been positive, but gradual. It’s helpful that U.S. pressure on China for the past few years has begun a tectonic shift of global supply chains that could ultimately dovetail with these positive reforms to help India along the path to manufacturing growth.

If, as we’ve noted in the past few months, the lockdowns have accelerated digitization trends in the U.S., they have also done so in India, on a massive scale. It is difficult for U.S.-based investors to get direct exposure to companies that trade on Indian exchanges, but there are some U.S.-listed names, and there are also ETFs that investors can use. Indeed, the enticing character of the Indian consumer market has led many U.S. companies to take stakes in India, including Amazon [NASDAQ: AMZN], Facebook [NASDAQ: FB], Walmart [NASDAQ: WMT], and Dominos [NYSE: DPZ]. (DPZ performed well during the lockdown, taking significant share from smaller food delivery services.) E-commerce and digital payments are particularly attractive areas.

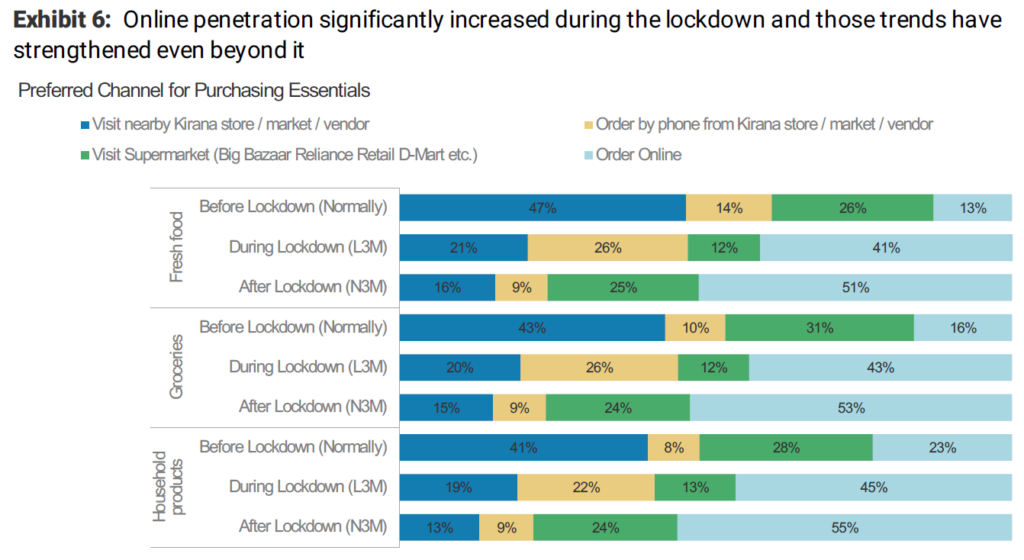

The pandemic lockdowns have tremendously invigorated Indian e-commerce. Historically, Indian consumers have been reluctant and slow to make the transition from internet use to e-commerce, but the lockdowns seem to have pulled forward several years of transition in the space of a few months. Consumers who before would have waited five years before transitioning to e-commerce purchases have done so in six months — and this is occurring at an inflection point in the availability of 4G data connection for many rural Indians and those who live in third- and fourth-tier cities.

Non-essentials such as electronics already had significant e-commerce penetration in India pre-covid, but grocery, fresh food, and personal care staples did not. The lockdown, which started on March 24, changed that. Even as the lockdowns have eased, since June 8, adoption of e-commerce solutions for these segments has accelerated still further. Anecdotal reports suggest that Indian consumers were favorably impressed with their lockdown e-commerce experiences in terms of convenience, price, and selection.

The real losers have been India’s ubiquitous mom-and-pop stores, the “kirana” stores referred to above. But there are several initiatives underway to make use of this unique feature of India’s retail landscape to facilitate delivery, by digitizing their inventory and using them as hubs for hyperlocal delivery services. Indian conglomerate giant Reliance Industries rolled out its JioMart app during the pandemic, quickly rising to fourth place in the Indian App Store and reaching 350,000 orders per day. Other initiatives, including one from Amazon India, are targeting the same relationship. (Optimists on Reliance Industries believe that the old giant could use its free cash flow generation over the next decade to fund a transition into e-commerce and green energy.)

Indian e-commerce looks set for 25% annual growth over the next decade, with the segments identified above growing at more than twice that rate.

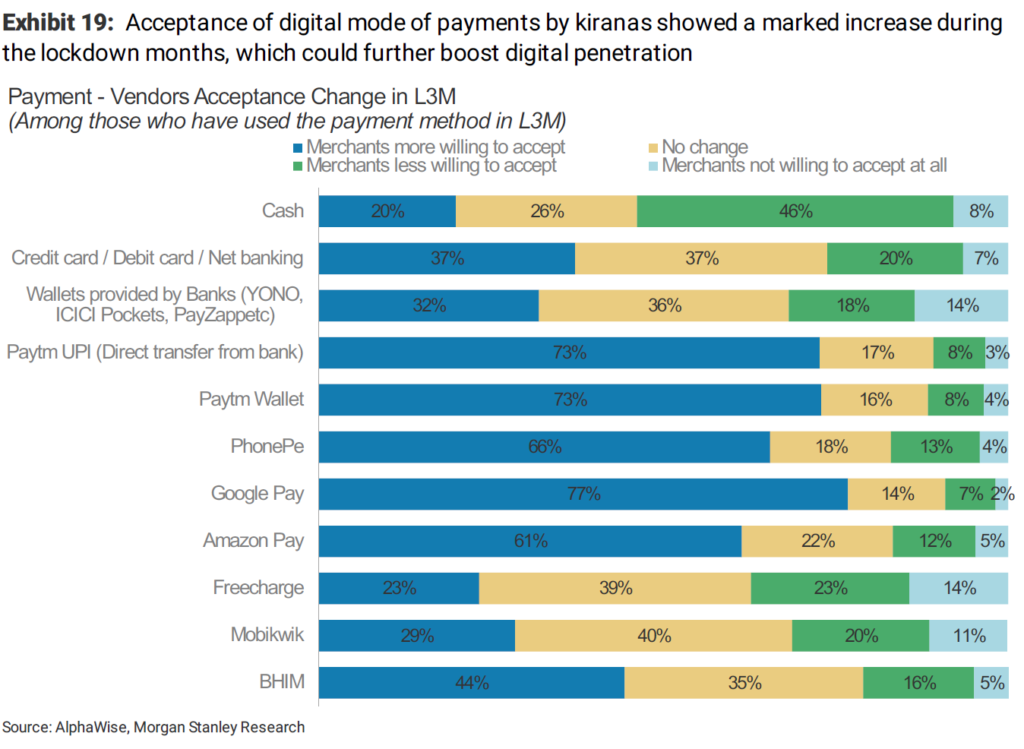

Digital payments are also experiencing a sharp boost thanks to the lockdown, in part due to fears of contagion surrounding cash.

U.S. readers will recognize some of the digital payments systems and companies mentioned above. Others, including YONO, ICICI Pockets, Payzapp, Paytm, and PhonePe, are local Indian digital payments solutions from Indian banks and fintech companies.

This shift to digital payments highlights the push FB (not yet appearing above) is making into the Indian payments market with WhatsApp, and potentially the Libra digital currency. (This is an illustration of what may be the real motivation behind a lot of digital currency initiatives — to gain traction in digital payments more broadly.)

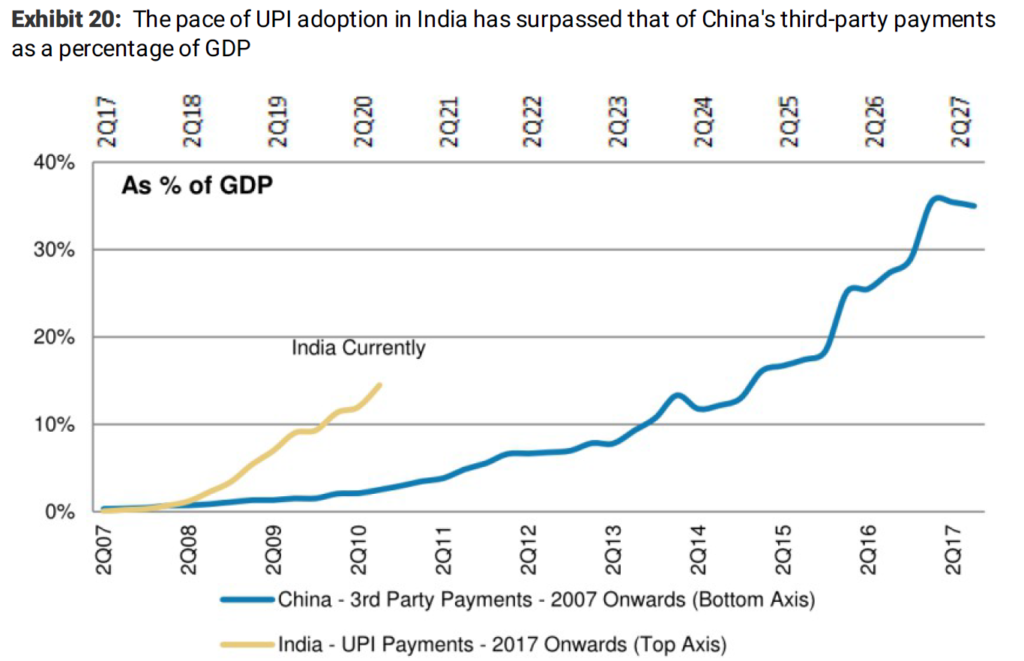

Investors who have watched the rise of digital payments in China might consider that Indian digital payments seem to be in the early stages of an even more rapid adoption:

Investment implications: The pandemic lockdowns seem to have dovetailed with other social and economic processes to induce a significant acceleration of Indian e-commerce and digital payments adoption. Patient U.S. investors with a long time horizon could consider any ETF of locally traded Indian stocks with significant technology exposure. Another way to gain exposure to the theme would be through U.S. companies that have established a significant presence in the Indian consumer and technology markets, such as those mentioned above. We believe India represents a significant long-term opportunity for global investors.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. Currently, Guild’s clients own AMZN and FB. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.