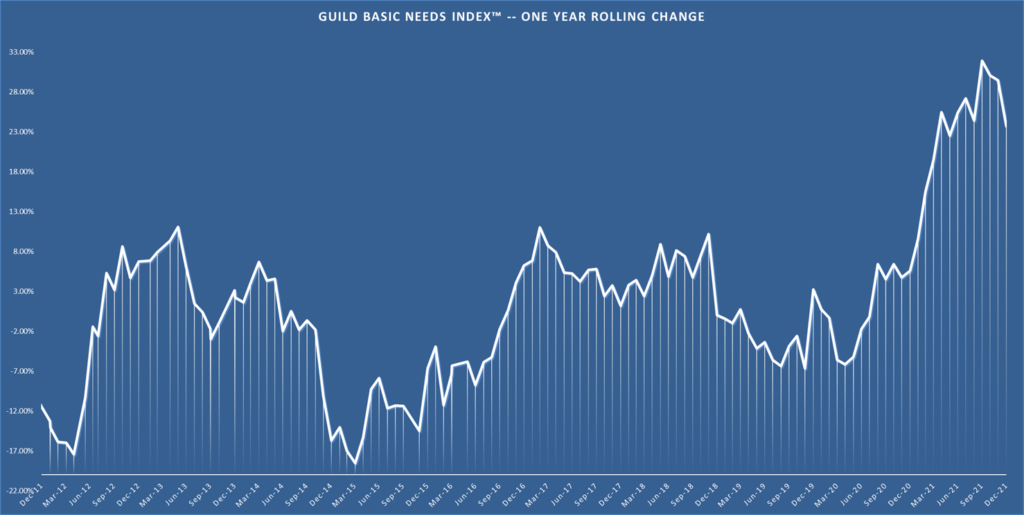

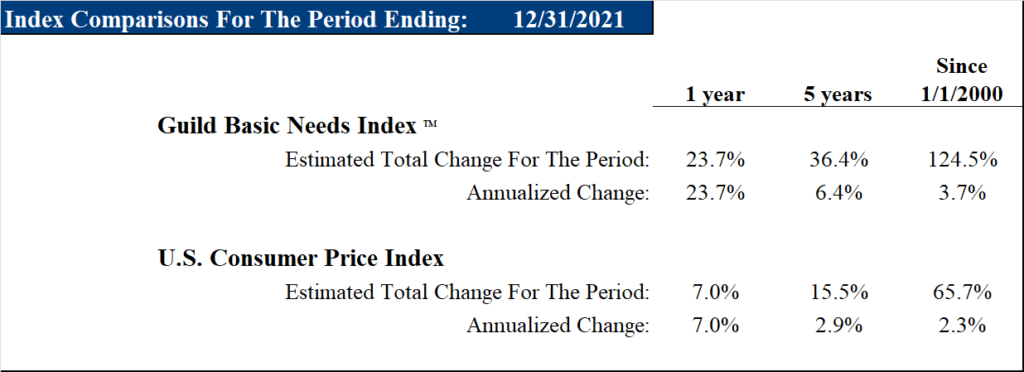

As we noted last week, our in-house real-world inflation indicator, the Guild Basic Needs Index, has cooled from last fall’s recent year-over-year high of 31.9%. It now stands at 23.7%.

It’s down from the peak, as is to be expected as the pandemic wave recedes. What we think will be revealed as it recedes, however, is persistently and structurally higher inflation than has characterized the whole period following the Great Financial Crisis. Even after the GBNI cools somewhat, there is still upside risk from a variety of scenarios; the Fed’s determination to stick to its tightening course has yet to be tested by a real market conniption.

We are not in the “hyperinflation is coming” camp. While monetary and fiscal largesse have been extraordinary, the U.S. is not close to a Zimbabwe-tier enterprise just yet. The U.S. dollar, the U.S. economy, and the U.S. financial system are still a superior toolset for global investors compared to any other markets. And Fourth Industrial Revolution tech — regardless of the behavior of overvalued tech stocks in the stock market — remains a relentless global disinflationary force, as does demography in both developed and developing countries.

While inflation will likely not rise to hyperinflation in the U.S., we believe it will be persistently higher than recent history — and that will be consequential for rates, for businesses, and especially for working-class citizens, who are already seeing real wages fall as nominal wages rise. Inflation is the most regressive income tax. In previous inflation episodes, that led to political backlash, and this time is not developing differently from that pattern.