Executive Summary

1. The Trump administration deepens its drive for transparent healthcare pricing. In February, the Trump administration asked for comments on a proposed rule with potentially vast effects on the entire U.S. healthcare sector. A rule that came into effect in January already required hospitals to make their list prices public — but that rule was of limited effect, because there is often little relation between the official prices and the prices that are privately agreed upon with insurers. Now the administration is proposing a new rule that would require those privately negotiated prices to be made public — not just for hospitals, but for all healthcare providers. The effects on the economics of healthcare delivery would be profound, enabling increasingly price-sensitive healthcare consumers to shop competitively for care. While many of the new rule’s medium- and long-term effects would be unpredictable, it could remove pressure in the near term from innovative biopharma companies by moving more political and public opinion pressure to hospitals and insurers.

2. The European Central Bank boosts lending again. Mario Draghi, ECB president, made a surprise announcement of another round of special lending to European banks — a program intended to keep funds flowing into the real Eurozone economy by making credit available to corporations. While corporate borrowing has dropped, it may not be the availability of credit that’s the real problem. Indeed, the Eurozone’s basic problems remain what they have long been: fractured politics, dissonant national fiscal policies and needs, and a banking system that has never taken the bitter medicine it needed after the global financial crisis. Although Europe may present occasional trading opportunities, we are not bullish.

3. China’s 2019 rally is not 2015. China’s big rally thus far in 2019 has investors recalling the boom and bust of 2015. We think this one is different. Local investor sentiment, which is driven by signals from the Communist Party bureaucracy, is king in Chinese domestic stocks, but there are number of powerful macro and policy processes at work to support that sentiment and also to draw in more investment interest from outside China. We see government stimulus, a likely reacceleration of the domestic economy into year-end 2019 (which we’ve been calling for since last year), lower margin debt, stock-friendly statements from regulators and officials, and a greater weighting for Chinese domestic equities in global indices. We’re bullish on China and view it as a buy-the-dips market.

4. Market summary. Slowing growth in the U.S. and China and stagnant growth in Europe have led to additional stimulus in Europe and China and

The Trump Administration Deepens Its Drive For Transparent Healthcare Pricing

Healthcare is the second-largest sector of the S&P 500, and healthcare stocks represent about 15% of the index. The ongoing and intensifying debate about healthcare costs is therefore an important matter for investors to monitor. It is likely that both Democratic and Republican solutions to rising costs will be highly disruptive to companies’ revenues across the sector. Below we will describe a new proposal by the Trump administration which, if it is put in place, will profoundly change the economics of healthcare delivery.

Problems and Solutions For U.S. Healthcare

“Medicare For All” is no longer just a slogan of Bernie Sanders’ presidential campaign, and is entering the mainstream of Democratic discourse. The “United States National Health Care Act,” H.R. 676, was introduced in the House of Representatives in 2003 with 25 cosponsors, and has been reintroduced every year since. As recently as 2015, it had only 49; as of this writing, it has 124. Bernie Sanders’ corresponding “Medicare For All” bill in the Senate, S. 1804, was introduced in 2017, and now has 16 cosponsors. Polls of younger voters show consistently growing support for the kind of state-run or state-guaranteed healthcare that is in place in many of the world’s other developed nations. The institution of some form of single-payer healthcare in the United States is neither a foregone nor imminent conclusion, but it’s clear that in the face of widespread dissatisfaction with the cost and availability of healthcare, the idea is rapidly gaining traction among sectors of the electorate.

Of course, the problem is real; the U.S. pays much more (overall) for healthcare than its developed-world peers, and has (overall) worse health outcomes. The question is simply how to solve the problem. In one form or another, the Democratic Party would like to use the power of the state; and in one form or another, the Republican Party would like to harness the free market.

As the Democratic Party seems, in fits and starts, to coalesce around some version of a single-payer system, the trajectory of Republican policy has been less clear. Even after years in the political wilderness, Republicans were unprepared to offer an alternative to the Affordable Care Act when they found themselves in possession of the White House and Congress after the 2016 presidential election. Analysts can begin to interpret the industry and company-specific risks of a move towards single-payer. The risks posed by Republican proposals are less tractable — because we haven’t yet seen the emergence of a Republican consensus.

Now, however, after Republicans’ loss of the House, their trajectory is becoming clearer, and it could be summarized by the term “transparency.” This has been a rhetorical focus of the Trump administration from the beginning.

A New and Disruptive Proposal

A dramatic proposal was buried in the February release of a 700-page draft of new regulations to help improve patients’ access to their electronic health records. The Department of Health and Human Services solicited comments on a rule which would require hospitals, doctors, and other health-care providers to publicly disclose the prices they have negotiated with insurers.

That would make it possible, for the first time, for health-care consumers to shop for health-care the same way they shop for other consumer goods — knowing the real prices charged by different vendors, and comparing them.

It is a powerful expansion of a Trump administration policy that is already in effect, and that has won acclaim even from the often Trump-skeptical New York Times. A policy came into effect in January mandating that hospitals make public their so-called “master charge lists” — the “list prices” that they charge for services. Some noted that knowing these prices isn’t very helpful, since they have little to do with the prices that are actually paid by insurance companies, thanks to the private negotiations and discounts that go on between insurers and hospitals behind closed doors. Still, the new rule was welcomed as a step forward for transparency — for helping make healthcare delivery a place where price was a functioning signal, and the basic mechanism of capitalist competition for consumer dollars could work more effectively.

After the new proposal, the Wall Street Journal noted:

“Industry officials say the administration faces many hurdles before implementing such price transparency. The move is likely to be met by fierce opposition, including possible legal challenges, from hospitals, doctors groups and insurers since it could have far-reaching impact.

“Insurers might demand the same hospital discounts won by competitors, while some hospital systems might push for payment rates that match their crosstown rivals’. If doctors’ negotiated rates become public, other doctors could lower their prices to try to lure away patients.

“The American Hospital Association said it opposes the move. ‘Disclosing negotiated rates between insurers and hospitals could undermine the choices available in the private market,’ said Tom Nickels, an executive vice president of the trade group. ‘While we support transparency, this approach misses the mark.’”

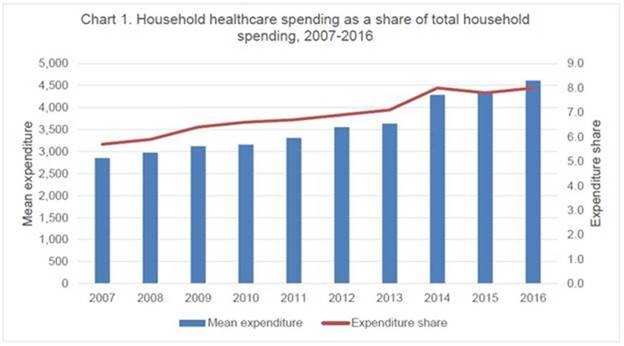

Consumers in the Obamacare era have been shouldering an ever-increasing portion of healthcare costs due to rising deductibles (and the increasing prevalence of high-deductible plans):

Source: Bureau of Labor Statistics

Consumers are thus more motivated than ever before to shop discerningly for care whenever possible — particularly in the case of expensive procedures and high deductibles. Until now, they haven’t had the tools — but this new rule would provide them.

Like the master charge lists, the raw material revealed by this information, if the rule is finalized, would not be very accessible to consumers. It would be large databases of difficult-to-interpret codes and prices. But these databases will certainly become the basis for consumer-facing apps that will enable easy comparison shopping — and that will profoundly change the economics of healthcare delivery.

The period of comment for the new rule closes on May 3. Sometime after that, a final rule could be issued.

What industries within the healthcare sector would be most deeply affected? Clearly, for-profit hospitals and managed care companies would see attention and pressure on their pricing models — perhaps distracting public attention from pharmaceutical companies and PBMs, who so far have been the primary recipients of political heat surrounding healthcare costs. (Note the immediately negative response of the American Hospital Association above — a clear sign of who sees their interests threatened by the rule. We can expect intense lobbying in the months ahead.) Indeed, the economic model for these companies, as it has been focused on private negotiation and complex discount structures, would be upended. Clinical-stage biopharmaceutical companies focused on areas of high unmet needs and on highly innovative therapies might experience some relief as political heat shifts to new parts of the healthcare value chain.

However, we note that the effects of this rule, if it is put in place, will be unpredictable. Second- and third-order effects of radical change are often unanticipated. Therefore in the near term, the prospect of such a change reinforces our sense of caution around the entire healthcare sector — even while as consumers ourselves, we welcome a constructive response to the much-publicized woes of the U.S. healthcare system.

Investment implications: The new, deepened healthcare pricing transparency rule proposed by the Trump administration would cause profound changes in the economics of healthcare delivery. While the rule would represent an immediate challenge to the models of hospitals and managed-care providers, the ramifications of a shift to a more consumer-facing, price-sensitive model of healthcare delivery are difficult to predict. We welcome a real market-based response to the problems of healthcare in the U.S., but the proposed rule increases our sense of caution surrounding healthcare-sector equities in the medium to long term. We think that in the near term, innovative biopharmaceutical companies addressing areas of large unmet medical needs could benefit from a shift of public and political attention away from drugs as the poster-child of U.S. healthcare dysfunction.

European Central Bank Launches New Stimulus

Last week, European Central Bank (ECB) president Mario Draghi announced a new measure to stimulate the Eurozone economy. Three months after ending a nearly $3 billion bond-buying program, Draghi announced a new round of the “targeted longer-term refinancing operations,” or TLTROs. This program basically lends money to European banks — “charging” them the ECB’s -0.4% deposit rate. (That means that the ECB is actually paying banks to take the loans.) In order to be eligible, the banks must in turn lend those funds into the real economy — to European corporations. It is a method to make sure the credit taps are still open, as Europe’s economy slows and parts of it (Germany and Italy in particular) teeter close to recession.

It seems like a no-brainer for European banks, who can make money on both ends of the deal. Of course the question is whether the observed slowdown in lending is a supply issue or a demand issue — in other words, is the problem that there’s no money to lend, or that there’s not enough desire for loans? On this point the data lean in the latter direction.

Europe has a lot of current worries — Brexit, a populist government in Italy, a slowdown in demand from China, and the Yellow Vest uprising challenging Emmanuel Macron, the great white hope of the European elite. The bigger picture is one we have harped on ad nauseam, and our apologies for pointing it out again: the fractured nature of European politics have meant that European banks have never taken their proper medicine after the 2008 crisis. The bottom line is that the system requires reform that the nations of the Eurozone cannot agree to provide.

Investment implications: Some political and economic events may conspire to create trading opportunities in Europe, but we do not view the continent as a long-term investment destination. If the U.K. manages to genuinely disentangle itself from Europe, we will become bullish on UK equities and the British pound.

China’s Stock Market Rally: 2019 Is Not 2015

China’s rapid stock-market advance in 2019 is leading some U.S. investors to recall that market’s 2015 boom and crash.

As we have pointed out, the domestic Chinese stock market is driven primarily by the sentiment of local retail investors (although the gradual opening of this market to investors outside China will eventually begin to change that). The sentiment of local retail investors is driven by pronouncements by government officials about stocks, financial events, and political events which will stimulate economic growth. This time, it seems to us that there are more significant policy and macroeconomic processes at work supporting that sentiment, while 2015 looked like a more purely speculative bubble.

- First, the economic backdrop is one of an economic deceleration that — as we’ve been suggesting since last year — will hit its low in the first half of 2019 and then reaccelerate in the latter half of the year.

- Second, the Chinese government is actively stimulating the economy in many ways, talking up the significance of the stock market for China’s global standing, removing some regulatory burdens on significant Chinese companies (especially in the tech sector), and telegraphing its desire to open more to foreign investors.

- Third, the rally is not being driven as much this time by local margin debt, and so will be less vulnerable to a sudden reversal if that evaporates.

- Fourth, the domestic market will be supported through year-end by the announced expansion of mainland Chinese equities in the indexes constructed by MSCI, which underlie many ETFs and global stock-market benchmarks; this expansion will mean a lot of foreign buying of domestic Chinese stocks.

- And fifth, there is the prospect of a fresh impetus of enthusiasm in the event of a trade deal with the U.S. — even if that deal is not thorough enough to satisfy political critics in the U.S.

Investment implications: We are bullish on China. It will be volatile, but the thesis is still intact, and we regard pullbacks in mainland Chinese shares as buying opportunities.

Market Summary

The Global Economy

Slowing growth in the U.S. and China and stagnant growth in Europe have led central bankers to open the taps in Europe (see above), to additional stimulus in China, and, as we noted several weeks ago, to a-wait-and-see attitude about U.S. interest rates, frequently reinforced in statements by Fed members and the Fed chair. In India, central bankers are talking about lowering interest rates, and an election is coming soon that will determine if the pro-growth positive attitude (that “we can become an economic power”) will continue, or if it will be replaced by a slow-growing “foreigners-get-out-of-India” attitude. All in all, these are clear indicators that central banks around the world are supportive of stock markets.

U.S. Stocks

We like some big tech companies among the FAANGs and other software providers that can grow and provide new technology and cost savings to the world’s large manufacturing and consumer products companies. We also like some development-stage biotechs which will attract buyers because of their science, and entertainment and travel-related industries. Most of the healthcare sector will be under pressure from political attacks, and some industrials will recover after the trade negotiations are settled. Among financials, we prefer electronic payments.

Latin America

In Mexico, Andrés Manuel López Obrador (AMLO) is popular with the electorate but the stock market is unsure of his approach and is acting timidly. In Brazil, votes are coming in July about cutting excess pension spending and thus freeing up the economy to grow. So the market is tepid as investors wait to see what will occur.

Europe

Europe is making modest progress as Draghi once again rises to help the stagnating economic situation. We are not yet enthused about Europe, due to Brexit and the fact that many parts of the continent seem satisfied with a very low-growth status quo. At some point, this may change, but we believe Europe, even if it rises, will underperform the emerging markets.

Japan

Japan is also making adjustments to allow itself to continue to move ahead. Support from the central bank, and a willingness of Japanese people and business to bend tradition to allow more guest workers, work longer beyond retirement age, and to welcome more women into the work force are all allowing Japan to be an interesting investment destination.

China and Emerging Markets

Clearly, China is the place to be investing at this juncture. Even the decline in stocks on Thursday and Friday of last week, which occurred as government-related brokers aggressively criticized some very fast rising stocks, was short-lived. Why? Because investors realized that what the government was trying to do was to keep the market from getting too euphoric while still allowing it to rise.

Clearly, economic growth is already slow and slowing further in China; for example, auto sales and retail sales are way down, economic activity is currently no more that 4.5% — well below the stated and expected growth rate that the government would like to see. Consumers and the public are less than totally satisfied with this slowing growth after they have become used to much more rapid growth until the last few years.

It is obvious that the government wants to improve public psychology and a steady but not volatile growth in the value of Chinese stocks is a good way to do that. (Other benefits and reasons for stock price appreciation are mentioned above.)

Other emerging countries that benefit from China’s growth are secondarily interesting — countries such as Thailand and Vietnam, which are potential beneficiaries but are somewhat vulnerable if a trade deal with China does not materialize within the next few weeks. Also interesting (and vulnerable) are commodities that benefit from China demand, such as copper, which is used in many electronic products that China and their outsourcing workshop countries make. Finally, emerging markets as a whole are somewhat interesting because of the possibility that China (a growing part of the EM universe), Brazil, India and many other Asian counties are growing and will be growing faster as 2019 moves along. Even Russia, which is not a growing country, and which depends upon commodities like oil to determine its outlook, is benefitting from higher oil and metals prices.

South Africa is not doing very well, but demand for minerals is helping somewhat. Eastern European emerging countries in general are moving ahead more rapidly than developed Europe, and parts of South America are taking up the slack which has been created by the implosion of Venezuela.

Gold

Gold is in high demand from central banks and from those who do not like to see the rapid expansion of debt in the entire world. If cash flows cannot support the payment of these massive debts, the demand for gold will reach very exalted heights. We believe that if gold moves past $1360 it will approach $1500 in the not too distant future.

Summary

We like U.S. major growth and tech companies and Chinese A shares. We will again regain interest in Brazil after the vote on pension reform coming in the next few months. We like Japan for slow steady growth, China for fast growth, and some Chinese workshop countries if a trade deal takes place; copper as a way to play Chinese commodity demand, and gold in recognition that many countries are now stockpiling gold in their national treasuries (Russia and China).

Thanks for listening; we welcome your calls and questions.