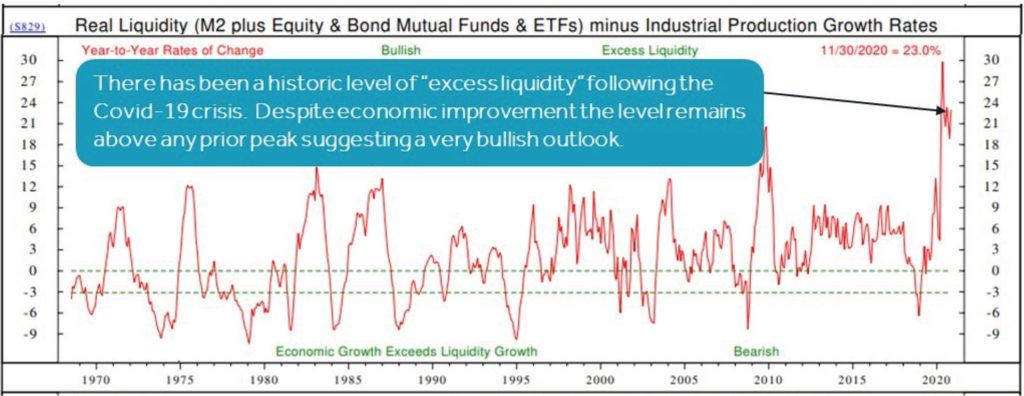

The remarkable market rally since last year’s pandemic lows can be attributed in large part to the very large and rapid increase in real liquidity in the financial system — that is, “readily available money above and beyond what is needed for economic growth,” as Canaccord Genuity strategist Tony Dwyer describes it.

Federal and state outlays in response to the crisis were enormous — and they are about to get another bolus thanks to the actions of the incoming administration, though it’s not yet clear how big it will be. However, it is very important to note that government entities are not the only ones who are primed to spend.

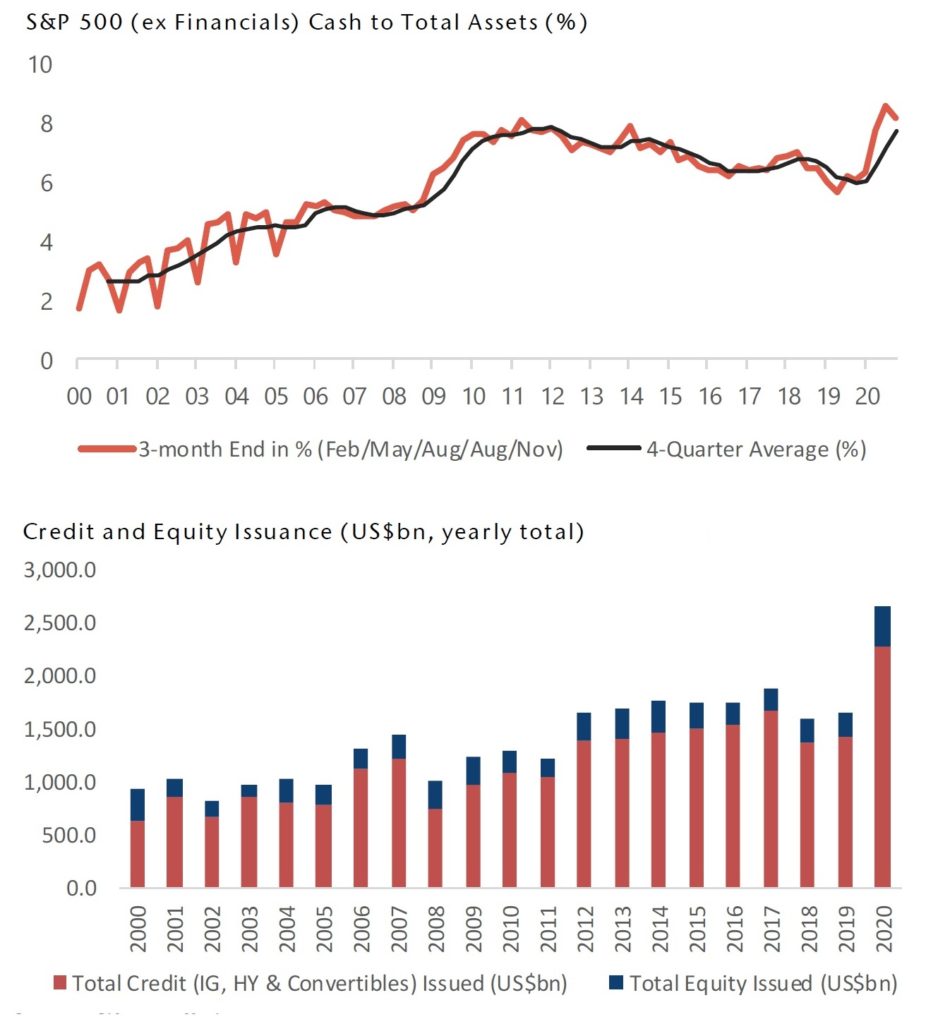

S& 500 companies raised record cash from equity and bond markets last year, and ended 2020 with record cash levels as a proportion of their total assets.

U.S. corporates are also seeing one of the greatest profit turnarounds in corporate history. On the surface, pandemic news is bad; underneath, we and most analysts see rapid improvement ahead in 2021 as “herd immunity” is reached, mostly with vaccines and mild cases, and the world continues to get back to business.

Rapid intervention by the Fed and Treasury has ensured that the financial “scarring” that often accompanies recessions was mild — the period of real credit stress back in March, 2020 was mercifully brief. The pandemic impact in some respects resembled that of a natural disaster, rather than a financial crisis. But unlike other financial crises, it did not leave a wake of destroyed physical infrastructure behind it that would need to be rebuilt. Factories were merely idle; office space merely empty. (It is also worth noting that the rapid response of government to mass unemployment has also enabled household balance sheets to remain robust. Consider that the country is exiting a recession with governments, corporates, and households all, on the whole, flush with cash.)

Because government spending is (relatively) transparent, we can have some insight into where that money will be going by looking at budget and program proposals. The runup since the election in green themes, alternative energy, transport decarbonization, battery technology, energy storage, novel recycling technologies, and new plastics formulations, are all examples of what the market has perceived as clear beneficiaries of the changed guard in Washington.

The question is, where will the corporate cash be going?

Buybacks are one obvious possibility, but aggressive buybacks might be politically unpalatable as long as the public remains focused on the pandemic dangers and the unemployment numbers. In our view, companies are most likely to deploy cash on capital expenditures, in an environment where they are cash-rich and facing a strong bounceback in global economic activity.

Investment implications: When we look at the greatest likely beneficiaries of accelerating capex in the context of current trends, we see the technology sector front and center. We do not necessarily mean the big tech FAAMG names, many of whom, we believe, have of late become ever more engaged in political gamesmanship that could eventually backfire by inviting antitrust action or other regulatory scrutiny. Capex at this time is likely to be focused on many of the themes accelerated in 2020 by the pandemic: business digitization and process automation software, cloud computing, manufacturing and logistics robotics, artificial intelligence, and accompanying this entire trend, cybersecurity. A new capex wave will also benefit much of the semiconductor industry, as well as more specialized innovators and manufacturers of sensors, remote monitoring hardware such as RFID technologies, and advanced medical diagnostics and devices that can integrate with telemedicine.