Goldman Sachs summarized the recent official inflation print: “August core CPI rose by 0.10% month-over-month, and the year-on-year rate declined three tenths to 4.0%… There were again signs of wage-price pass-through, with firmness in restaurant, personal care, and healthcare prices… [We] estimate that the core PCE price index rose 0.25% in August, corresponding to a year-over-year rate of +3.54%.”

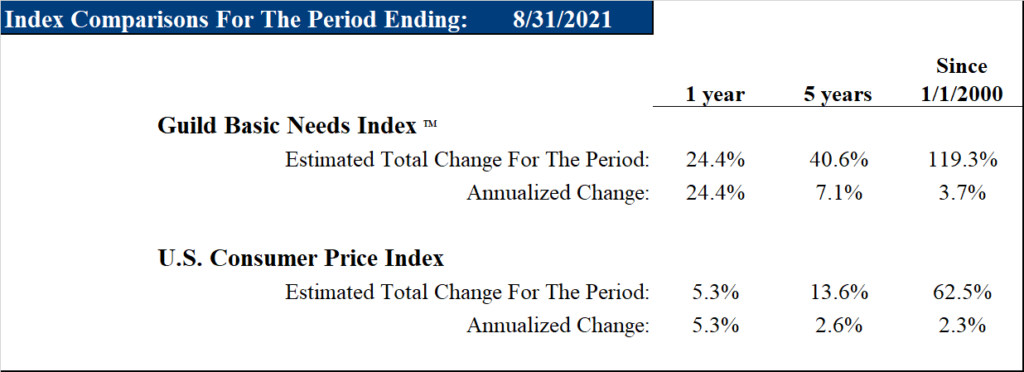

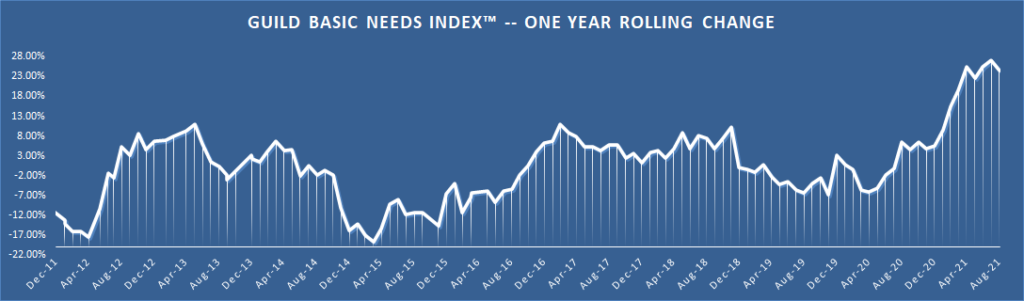

In short, the numbers surprised a little with their softness. How has our in-house, grassroots-level inflation measure, the Guild Basic Needs Index [GBNI], stacked up recently? A slight downtick from recent highs, but still elevated and trending up.

Source: Guild Investment Management, Inc.

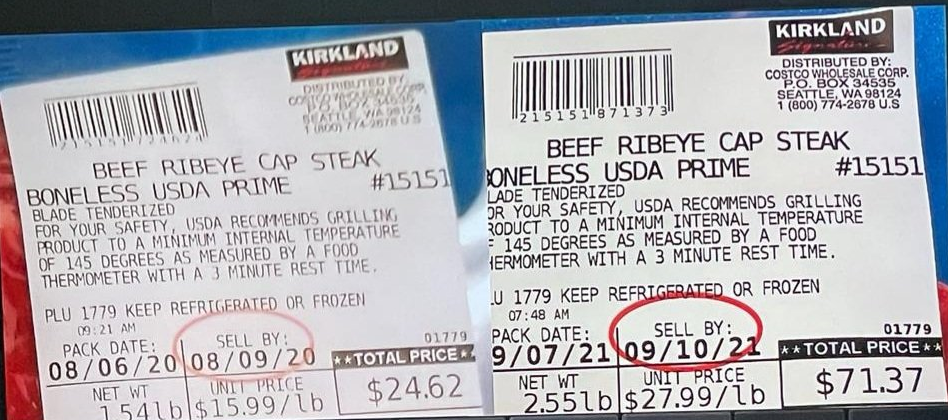

As a more direct piece of anecdotal evidence, the following snippet making the rounds on social media also caught our eye:

While “transitory” talk is also softening, the inflation heat map shows a movement of inflation from the “non-sticky” to the “sticky” categories. Further, we doubt that Costco shoppers will ever in future experience a decline in the price of ribeyes that will make up for the increase they have just experienced.