Guild’s Basic Needs Index

Bitcoin

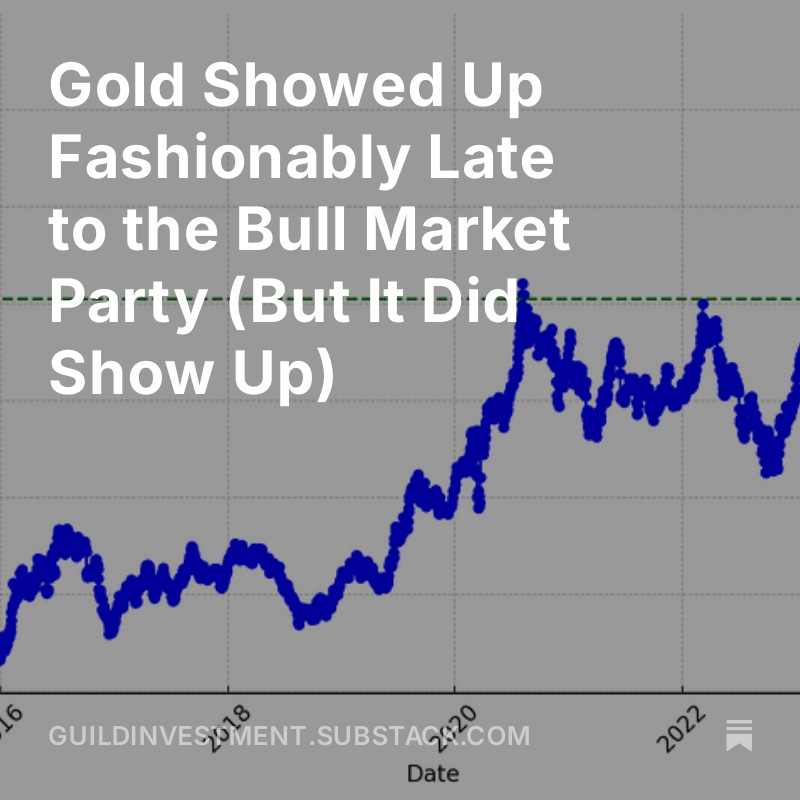

Gold Rallies, Crypto Acceptance Expands, But Liquidity Still Holds the Key To Sustaining These Moves

February 6, 2025

No Comments

February 6, 2025

Bitcoin

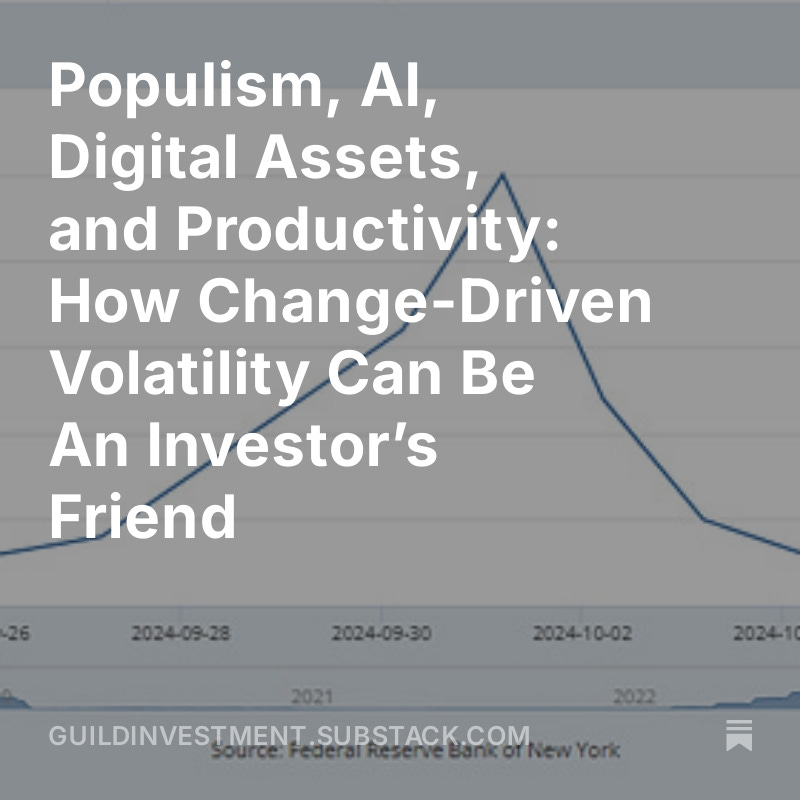

Populism, AI, Digital Assets, and Productivity: How Change-Driven Volatility Can Be An Investor’s Friend

October 17, 2024

No Comments

October 17, 2024