Is Gold’s Rally More Than a Flash In the Pan?

At the end of January, we wrote:

“Gold has been a stellar performer in 2019, and our bullish attitude is undiminished. We are believers that (1) slow economic growth in much of the world, (2) some rising inflationary trends in Asia and developing world, (3) lower values of some currencies, (4) the realization that many countries have excessive debt levels, and (5) a lack of trust in the wisdom of governments and their ability to make rational decisions to benefit their citizenry, are all encouraging the rise in the gold price. Gold demand is coming from many countries, and the fact that gold has underperformed for many years and is cheap is a major contributing factor. We remain bullish on gold and… gold-mining shares.”

We remain enthusiastic about gold (we are also bullish on silver and silver-mining shares). We were joined this week by Bridgewater Associates founder Ray Dalio. In a post on LinkedIn last week (which you can read in its entirety here), Dalio echoed points that will be very familiar to Guild’s readers and clients from our communications over the past four decades, and ended by endorsing a newly prominent role for gold in investment portfolios.

We believe that some portfolio allocation to gold is perennially important for investors. The size of that allocation should reflect current conditions and investors’ best assessment of new emerging trends. An excessive gold allocation during periods of economic expansion has an opportunity cost — namely, a smaller allocation to equities, which are the real long-term wealth creators for any investor. But at the right point in the economic cycle, gold can become an indispensable defense to protect the gains that stocks have provided.

We believe that 2019’s gold rally shows that increasingly, investors around the world — from individuals to central banks — believe that a financial, political, and economic environment is coming that will be different from the one that has marked the period since the end of the Great Recession. They are accumulating gold because they believe the coming environment will be one in which gold’s basic utility will become increasingly important — preserving wealth in the face of fiscal profligacy and the monetary woes that it ultimately, and inevitably, creates.

So what are the relevant factors that we see at work now, and what do we see coming for which gold buyers are beginning to prepare?

First, central banks globally are beginning another round of easing in an attempt to prolong and strengthen the current economic expansion as it flags.

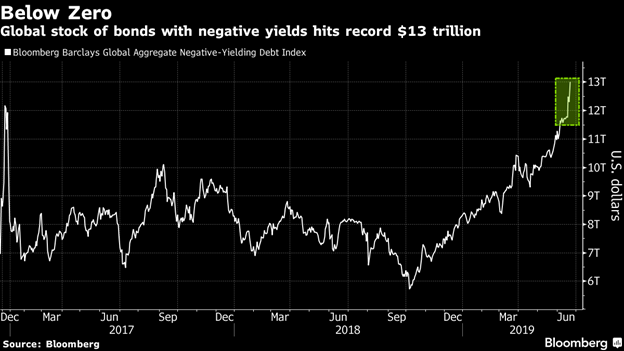

The extraordinary actions undertaken by central banks in the wake of the 2008/2009 financial crisis helped to avert the collapse of the global financial system. They pushed interest rates to unprecedented historical lows, and through quantitative easing and the expansion of central bank balance sheets, flushed the financial system with liquidity. These radical actions would have been dismissed as unthinkable just a few years before the crisis; now the prospects of normalized interest rates and balance sheets are greeted with “taper tantrums.” With interest rates barely off those unprecedented lows (and for $13 trillion in debt around the world, not even yet in positive territory), and balance sheets barely moving in the direction of pre-crisis levels, it is unlikely that further interest-rate cuts and balance-sheet expansion will get nearly the effect it did in the beginning.

Second, those extraordinary monetary policies have created distortions. The post-crisis monetary regime has been extremely friendly to borrowers and debtors, and extremely unfriendly to lenders and savers. Easy money has not resulted in much visible inflation in most consumer goods. It has, though, resulted in an inflation in asset prices. It has also encouraged the accumulation of debt, mostly by corporations and governments. As is always the case, no process can go on forever, due to diminishing returns, increasing distortions, and impatience and resentment on the part of those who are being hurt (in this case, savers, whether individuals or huge pension funds). When the current trend reverses, the distortions will be revealed.

What is likely to change as the cycle turns, as further stimulation garners diminishing returns, and angry constituents push for new policies?

First, the accumulation of debt and other obligations will hit a wall, as there will not be enough money to pay everything that has been promised, including both debt service and entitlements. Highly indebted governments will have a limited set of responses: to run large deficits and monetize them; to depreciate their currencies; and to raise taxes. They will likely use all three of these to varying degrees. All three of these are bearish for government-issued currencies — i.e., for cash. (Governments will favor the first two.)

Second, people will become increasingly reluctant to pay to safeguard the value of their savings in government bonds. That is the reality created by negative interest rates. Negative interest rates in Europe and Japan make gold less expensive to own than government bonds; and gold-mining shares that offer a dividend, much less expensive to own.

When in addition to negative interest rates, people begin to anticipate the coming monetization of debt, currency depreciation, and higher taxes, other forms of money will become increasingly appealing. Of course, historically, the form of money that is independent of governments and central banks, and largely immune to their manipulations in the long run, is gold.

There is a newcomer this time, of course: bitcoin. However, we believe that when push comes to shove, governments will have a free hand to be even more hostile to cryptocurrencies than they can be to gold — criminalizing cryptos outright, driving users into government-sponsored digital currencies, and generally making it extremely difficult for crypto investors and traders to interact with the formal financial system. We do not know how this will play out; the multiplication and penetration of cryptos and the growth of the crypto ecosystem may mean that cryptos will also be beneficiaries of the trends we are identifying, but it’s far from certain.

Beyond these strictly financial effects, it is likely that the last decade of unprecedented monetary policy has resulted in other social distortions, some of which Dalio points out. For example, ultra-low interest rates and quantitative easing resulted in an inflation of asset prices — an effect welcomed by former Fed chair Ben Bernanke and other architects of these policies. That inflation has helped exacerbate the divergence between the wealth of asset-holders and the wealth of non-asset-holders — or, in a simpler phrase, it has helped exacerbate income inequality. Whether or not income inequality is an intrinsically evil or undesirable phenomenon is better left to a political or philosophical analysis than an economic one. However, we can observe that income inequality has a tendency to lead to political strife and populist economic and social policies (of left or right-wing persuasion). Those policies in turn may produce a host of other unintended consequences… particularly because in our experience, populist politicians are seldom willing to address the real root causes of economic problems.

When we view these considerations together with the technical characteristics of gold’s current rally, we believe that gold’s price is responding to deeper issues than just transitory stock-market or geopolitical volatility.

Investment implications: We believe that the time is right for investors to begin to add to their gold allocation, because of both technical and fundamental factors.