While some economic data — notably year-over-year GDP growth — are flashing “recession,” some other important data are contributing to positive investor and trader psychology, and helping maintain the current counter-trend stock market rally. It can be awhile before reality comes calling… and that means that we wouldn’t want to call a premature end to the rally.

Inflation

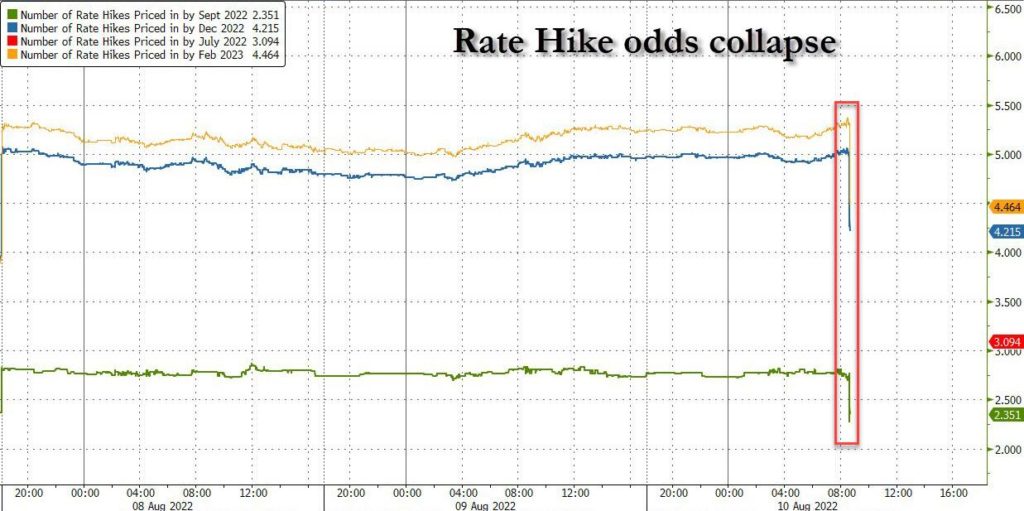

Yesterday, the supportive data were on the inflation front. The Guild Basic Needs Index (GBNI), our in-house real-world inflation gauge, began to retreat from its post-pandemic high in June; now the official inflation statistics are doing the same. The CPI fell back from 9.1% to 8.5%, retreating faster than anticipated; the index was flat month-over-month. Services and shelter costs continued to rise, but declines in energy (particularly gasoline) and used cars contributed to the faster-than-expected moderation.

Our take: as with the GBNI, while a cooling from the hottest year-over-year increases was expected, we see two problems with exuberance over the inflation data. First, there is little evidence to challenge the longer-term view we have maintained for some time — that while inflation will come down, it will remain persistently elevated for years to come. If anything, recent developments such as the passage of the Inflation Reduction Act suggest that more inflation lies ahead. The second problem is that in our view, given the likely persistence of inflation at 5–6%, the current Fed funds rate is not yet close to neutral, and so the market’s apparent discounting of a Fed pivot seems to us to be premature.

Source: Bloomberg, LLP

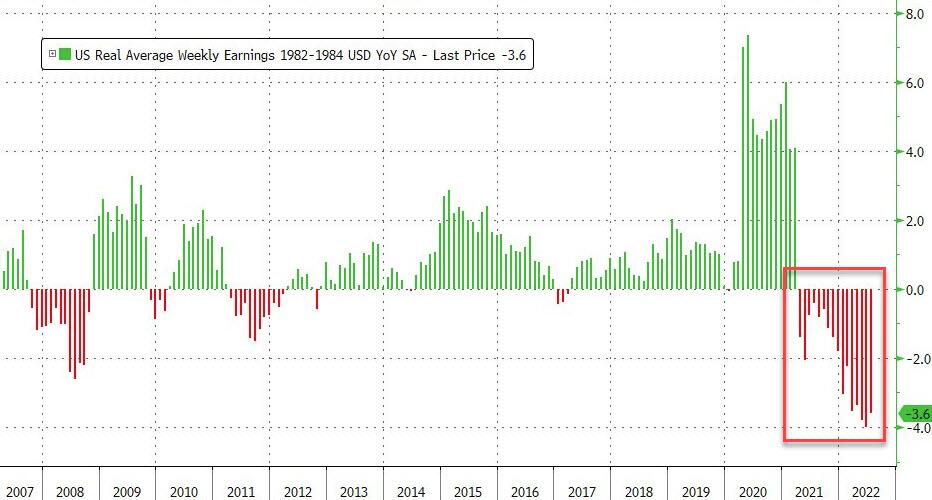

Should such a pivot occur, we would view it as a precursor for a further inflation surge followed potentially by a more significant recession in 2023. And finally, we note that real wages are down again-year-over-year, showing clearly that an 8.5% CPI is far from a triumph as wage gains are being more than offset by the rising cost of living. This is not the stuff of a strong consumer-led economy.

Source: Bloomberg, LLP

Employment

Earlier, the positive news driving (or excusing) the market’s ongoing bounce from the June lows was employment data: a seasonally adjusted gain of 528,000 jobs, versus a consensus expectation of only 250,000. (To the data nerds, that is a six-standard-deviation outlier — in simple terms, it is a huge deviation that should be extremely rare.) Here, we have cause to look a bit more carefully under the hood, and what we see gives us pause. This more careful look illustrates to us why employment data should not be taken at face value as a decisive indication of economic strength.

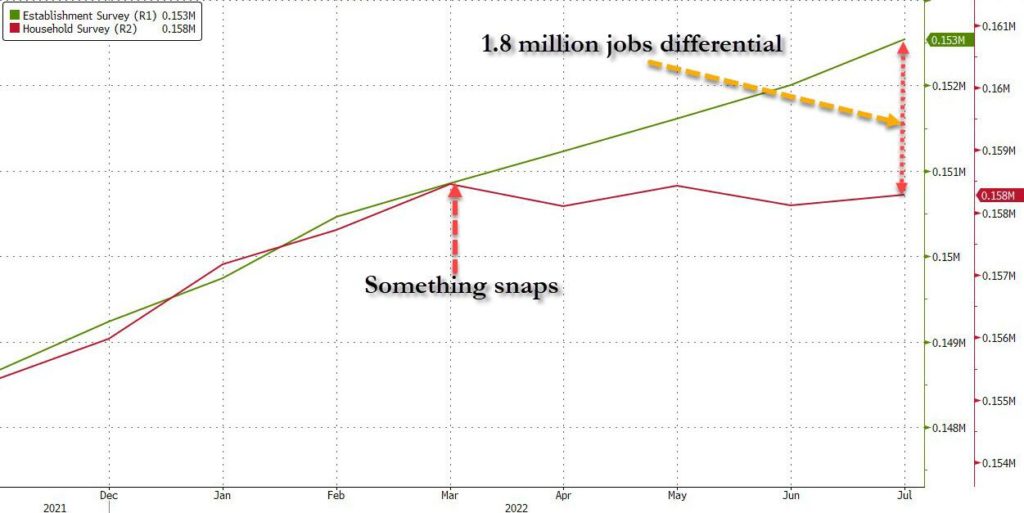

Our take: Our attention was drawn to a notable divergence between two data sets. The employment situation is assessed in several different ways: both by government reports, which result from surveys, and the reports of major payroll processing firms. The government reports are derived from surveys that are addressed on the one hand to businesses, and on the other hand to households. It is the business survey that showed the extraordinary beat in job creation. When we set the business and household surveys side by side, however, a wild discrepancy emerges. On net, since March, the business survey shows a gain of 1.8 million jobs, while the household survey shows a net loss of 168,000 jobs.

Source: Bloomberg, LLP

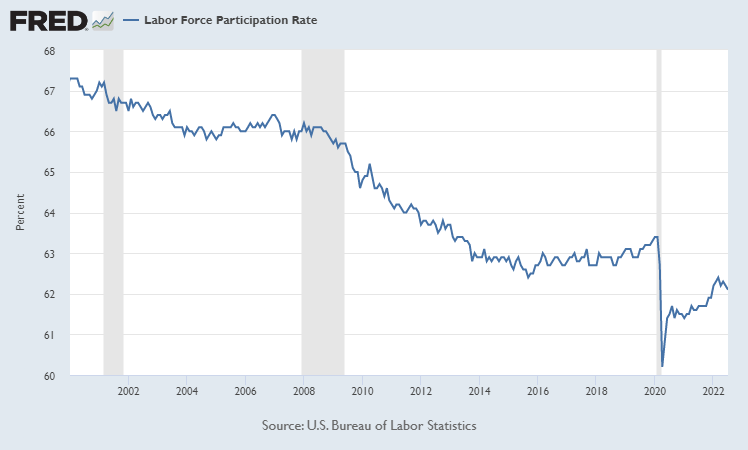

The explanation for this discrepancy appears elsewhere, where an elementary analysis would expect it to appear. The labor force participation rate continues to languish far below its pre-pandemic level.

Source: Federal Reserve Bank of St Louis

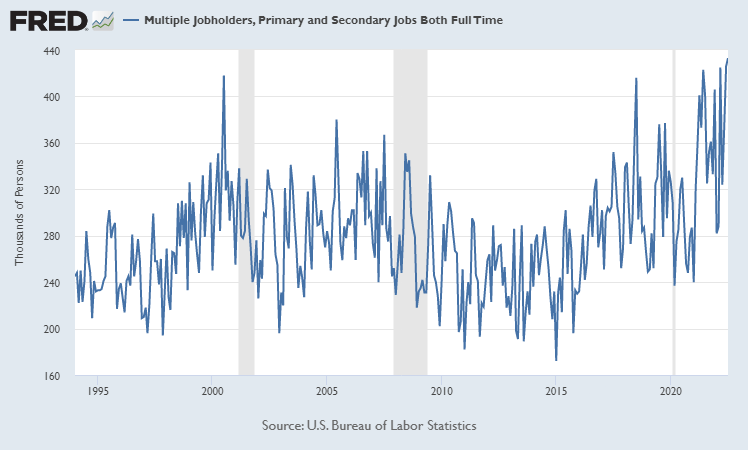

Further, part time job-holders who “usually work full time” remain at elevated levels; and more ominously, holders of multiple full-time jobs are at all-time highs. Workers who need to work two full-time jobs are not, in our view, a ringing endorsement of a strong economy.

Source: Federal Reserve Bank of St Louis

All in all, we are hard-pressed to understand why the headline establishment survey should be so promoted or taken in so bullish a fashion when other underlying trends suggest that the labor market, and the average consumer, are far from healthy and secure. We have no reason to believe that the data would be massaged and presented in a way to bolster the appearance of confidence by the current majority party… except that this is a phenomenon that seems to occur consistently no matter which party is in power. This is why it is important for sober analysts to look more deeply than the dominant headlines.

For investors, this is an important process because so much depends on accurately anticipating the economic environment into which the country is moving. Regardless of the actual direction of the economy, the market rally in recent weeks is the result of: investors’ placing some bets that maybe the Fed may not have to be so restrictive, maybe the recession will be modest, maybe sentiment got too pessimistic, maybe inflation has peaked, maybe earnings (which were not great, but could have been much worse) will get better later this year… That may be a lot of maybes, but nonetheless the market is happy with the data it is getting… for now.

The Next Big Acts: Inflation Reduction and CHIPS

A similar response should accompany the recent big headline legislative accomplishments of the current government: the so-called Inflation Reduction Act and the CHIPS Act.

The Inflation Reduction Act is a nonstarter simply because it will spend an additional $700 billion into the economy. Neutral analyses suggest that its long-term effect on inflation will be similar to the effect of its climate measures on rising global temperatures: insignificant. (In the case of addressing climate change, the Act will have insignificant results because in the long run, the marginal impact of U.S. actions on climate are minuscule to the point of irrelevance compared to the future carbon emissions from China, India, and other developing nations.)

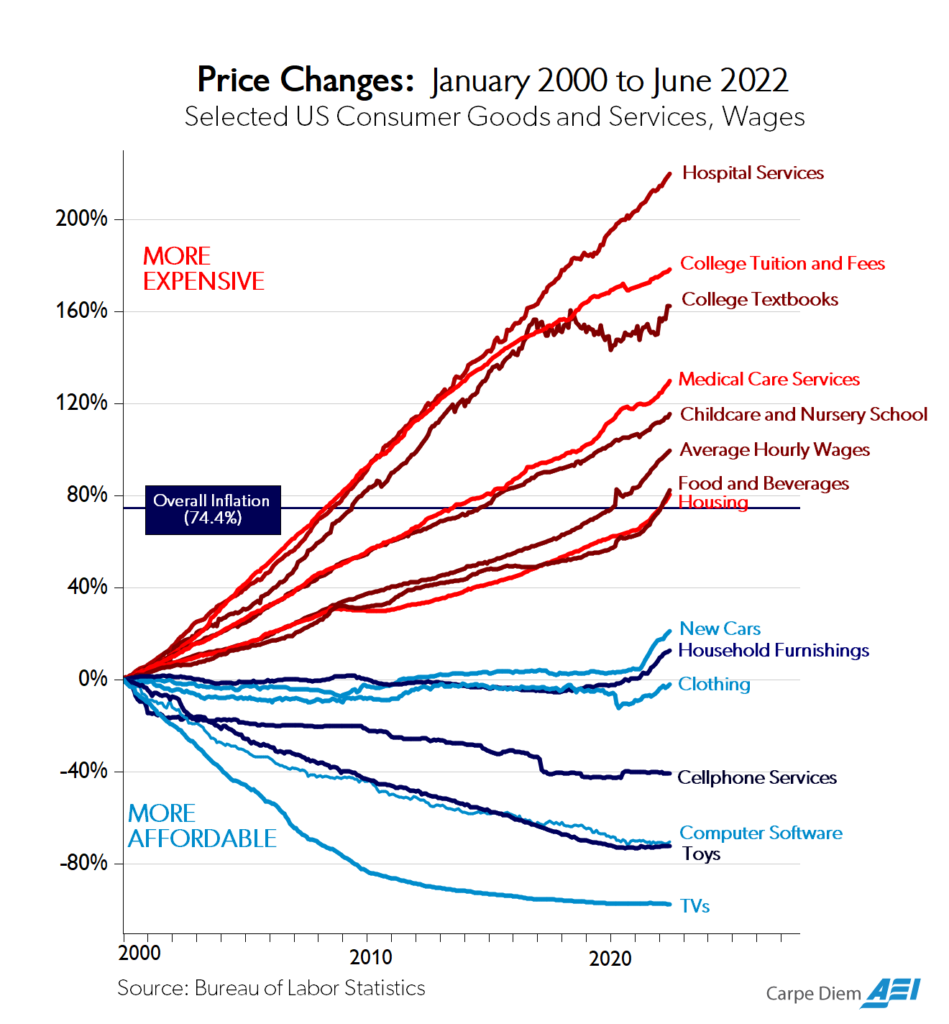

In the short run, however, deficit spending simply increases effective demand while doing nothing to increase supply — and that is a recipe for higher prices. In addition, we note that the Act contains vast new swaths of regulation — notably on drug prices. Disincentivizing manufacturing while raising effective demand is, ceteris paribus, going to raise prices, a phenomenon which is clearly visible in long-term U.S. inflation data. To revisit a chart we shared a few weeks ago, it illustrates how certain consumer goods and services which have seen some of the greatest price inflation since 2000 are items which in one way or another have been subsidized by, and/or regulated by government programs… versus other items with less governmental involvement.

Source: American Enterprise Institute

The CHIPS Act, while also a deficit-spending endeavor that will pump more money into the economy, is smaller — and has a different goal. We view it as being in essence a strategic preparation for further reshoring of critical semiconductor manufacturing capacity. The legislation is not perfect. It rewards some large incumbents that are less than innovative powerhouses, and shuts out some of the U.S.’ more creative firms in the industry; but it does represent a willingness in Washington, D.C. to be bipartisan when it comes to the defense of a commodity which is absolutely critical to the functioning of a modern economy.

Investment Implications: The weak underpinnings of the U.S. job market and economy, declining real wages, and the likely forward trajectory of elevated inflation, reinforce, in our view, the consolidation of a stagflationary environment. We continue to view a double-dip recession as a probable outcome, whether or not the current environment ultimately meets other recession criteria than the canonical definition of two successive quarters of negative GDP growth. None of this, however, necessarily means an imminent end to the market bounce from the June lows. We continue to believe that company estimates for second-half and 2023 earnings need to decline further, and that as that happens, the current rally will be challenged.