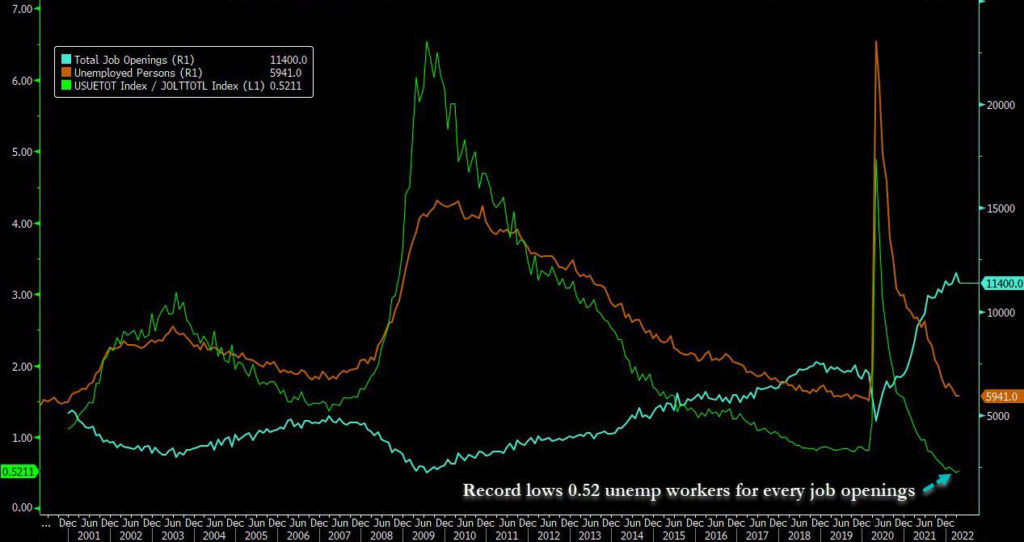

Yesterday, Wednesday, June 1, saw the publication of April JOLTS data – “job openings and labor turnover” — by the Bureau of Labor Statistics. This report is one of the key data sources evaluated by the Fed as it monitors the U.S. employment situation; remember that its dual mandate is “price stability” and “maximum sustainable employment.” Sustainable is the key there. Descriptions of the labor market as “red hot,” or alternatively, “white hot,” are everywhere in financial media — as are the discussions of a so-called “wage-price spiral,” in which high demand for labor pushes up wages, companies’ expenses, and the prices of their products.

So how did the April JOLTS data come in? Not in a way that is likely to allay the Fed’s concern about an overheating job market. One of the main items tracked in JOLTS is open positions, which did drop substantially — but the previous month was revised sharply upward. Thus open positions that companies are trying to fill, and can’t, remain near record highs, with nearly two jobs available for every unemployed worker looking for a job.

Source: Bloomberg, LLP

Another item that indicates the strength of the U.S. labor market is the willingness of workers to leave their jobs, as measured by quits – and that number, 4.42 million, was more or less unchanged from March’s 4.54 million record high.

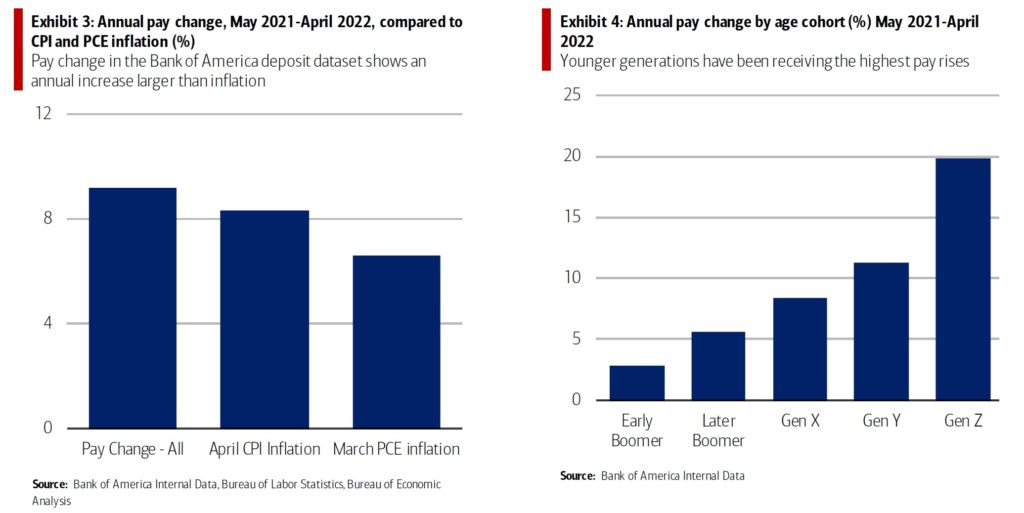

Finally, wages: in spite of ramping inflation, by some measures, U.S. workers are in fact not drowning, but are largely keeping their heads above water. Bank of America [BAC] aggregates anonymized data on about nine million of their direct-deposit customers, from which they can extract information about employment and wage trends. Overall, pay has increased 9.2% in the past 12 months, with younger worker cohorts performing better (and Millennials, aka “Gen Y,” beginning to catch up with higher-paid Gen X and Boomer workers). That increase is outstripping both the consumer price index and the Fed’s preferred measure, PCE (which we discussed last week).

Source: Bank of America Institute

We note that the biggest beneficiaries of rising wages are younger workers and workers in the lowest income quintile, those earning under $50,000 a year, who saw their wages rise 11.5% on average over the past year. (The other big category benefitting: people who jump ship for a new job experience an average 17.6% wage increase, which helps explain the ongoing elevated quits level.)

It’s not keeping up with our Guild Basic Needs Index [GBNI], of course – our in-house real-world inflation measure which, as we reported last week, most recently showed a year-on-year rise of more than 40%.

There is a little bit of evidence at the edges that the labor market may be cooling slightly. After all, JOLTS is retrospective and survey-based; and an up-to-the-minute analysis of actual job openings (data below from a company called Revelio) shows a downtick. The Fed doesn’t care overmuch about data like these, we think they likely indicate a coming trend change.

Source: Bank of America Global Research

For ourselves, we expect that this is the peak of postings for high-skill job postings — we already see layoffs beginning in tech companies, and it may spread to other sectors. When you look at the JOLTS job openings chart itself, it looks like a spike that we might sell if it were a stock.

Also, as we mentioned in our May conference call, we’re not entirely sure that all the listed “openings” are real. They may to some extent be an artifact of human resource managers also dealing with “supply chain” issues, and just like purchasing managers — placing a lot of orders in the hope that some of them may be filled, making sure that they have access to a pool of talent in a competitive marketplace.

Still, the overall picture as seen by the Fed is a stubbornly strong job market and companies scrambling to find the employees they need to meet demand. This “red hot” market is what the Fed will be looking at, along with inflation, as it decides how long it needs to stick to its guns before it can declare victory. More reports like yesterday’s JOLTS numbers will push the “Fed put” lower. Friday brings new headline employment numbers, and we’ll be watching closely.

Bring on the Robot Overlords

Not every employer will have the fortitude of an Elon Musk, who a few days ago sent an email instructing all Tesla [TSLA] employees back to the (physical) office full-time and telling anyone who didn’t like it that they could “pretend to work somewhere else.” Faced by workers with rising demands for wages, ancillary benefits, and accommodations of various kinds, the red-hot labor market and the “great resignation” that pulled so many workers out of the work-force are already having a sharp impact on robotics deployment by American businesses.

Back in November, we wrote on this topic, and since then, data from a robotics industry association show that it is accelerating. Many employers would like to hire humans, but simply can’t fill the positions — so they’re making the capital investment for new “workers” who they can easily get on board, whose wages won’t rise, and who won’t be quarantined when the next covid “winter wave” rolls through. The U.S. has lagged other developed economies in robot deployment — Germany and Japan in particular — and historically, most such deployment in the U.S. has been by carmakers. In 2020, 71% of robot orders were for carmakers, but in 2021, that dropped to 42%, implying a sharp expansion of robotics to other industries. (We called that trend in January, 2021, mentioning logistics and manufacturing as special areas of focus for new robot capex.) Manufacturers remark that robots have become more user-friendly, and now are often deployed as “cobots,” which work side-by-side with humans, augmenting their productivity.

In the course of time, as we have often written, automation changes the division of labor and the jobs humans do, but doesn’t necessarily reduce economy-wide employment. So we’re not writing here to stoke fear of the robopocalypse. We’re more suggesting that some automation-related stocks, many of which, like other high-tech stocks, have made round-trips back to price levels they last saw before the pandemic, may soon be appealing long-term thematic holds, overall market conditions permitting.

Investment implications: A Fed “pause”? With employment still very strong, and wage gains keeping pace, hawkishness seems more in the air — with Atlanta Fed chief Bostic walking back his comments about the possibility of a pause in rate increases after September. It’s still possible, but less likely; so watch the employment and inflation data carefully. While the hawk flies, long-dated assets will remain under pressure, though there can always be a rally; trade it only if you are nimble. In the long run, today’s labor conditions are frustrating businesses and pushing more who can do so towards more robust automation — which bodes well for the robotics space longer-term. It remains one of our favored “Fourth Industrial Revolution” themes.