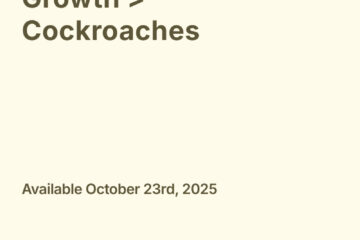

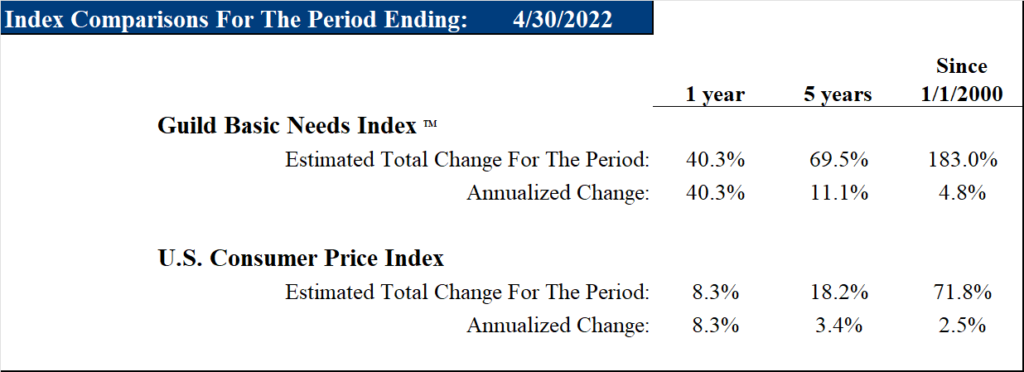

First, let’s touch on the inflation level revealed by the Guild Basic Needs Index [GBNI] — our in-house, real-world inflation measure which we compile from a simple set of data series covering consumer expenses for food, shelter, clothing, and transportation. We had to adjust the x-axis on our graph: year-on-year, the GBNI was up 40.3% in April. That likely feels like a more realistic assessment to you than the single-digit percent price increases you hear from the Fed or the Bureau of Labor Statistics (which publishes the most commonly cited consumer price data).

Source: Guild Investment Management

Market Participants Parse Fed Minutes Trying to Determine How Much Further Rates Will Rise… and Trying to Spot the Fed “Put”

Yesterday, May 25th, saw the release of the minutes from the Federal Reserve’s FOMC meeting on May 3rd and 4th. At this meeting, the committee reiterated that inflation is too high, raised rates by 0.5%, charted a path forward for several more large rate increases, and indicated how they intend to begin balance-sheet reduction. It seems unlikely that the Fed will achieve victory in the inflation war soon, and if the Fed “put” comes into play, we believe it comes after significantly more market stress.

The minutes noted that:

“Consumer prices continued to rise rapidly. Total PCE price inflation was 6.6 percent over the 12 months ending in March, and core PCE price inflation, which excludes changes in consumer energy prices and many consumer food prices, was 5.2 percent over the same period. The trimmed mean measure of 12‑month PCE price inflation constructed by the Federal Reserve Bank of Dallas was 3.7 percent in March, 2 percentage points higher than its year-earlier rate of increase.”

Problematic Inflation Measures

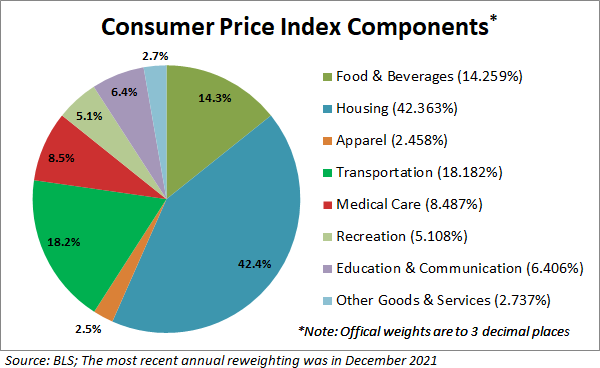

PCE inflation, or “personal consumption expenditures,” has been the Fed’s preferred inflation measure since 2012. PCE is even less transparent and granular than CPI (see chart below), and tends over time to provide a lower estimate of inflation. When additional finessing is applied, as in the construction of the “trimmed mean measure” noted above, the number is even more constrained relative to what we see in the straightforward price indices for consumer goods that comprise the GBNI. The Federal government has many reasons to want to lowball inflation — of course political reasons, but also budgetary reasons. As we’ve often said, the utility of official inflation statistics, whether “core” measures, measures with malleable and ever-changing baskets, etc., is that they can be used to obfuscate and manipulate the public’s perception of unsavory inflation reality. We look at them mostly to understand what officials want us to think… rather than to understand what is actually happening.

Regardless of the index one uses, the reality is that the Fed is in a bind, and needs to get inflation expectations down.

What the Fed Has Already Accomplished

Many agreed that the Fed’s minutes sounded hawkish. They contained many comments about the underlying strength of the U.S. economy and the risks posed by inflation — presumably conveying a message of determination so that markets would continue to believe (or to fear) that a lot more rate hikes are coming, probably past “neutral” to “restrictive” financial conditions. “All participants reaffirmed their strong commitment and determination to take the measures necessary to restore price stability.”

However, there does appear to be some weakening of resolve among members when they went on to note: “Many participants assessed that the Committee’s previous communications had been helpful in shifting market expectations regarding the policy outlook into better alignment with the Committee’s assessment and had contributed to the tightening of financial conditions.” And this was almost a month ago; more economic deterioration has happened since.

While not yet any sort of declaration of victory over inflation, there is thus some admission that the Fed’s actions and communications thus far have already had a significant effect in cooling off certain parts of the economy and in taking some froth out of markets.

The massive spike in money creation that came from pandemic stimulus is now falling off, and some measures of money supply growth, such as M2 (which measures both cash and highly liquid assets such as money market accounts) are returning to more normal levels.

Source: Bloomberg, LLP

Modern Market Cycles Are Credit Cycles

The huge global credit balloon driving all markets gives the Fed a great deal of power (even if it is seldom wielded effectively). Watch credit spreads and credit relationships closely. Overall, financial conditions have already tightened to the levels which caused the Fed to pivot in 2018. The current environment may be more fraught — because of inflation, and because of Russia’s war in Ukraine and China’s slowing lockdown economy, among other reasons — but it is still an instructive observation.

Cracks Appearing In the Economy

The CEO of Snapchat [SNAP] set the tone for a series of disappointing retail earnings reports (including Target [TGT] and Walmart [WMT]) when he said: “The macro environment has deteriorated further and faster than we anticipated when we issued our quarterly guidance last month.” That comment caused SNAP to fall 40% and brought down the whole ad-driven online social media complex.

The FOMC minutes also noted, “With respect to the business sector, participants cited robust consumer demand, healthy household balance sheets, and inventory rebuilding as factors supportive of business activity and investment.” However, others, even the FOMC within the same minutes, have noted the very rapid increase in consumers’ credit card balances. While pandemic transfer payments did improve the household balance sheet, the more recent trends are not so healthy — driven, we expect, by inflation and real wages that are eroding even as nominal wages rise. As for rising inventories, from another perspective, those are simply pulling forward future orders and imply depressed future demand.

Setting the Stage For a Pause?

The FOMC has laid out its own expectations for inflation. “All told, total PCE price inflation was expected to be 4.3 percent in 2022. PCE price inflation was then expected to step down to 2.5 percent in 2023 and to 2.1 percent in 2024 as supply-demand imbalances in the economy were reduced…”

If this projection proved accurate, it would suggest that the Fed has not eleven increases, and not six increases, but perhaps only three 50-basis-point increases ahead of it; and that would allow for a “pause” in September — a few months before the midterm elections, conveniently. This possibility was already floated by U.S. Atlanta Federal Reserve Bank President Raphael Bostic a few days ago, when he said “a pause in September might make sense.” Could the Fed be setting the stage to declare victory in the war on inflation, if PCE measures are following their expected trajectory and if elements of economic distress are beginning to appear more clearly? Please note that we don’t believe the Fed will achieve victory… merely that it might declare enough victory to justify a pause.

Perhaps the recent bounce in high-yield bonds [HYG] are reflecting the market taking many future rate hikes off the table.

Source: Bloomberg, LLP

If that possibility began to trickle into market consciousness, it could set the stage for a stock market rally as well. So, while the high-yield bond market may have turned higher based on interest rates not going up as high as feared, this asset class may not be taking into account the increased credit risk that will arrive should recession come. The same could be said for stocks; any rally could ultimately be reversed later in the year when recession heaves into view.

All of This Is To Say: Be Ready for A Rally, But it May be Brief

Ongoing inflation that is well above the “lowflation” trend of recent decades, and an eventual recession, remains our base case. Recession is probably the Fed’s real base case as well, at least implicitly, given the progression from Chair Powell’s discussion of a “smooth landing” to a “bumpy landing [with] some pain.” The Fed always tries to communicate its bad news gradually.

The market can rally strongly, and if it begins to price in a hoped-for Fed “pause,” we think it will do so. This can lead in two directions, depending on your constitution as an investor. If you have the skill and desire to trade, you can trade the rally.

If you are more long-term oriented, you can look around now for attractive entry-points. We would say that what constitutes “attractive” has a few factors:

- The company should exhibit GARP — growth at a reasonable price. After the recent declines, GARP is no longer the purely mythical beast it has been for the past several years. (Of course, there’s a lot of growth at completely unreasonable prices still out there — price matters.)

- Margins, balance sheets, and earnings quality will matter more in a persistently elevated inflation regime than they have for a generation.

- The company should be situated in a sector or industry that is advantaged by ongoing global geopolitical, social, technological, and economic trends. In short, it should be thematically desirable. We’ve described these very often in recent letters — primarily focused on technology (both software and hardware), new energy tech, tech-adjacent materials, precious metals, and cryptocurrencies.

- Geopolitics can wreck or make an investment. Some emerging themes that have risen to prominence — such as legacy energy and hydrocarbon production — depend for their future evolution on the global geopolitical landscape.

If you’re willing to endure some volatility, we think attractive entry points are available now for the establishment of investment positions in certain sectors with longer-term growth trends still intact.

Thanks for listening; we welcome your calls and questions. We’ll be hosting a Zoom call on June 30 — keep an eye out for the link, and please send us your questions ahead of time.