If only everything were linear and two-dimensional, the investor’s task would be a lot simpler. The inflation, margin, and productivity trends noted above would be easier to translate into predictions. Unfortunately there are confounding factors which make the problem multidimensional, non-linear, and much more unpredictable.

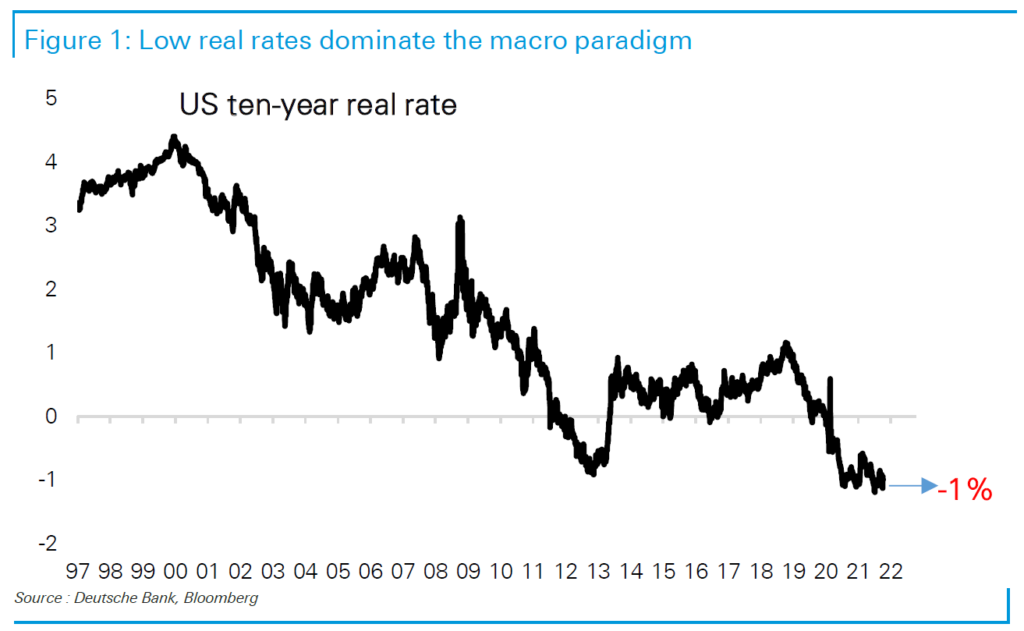

Among the most significant of those is real long-term interest rates. Why are they so persistently low? And why have they not budged, even with the Fed’s announced plan to begin tapering its asset purchases?

“One Chart To Rule Them All”

Source: Deutsche Bank Research

For whatever reason (the market’s anticipation of a “policy mistake,” impending recession, a global savings glut, etc.) there is ample reason to suspect the signal value of the most fundamental price signal of all — the price of money, which is the foundation for the valuation of longer-dated assets.

Perhaps this is unavoidable in an era of astronomical deficits, debt monetization, and nearly universal currency debasement. Adults in favor of responsible spending have left the room, or have been reduced to Twitter-based curiosities. As we have often observed, though, the U.S. remains the best house in a bad neighborhood — for now.

Thus, we continue to have a constructive view on some areas of the U.S. stock market, as noted above, focused on tech growth at a reasonable price, tech-related materials producers, and tech-adjacent disruptive entrants in other sectors and industries, particularly healthcare services, medical technology, business services, and logistics. We are enthusiastic long-term about uranium, as we view nuclear power as a critical component of any realistic low-carbon energy future, and also about novel and disruptive battery technologies.

We also continue to like gold, some precious metals, and bitcoin, in the face of the structural risks represented by persistently negative long-term U.S. interest rates.

Thanks for listening; we welcome your calls and questions.