We believe that inflation will hover from 3–5% for the next several years, even as it falls from June’s CPI print: 5.4% over the previous 12 months, and 0.9% month-on-month.

Five Areas That Merit Your Attention

Tech growth at a reasonable price: hardware, services, and software.

We would be buyers of growth, and particularly high-tech growth, stocks on dips. Many major tech stocks such as Alphabet [GOOG], Facebook [FB], Microsoft [MSFT], and Apple [AAPL] have low PE ratios compared to current and expected growth rates.

Recently there has been a run in some financial technology stocks that represent the way new young investors gain knowledge and insight, as well as chase stocks as a group. Last year, a new generation of millennial and Gen Z investors and speculators came to prominence on Reddit and other message boards; periodically, their embrace of meme stocks and their crowdsourced strategies have created volatile price action.

Healthcare companies that can navigate a rapidly changing medical landscape.

We like CVS, and the intersection of healthcare and technology; we like medical technology, healthcare delivery and communications technology, and pharmaceutical technology at a reasonable price. On dips there are many potential ideas in these areas.

Raw materials and new energy systems technologies.

We like lithium, copper, lead and other materials for an electrified, battery-driven future. Uranium and natural gas are unpopular with the public but popular with the writers of the new U.S. infrastructure bill, who realize that the growth of solar, wind, and battery technology will not immediately fill the gap that will be created as fossil fuels are phased out.

Online education.

Children in many countries outside the U.S. supplement their education through online instruction. However, many investors are unaware that the same phenomenon is growing rapidly in the corporate world.

In the last 50 years, most universities in the developed world have transitioned from a role as low-cost training schools for those who want to work in business, the professions, and government, to a new role as politically active and very high-priced purveyors of a political philosophy. Much of the public in the developed world does not see the value in paying $70,000 per year for tuition, room, and board at a private university, or $35,000 at a public university, for the education those institutions now have on offer. Major corporates are beginning to do a great deal more training in management, technical fields, and the sciences than had previously been the case. We think that this trend will continue and grow rapidly.

This trend has been long been prevalent in many developing countries whose high school and university educational systems generally lack extensive tech and science resources, and is now visible in Europe, Canada, Australia, and the U.S.

Companies have come public whose platforms enable training in specific business- and technology-centered knowledge and skills to benefit both company and employee. These platforms enable the companies who adopt them — GOOG, IBM, FB, and a growing number of large U.S. and international corporates — to offer continuing education programs and certificates to their employees. They can then reward employees who participate with promotions and higher pay.

Fintech.

While we are not excited about banks, we are excited about fintech, including payments technology. Banks may be disadvantaged, and new financial institutions and apps will take over much of lending and transactional finance. PayPal [PYPL] is an example. There are others to buy on dips.

Earnings Season and Coming Attractions

Earnings season is progressing, with strong performance from many of the big cap tech beneficiaries (some of them mentioned above), as we highlighted last week.

On a short-term basis, we note that many companies will report good earnings, and then have nothing further to report until next quarter.

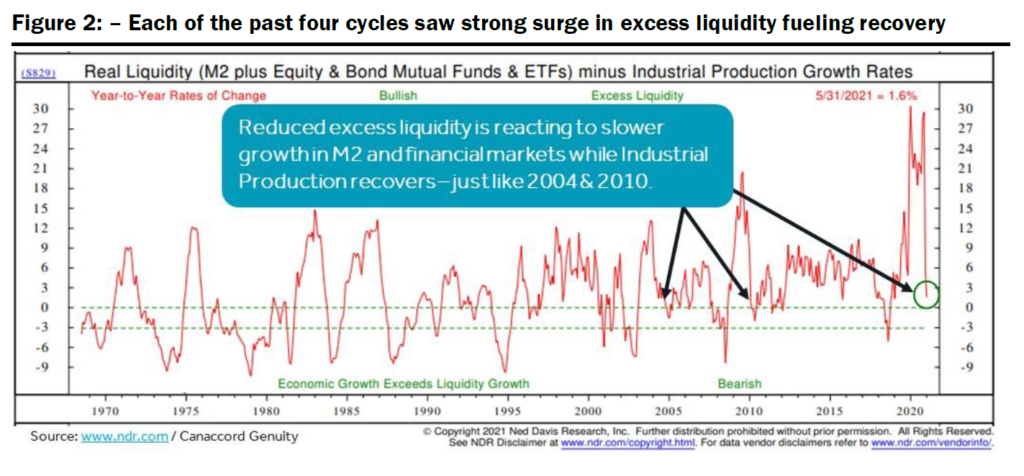

As we have observed, while the Fed’s asset purchases are ongoing, other policy adjustments are underway that are reducing liquidity from its pandemic peaks. Canaccord’s Tony Dwyer has repeatedly pointed out that free liquidity typically declines as a recession recovery progresses and that liquidity is put to work in the real economy.

Source: Canaccord Genuity

This is not a sign of imminent disaster, but reduced excess liquidity could have an impact on markets, especially combined with weak seasonality.

Many investors will be looking out into the future at two events. First, the coming Federal Reserve Economic Policy Symposium at Jackson Hole, WY, late this month, may be an occasion for the Fed to telegraph future intentions about its asset purchase program — and if the market doesn’t like what it hears, there may be some indigestion. And second, a Federal infrastructure bill may be finalized, giving investors a view of how much and what kind of further stimulus to expect. That event too could lead to enthusiasm or disappointment.

All of this suggests to us that the next few months may be a good time to study, and work on your buy list. As we indicated above, we are fundamentally positive on disruptive themes in technology, both hardware and software, business digitization and its sub-themes, disruptive healthcare, and the global electrification of infrastructure. We are constructive on some technology-related materials themes with likely long-term supply pressure from insufficient investment, including copper and lithium.

Gold remains a fundamental long-term component of any inflation-sensitive investment strategy, though investors must recognize that an increasing portion of gold demand will be siphoned off into alternatives, particularly cryptocurrencies and DeFi.

Thanks for listening; we welcome your calls and questions.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.