The U.S.

Most large U.S. indices have pushed to new all-time highs, on the back of optimism stoked by positive earnings (as we have have been anticipating over the past few weeks) and perhaps because of optimism about U.S./China trade negotiations.

We see that negotiation process continuing to play out, and would not hang our hats on a near-term resolution as a reason for market optimism. More likely, that ebb and flow of negotiations will contribute to small corrections; we would regard such corrections, from any proximate cause, as opportunities, given the fundamental backdrop.

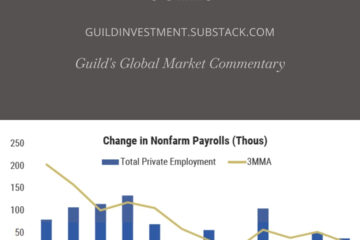

That fundamental backdrop continues to be the nascent recovery of the U.S. economy from its third mini-slowdown of the post-2009 expansion. We continue to see signs that this inflection is underway. The ISM non-manufacturing index rebounded in October, rising more than expected, to 54.7, with increases in business activity, new orders, and employment components. Job growth was strong, as reported in the Job Opening and Labor Turnover Survey (JOLTS) conducted by the Bureau of Labor Statistics, with openings decreasing by 277,000. October typically marks the start of the season for heavy truck orders, and saw such orders rebounding to an 11-month high — a possible early sign of a turn for some industrial bellwethers. All contributing elements to Bank of America’s industrial momentum indicator improved in October, with the indicator itself reversing a six-month decline through September. This is not necessarily an invitation to weight industrial stocks more heavily in a portfolio allocation, but supportive data to suggest a general improvement in tone for economic fundamentals.

The monetary and financial side of the equation continues to be supportive, with both the U.S. Federal Reserve and most global central banks remaining highly supportive, and U.S. financial conditions remaining unstressed. With the credit cycle intact, and the economy ticking up, our framework remains the same: in our view, we are in the late stages of a long bull market, in which small corrections are likely, but large gains remain ahead before the bull is done. Given this backdrop, we counsel investors to avoid falling prey to premature pessimism, and to remain invested and continue to look for opportunities.

The U.K.

Shouldn’t the Brexit drama have concluded by now? Alas, October 31 has come and gone, but the drama goes on, with the U.K headed toward an election and all its attendant uncertainty. Taking a larger view and stepping back from the blow-by-blow, we see a Brexit in some shape as likely, and believe that the long chaos of negotiations and political turmoil has made the U.K. market and the British pound relatively cheap and attractive. We have been scrutinizing London’s FTSE index for inexpensive dividend-yielders in particular. We are bullish on U.K assets for the medium term, though there will be volatility as the Brexit process is completed and then as its consequences unfold and mature.

Bitcoin and Cryptocurrencies

A new study, soon to be published online by the Journal of Finance, elaborates on the forensic data showing that bitcoin’s meteoric price rise in late 2017 was largely due to a manipulation scheme. This is not news — as we reported in June, 2018:

“Stanford professors’ study alleged price manipulation in Bitcoin’s 2017 price spike. Crypto exchange Bitfinex has been under pressure since last year due to allegations that the allegedly one-to-one U.S.-dollar backed cryptocurrency “Tether” was actually being created out of thin air to generate artificial demand for XBT and forestall price declines. In the absence of a formal audit (which Bitfinex has still not provided), the analysis of two Stanford professors largely corroborates the accusations made earlier this year by anonymous Medium analyst ‘Bitfinex’d.’ If true, the allegations underscore the need for regulated crypto exchanges where participants can have a measure of certainty that they are not being fleeced.”

The new research, however, zeroes in on a single entity manipulating the bitcoin price via Tether on the Bitfinex exchange. The new study’s authors — finance professors and forensic accountants at the University of Texas and Ohio State — stop short of alleging malfeasance by the operators of Bitfinex, an exchange which is not located in the United States and not subject to the jurisdiction of U.S. regulatory authorities. However, they do say that “If it’s not Bitfinex, it’s somebody they do business with very frequently.” If you bought bitcoin (or any other crypto) near the peak, and you are still underwater, you can likely thank a single fraudster.

Therefore, a word to the wise: crypto markets globally are almost all unregulated. Lack of regulation is not a good thing, when that lack permits fraud and theft. Those speculating in digital currencies, or interested in such speculation, should understand that the market is not transparent and is likely still subject to this sort of manipulation. Speculators can remove some risks by conducting business only on regulated, U.S.-based exchanges — advice we have been giving you since we started writing about cryptos years ago. But since prices are set by global trading activity, there is for now no way to avoid the larger risks posed by the presence and potential dominance of unscrupulous actors in those global markets.

Thanks for listening; we welcome your calls and questions.