The Federal Reserve, as expected, delivered another 0.75% rate increase, bringing the Fed funds rate to 2.5%. Markets were buoyant in response — perhaps concluding that a Fed pivot or declaration of victory is closer than feared, or that too much pessimism had been baked in about the likelihood, and likely depth and severity, of an oncoming recession.

We’ll be tuned in to earnings, which thus far have in many cases been impressively resilient. The first official GDP data for the second quarter came in at -0.9%, confirming (unless there is an eventual revision to positive territory) that we’re in a recession. Stagflation is no longer just a fear — it’s a reality.

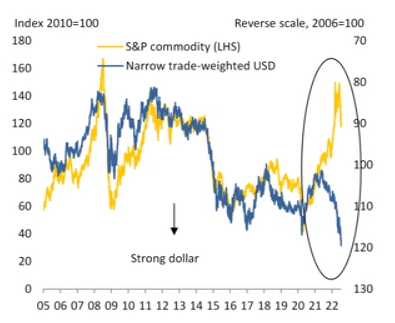

One of our favorite analysts, John Anderson of Emerging Advisors Group, recently provided this chart, which illustrates the recent decoupling of the historically normal relationship between the U.S. dollar and the performance of the S&P commodity sector.

Source: Emerging Advisors Group

We took this as a useful and instructive illustration of how unusual current conditions have led to the breaking of many longstanding economic and financial relationships. To say that in another way: there are real, objective reasons for the confusion that can afflict any investor in current markets who expects their behavior to track what he or she knows from the past.

Finally, this photo from the back yard of one of our staffers reminds us what a time of uncertainty is really useful for… getting your ducks in a row. (Thank you, Barbara!)

Thanks for listening; we welcome your calls and questions.