Is it a top yet for the bear market rally? It has continued to march on into the teeth of skepticism from many professional money managers, who according to surveys, remain at the peak of bearishness even as they are almost fully invested (yes, again the phenomenon of the “fully invested bears”). And yet, recession fears have sharply declined. We don’t think that sanguine view is entirely rational… but we don’t want to fight the tape.

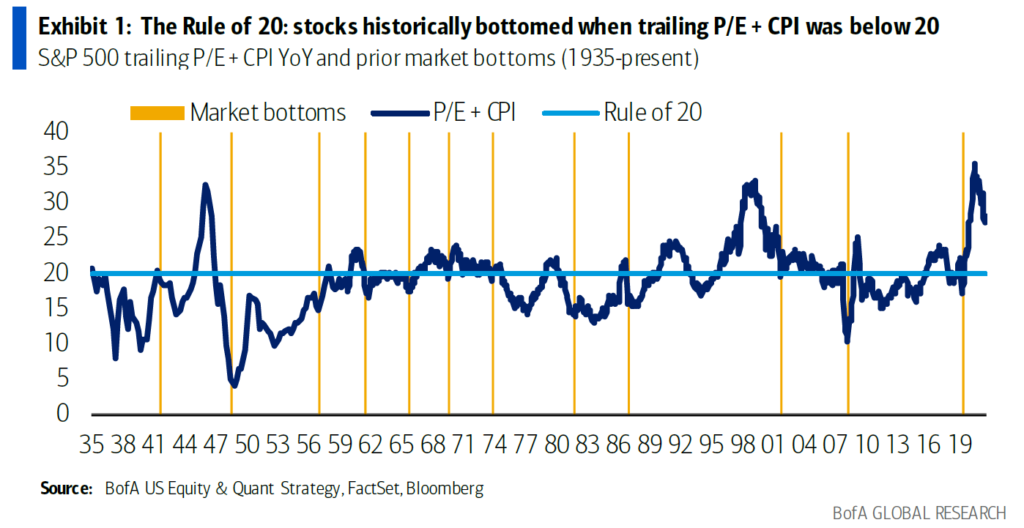

A comment from Bank of America was suggestive: declines have never bottomed when (a) the market’s trailing price-to-earnings ratio and (b) the consumer price index, added up to more than 20. As the chart below shows, we’re not there — and that suggests that further declines lie ahead… eventually. How eventually? We do not know, therefore we remain invested for most of our clients, focusing on cash-flow generating businesses with good balance sheets and visible growth, selling at a reasonable price.

Source: Bank of America Research

Gold has languished, but given the depth of monetary excesses around the world, and the non-zero and non-trivial possibility of geopolitically significant events in Russia and Asia, a gold allocation, in our view, is still sensible. Bitcoin has begun to show some life — but more interesting to us than current bitcoin price action is the about-face of Blackrock’s [BLK] Larry Fink on bitcoin. In 2017, Fink called bitcoin “an index of money laundering.” Now the company is offering a spot bitcoin trust to private clients, and partnering with Coinbase [COIN] for the backend, which was a nice shot in the arm for COIN. Maybe Mr Fink just wishes he’d been HODLing since 2017.

We continue to note that in this “crypto winter,” institutional interest remains strong, despite price vicissitudes. We also remain interested, particularly in genuinely decentralized cryptocurrencies such as bitcoin, whose utility and desirability derive from their independence of monetary authorities. Other digital currency projects are increasingly taking on the characteristics of regulated fintech innovators. In that context, the associated tokens will increasingly be analyzed not as speculative assets with huge potential future price appreciation, but in the same terms as other investments — namely, according to the anticipated future cash flows that will accrue to them. Such regulation and sober analysis will mark a different era for these digital assets. We believe these other tokens should not necessarily be categorized conceptually with crypto, but rather with fintech.

Thanks for listening; we welcome your calls and questions.