Accelerating GDP data (annualized quarter-over-quarter at 2.6%, with the real-time “GDP Now” estimate running over 3%) and cooling PCE inflation data (4.5%) in the U.S. that were just released suggest that some of the most bearish economic prognostications have had the wind taken out of their sails.

Earnings season is underway, with a deluge of tech earnings this week. Results from tech stalwarts Alphabet [GOOG], Microsoft [MSFT], and Meta [META] have disappointed. META in particular saw its stock price descend to a six-year low as investors digest a darkening internet ad environment and the company’s unwillingness to rein in capex spending on its “metaverse” push. Central themes for the tech complex — ad revenue and cloud growth, for example — appear challenged, at least at this juncture. The stock-market leadership of megacap tech is reaching its sell-by date; the question, as we posed last week, is what can replace it. Some companies are using the current environment to do well — others are performing below already lowered expectations. There is wide variance, opening the door for discerning stock selection.

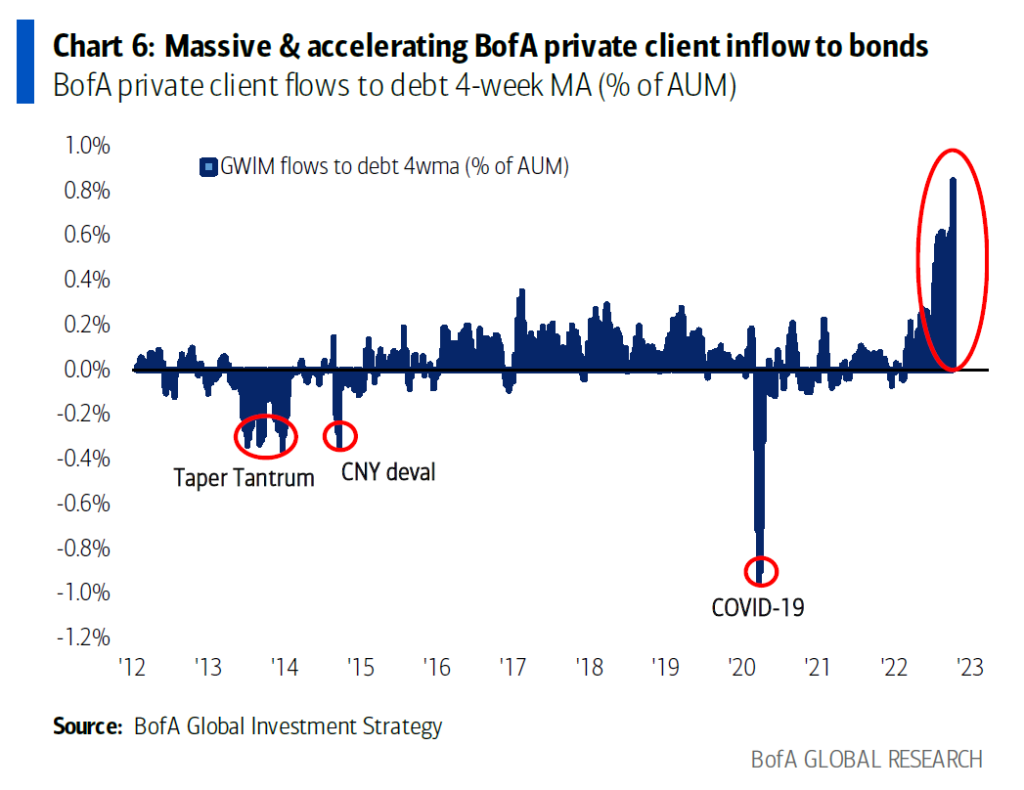

If investment flows are an indicator of the current answer and the current mood, the destination for outflows from megacap tech stocks is in fact bonds (and secondarily, cash).

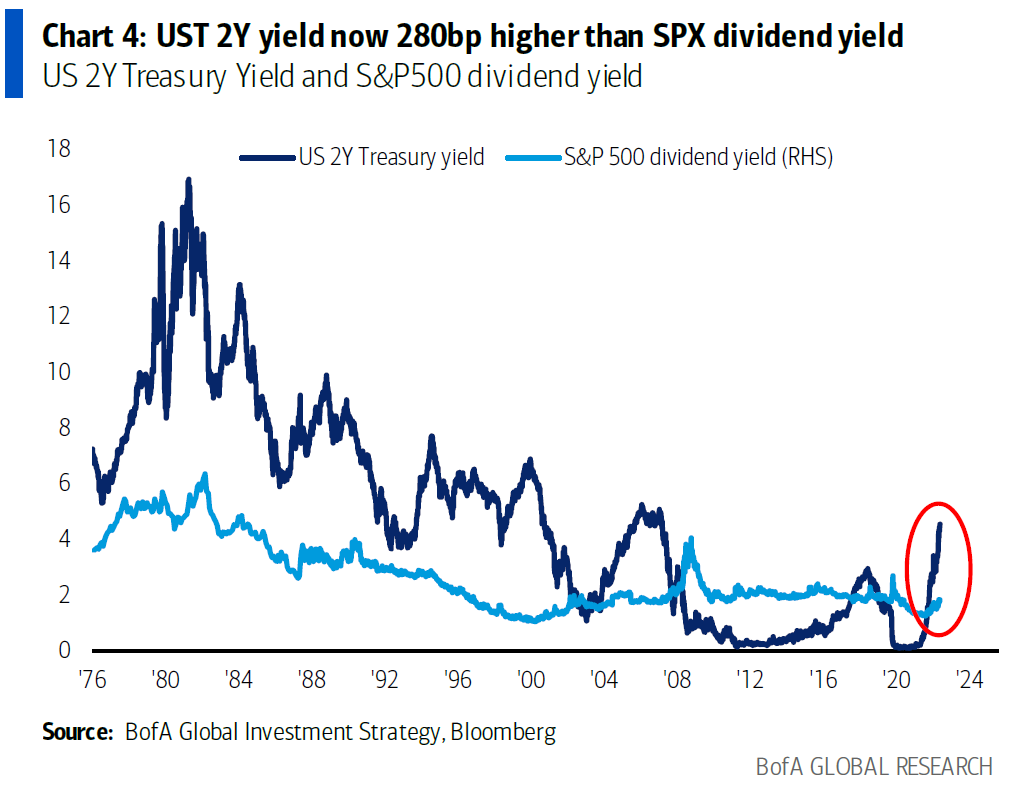

Short-dated U.S. Treasuries now offer a yield exceeding the dividend yield of the S&P 500, suggesting their relative appeal compared to stocks.

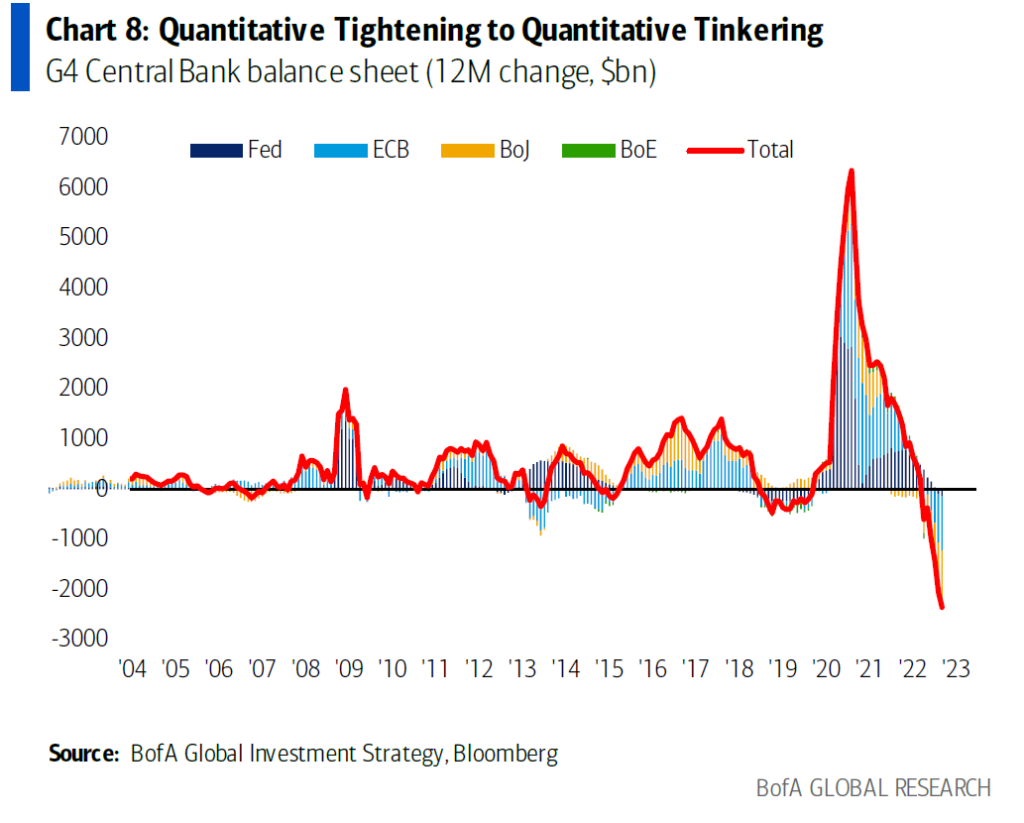

Finally, we note that even though there has been hardly any “quantitative tightening” to speak of, compared to the supernova of balance sheet expansion that happened in 2020 and 2021…

… yet central banks in various ways are already casting disturbed glances at potential dysfunction in credit and currency markets and wondering how they might flip the script. Perhaps another “Operation Twist” is in the cards — or some other version of “QE that is not QE”? Money printing is not over; it’s just napping.

Thanks for listening; we welcome your calls and questions.