The Fed

“We still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.”

Jerome Powell, Nov 2 2022

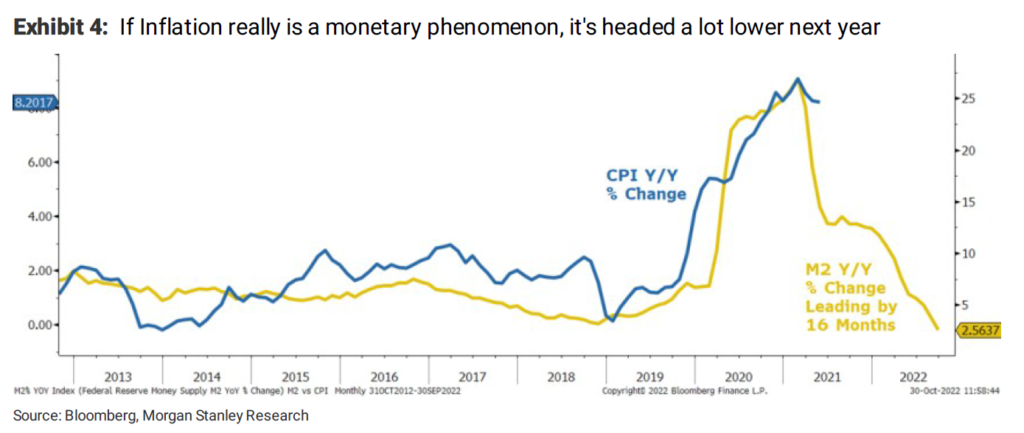

By one significant measure, the Fed has succeeded. In the wake of the pandemic fiscal and monetary supernova of 2020 and 2021, the growth of the U.S. money supply as measured by M2, expanded at a rate never before seen in the 70-year history of the data (peaking at a 27% year-over-year growth rate). It is currently expanding at just 2.5% and slowing. That suggests that, as we have been saying for some time, inflation will cool from its recent blistering pace. While we believe inflation will settle in at a lower level, it looks like it will remain quite elevated compared to what we have been accustomed to. Nonetheless, markets are looking for any sign in the economic and inflation readings that give the Fed a reason to pivot to a less restrictive policy.

While the bulk of the inflationary impulse came from the immense, deficit-driven outlays of pandemic fiscal policy in 2020 and 2021, the task of reining in the resultant inflation has largely fallen to the Fed in 2022. (Of course, the Fed contributed handily to inflation by maintaining its easy stance for far too long against easily observable trends and against common sense.) As we have often noted, the Fed funds rate is a blunt instrument that is actually ill-suited to the task of correcting the effects of fiscal profligacy — but it is the tool to hand, and Mr Powell today assured us that the Fed will keep going.

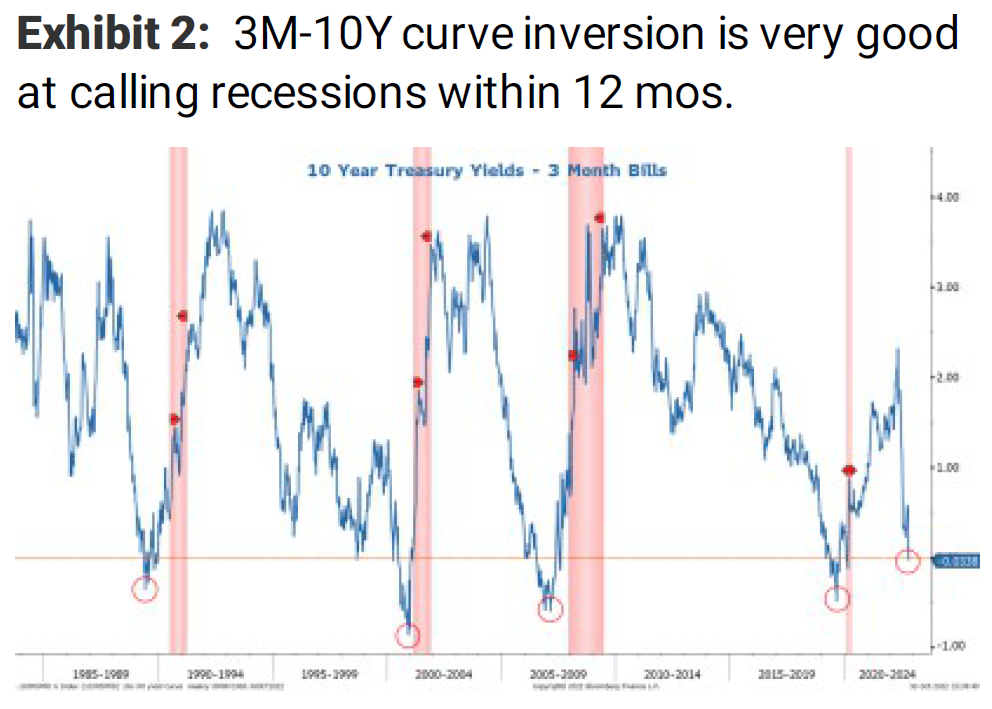

We don’t take him entirely at face value. Mr Powell has said that he is willing to risk recession to get inflation in check, and we recently got another indication — one favored by Mr Powell himself — that a recession is in the cards, with the rise of three-month above ten-year Treasury rates. That particular “yield curve inversion” has a faultless recession-predicting track record, and has never yet given a false positive.

Source: Morgan Stanley Research

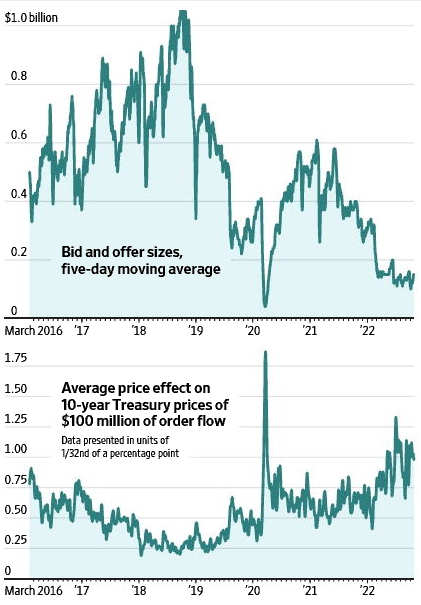

On the surface, the Fed may be telling the nation that it has functionally become a “one-mandate” institution, willing to tolerate a recession and a rise in unemployment so that it secures “price stability.” But its other, unspoken fundamental mandate is still operative in the background: the mandate to maintain a smoothly functioning financial system, both in the United States and abroad. Declining Treasury liquidity has raised concerns among some observers; a sufficiently serious “accident” in the systemically critical financial plumbing at home, or in Europe, or in Japan, would certainly call forth a Fed pivot.

Source: JP Morgan

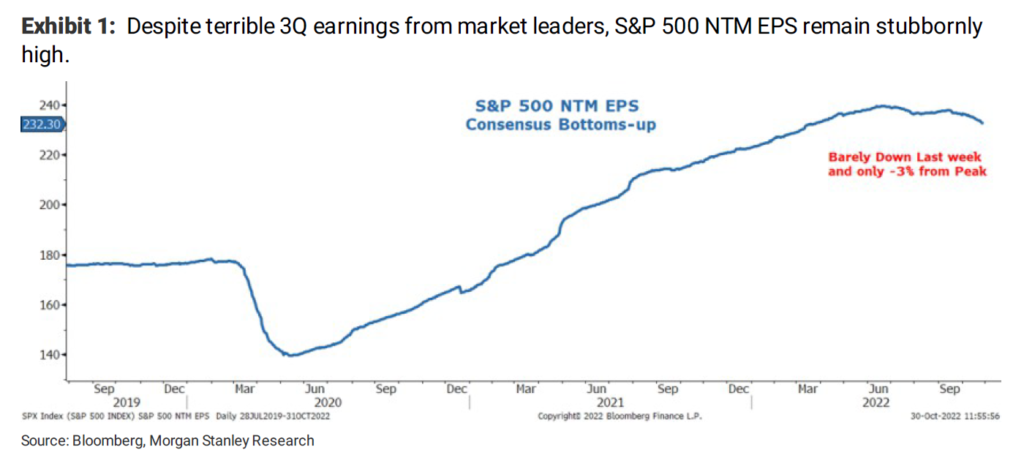

Barring such an “accident,” however, the Fed is likely going to continue putting on the brakes, at the cost of recession. Earnings for some of the most-watched former tech leaders have been disappointing. Listening to a wider variety of conference calls, what we have heard broadly is “not as good as hoped, not as bad as feared.” That is not the kind of talk that inspires analysts to sharply revise their forward estimates, and indeed, those estimates have not come in very much.

Source: Morgan Stanley Research

Does the Rally Have Legs?

For the market as a whole, it looks to us that earnings need to be revised down further — partly because a recession, whether mild or severe, is very likely in the cards, but also partly because with consumer inflation dropping more rapidly than producer price inflation, margins would be setting up for a squeeze if that trend continued. Add that to the ongoing re-rating of price-to-earnings multiples being driven by rising rates, and it becomes a solid thesis that the present relief rally in the broad markets has an upside cap that’s getting closer. The long and the short of it is: there is probably another buying opportunity that lies ahead — so keep honing your buy list. We have seen many recessions come and go over the years; that is one of the advantages of being in business for over 50 years: experience. To us the current environment spells opportunity, not panic.

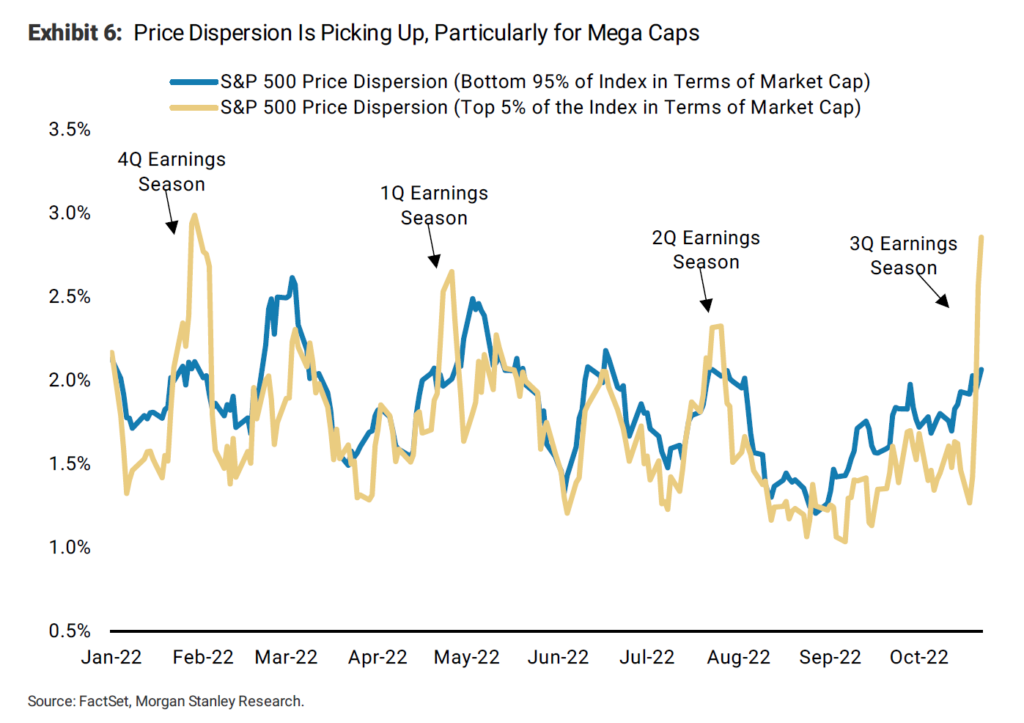

In spite of our view that the broad market needs to correct further, we want to highlight the value of being selective. There is a distinct margin pinch between dropping inflation at the consumer level and stickier cost inflation faced by many goods and service producers and providers. However, this applies very unevenly across the economy. We return here to a theme we have mentioned often in 2022 — pricing power. Companies making goods and providing services who have pricing power will be better positioned to outperform. Performance dispersion is rising (especially among mega-caps), and that favors stockpickers over indexers.

We are in the middle of Q3 earnings season and the variance between companies’ performance is quite wide. In general, the past earnings is better than feared, but the expectations and guidance looking ahead is more muted. On the many calls we are listening to, we are seeing how different corporate managements are dealing with the various challenges in a variety of ways: doubling down, expanding, contracting, retrenching, etc. Some companies will be proven right and will reward their investors; and then there will be others… who will “have some ‘splainin to do” in 2023.

Source: Morgan Stanley Research

Here Come the Midterms

Midterms are upon us, and this year they are particularly consequential. Polling suggests that a split government is increasingly likely, which with one caveat is something generally welcomed by markets. (While it may sound cynical, our experience is that having a split government makes it harder for radical ideological and unexpected policy actions in any direction, and markets usually do not respond well to the unexpected.) So what’s the caveat? Bitter partisan rancor setting the stage for more debt-ceiling brinksmanship and a government shutdown, or even a redux of the U.S. debt downgrade that happened during the Obama administration in 2011. Of course, with interest rates potentially set for a structural re-rating compared to the last two decades, public debt levels and debt maintenance costs are unavoidably going to become a louder conversation and source of contention.

Global asset allocators are watching the U.S. political drama closely. The dollar (and therefore global currency markets) are in the front row of this political sparring match. Gridlock suggests that while there will be much jockeying and deliberating over tax policy, foreign policy, national security, and defense spending, perhaps it won’t materialize (or metastasize) into something the markets are not prepared for.

As for the Dollar…

The DXY index has twice attempted and failed to breach the 114 level. If the dollar begins to look forward to moderating inflation and an eventually more dovish Fed, that would bode well for foreign currencies and foreign stocks (but that presents its own challenges for the retail investor). It would remove a little of the fear that has been driving global investors to the dollar and dollar assets as a haven. Under these circumstances, we would begin to seek out opportunities abroad; tactically, even Europe might be appealing, especially if the new Congress manages to encourage a cease-fire in Ukraine and take some of the potential nightmare escalation scenarios off the table.

Thanks for listening; we welcome your calls and questions.