The extraordinary pandemic support measures enacted last year by the Federal Reserve and the Treasury were a critical component of the U.S.’ so-far successful navigation of pandemic disruption. Still, those support measures would have had little to work with if the U.S. economy had not already undergone substantial digitization in the prior decade. Digital infrastructure permitted a large part of the service-sector workforce to transition quickly and more-or-less seamlessly to remote operations. It also permitted e-commerce platforms to expand rapidly enough to meet the spike of demand created by the lockdowns.

These changes will be lasting. E-commerce is continuing to expand in absolute terms off the elevated pandemic base. Many workers are returning to their offices, but some will remain fully remote, and many will have permanent hybrid schedules, partly in the office and partly at home.

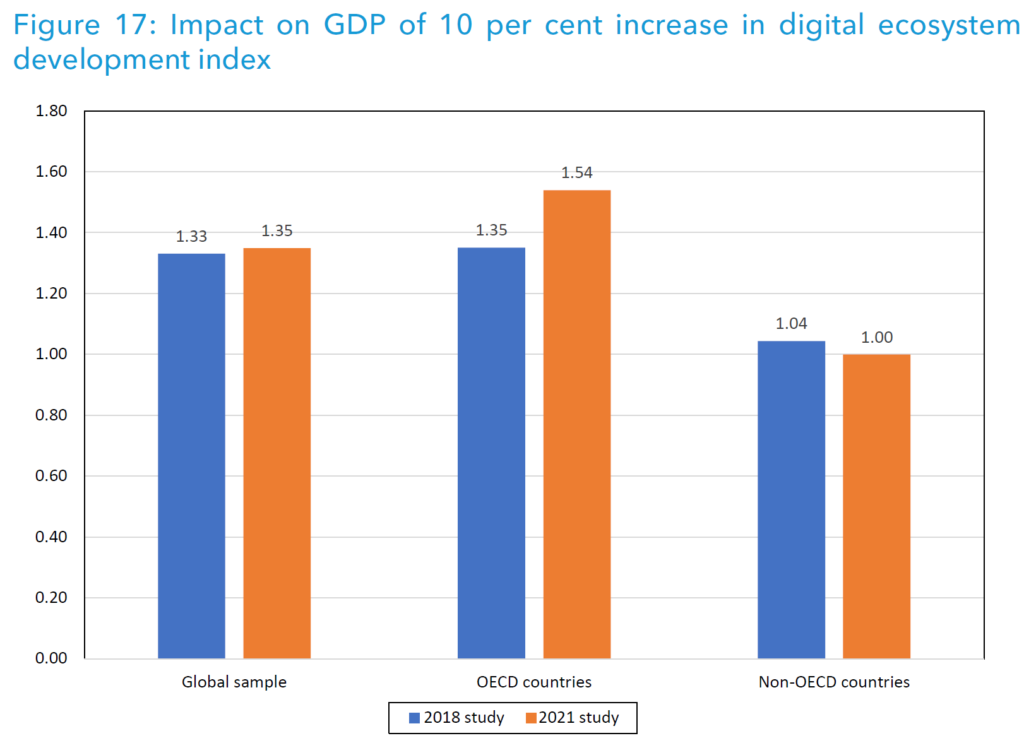

In these pages we’ve often described the productivity benefits of economic digitization, process automation, software development, and so on. The ITU (International Telecommunications Union) is a United Nations agency encouraging cooperation and development of IT resources and infrastructure; it recently produced a report analyzing the economic impact of digitization in light of the covid pandemic experience. Their model, as we would expect, shows significant economic growth benefits for increased digitization. That benefit actually increases as economies become more digitized — surely a manifestation of network effects. The highest growth benefits for ongoing digitization accrue to the most advanced economies — especially the U.S. That means that wherever there is low-hanging fruit, for example, where there are regions or communities in the U.S. underpenetrated by fixed-line or wireless broadband access, there is an opportunity for infrastructure investment to generate outsized returns in economic growth.

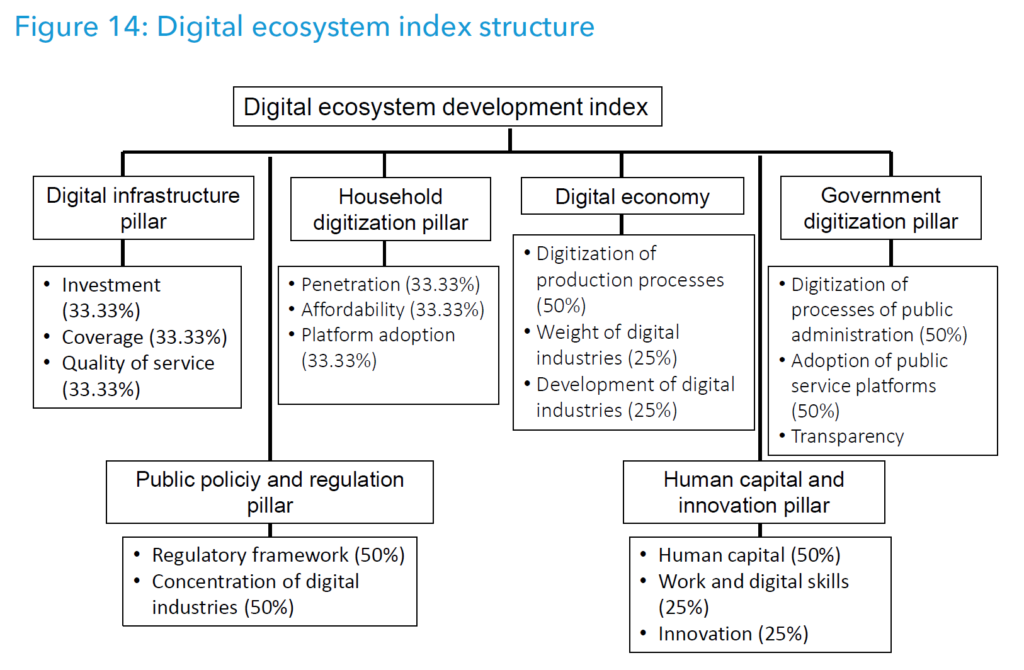

The ITU’s comprehensive map of digitization encompasses households, businesses, and government:

The benefits of advancement on this “digital index” are high for developed economies such as the U.S. Between 2018, when data were previously compiled, and 2021, when pandemic data were included, the effect appeared even greater.

This kind of analysis is likely to encourage bipartisan agreement on the inclusion of fixed-line and wireless broadband buildout in the current infrastructure push, since the benefits are clear, put in high relief by the experience of the past year, and focused on productivity enhancement and economic growth.

Investment implications: The backbone for increasing economic digitization is fixed-line and wireless broadband. Penetration in the U.S. nationally is already high, but particular geographic areas and demographic groups remain underpenetrated and underserved. Encouraging the closure of the digital gap could be a rare topic of bipartisan agreement. Capital expenditures should particularly benefit companies engaged in the buildout of rural broadband access in the U.S. Further, 5G remains in early innings in the U.S. with the prospect of strong near-term expansion, and broadband infrastructure spend will likely also flow to 5G hardware beneficiaries. We note also there is an powerful disinflationary impact from digitization. Efficiency enhancements can continue to keep a lid on runaway inflation.