Two weeks ago, the worst single-day decline since March was blamed in part on emerging signs of a second wave of coronavirus illness in some reopening states, particularly Florida, Arizona, and Texas. That nervousness in turn raised fears that in some locations, authorities might need to re-institute lockdowns or tighten local policies. So of course, that led to investor anxiety about the soundness of the market’s remarkable V-shaped rally from the March lows, which depends for its conviction on a powerful economic rebound.

On balance, we are not sure that second wave fears were really the main reason for the dip. After a rally like the one from late March to early June, a breather is necessary for technical reasons alone, and “explanations” are largely post hoc constructs of the mind. It seems as likely to us that the “real” driver was the slowly gathering focus of attention on the upcoming political battle in November, which promises to be preceded by many months of ugly, contentious partisanship, even as the country continues to clamber out of the ditch into which coronavirus pushed it.

We understand people’s apprehension about there being a second wave. Many have just begun to emerge blinking into the sunlight of somewhat normal life after two months indoors binging video, consuming social media, and/or trying to be productive on Zoom and Slack. However, we see reasons to be skeptical of some interpretations of the data. As has been the case from the beginning of the coronacrisis, nothing is plain and straightforward, and data are sometimes framed and presented with an agenda.

Importantly, increasing positive test results are occurring just when testing is ramping up (which was one of the critical planks in the CDC’s reopening strategy).

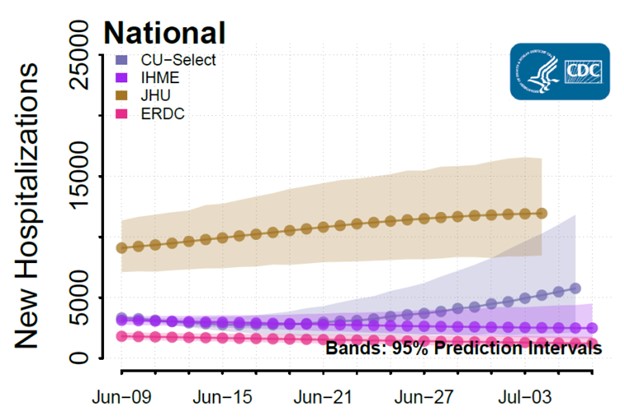

With data on positive tests confounded by increased testing, rates of hospitalization are a more direct measure of how we’re doing post-lockdown. Hospitalizations nationwide remain far below their April peak, and according to most projections, will be flat, or continue to decline.

Fatalities are also sharply down and trending lower.

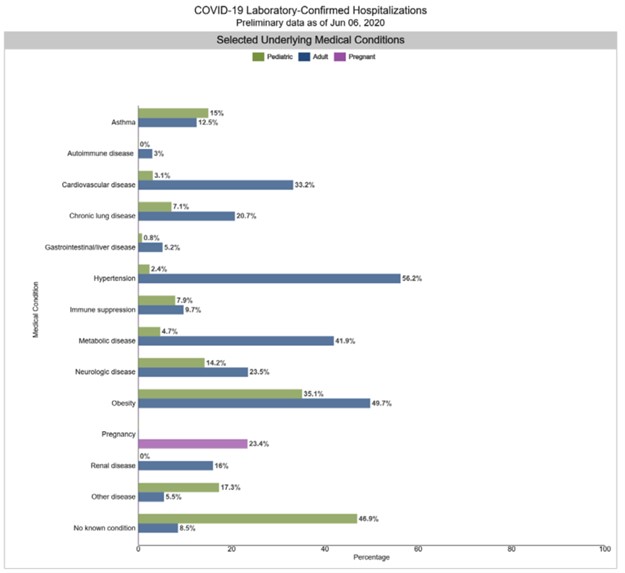

What we notice consistently in examining and discussing these data is that the danger posed by Covid is spread very unevenly across demographics and geographies. Populations that are especially prone to these “co-morbidities” will be more vulnerable to serious illness. The chart below was published in this week’s data update from the CDC:

The last line there is striking — of hospitalized adults, only 8.5% lacked any identifiable underlying condition. Cardiovascular disease, hypertension, diabetes, and obesity are the main culprits for increased mortality risk. The prevalence of these conditions in more underprivileged populations helps explain a great deal of Covid’s demographic disparities. Coupled with the extremely significant difference in risk profile by age, here is how the “second wave” thesis looks to us.

The apparent second wave is probably an artifact of increased testing and the repatriation of U.S. citizens from developing-world Covid hotspots, combined with a modest uptick in cases because of the rollback of lockdown measures.

In fact, as Dr Anthony Fauci (Director of the National Institute of Allergy and Infectious Diseases and the public face of the administration’s Covid response) and others have pointed out, this is not the second wave — it is still the first wave, ongoing and now moderating.

The most significant risks remain confined to vulnerable populations: the elderly, the institutionalized, those suffering from chronic illnesses, and those who work in a few specific environments, such as meat-packing plants, that are particularly prone to infection spread.

All of this makes us confident that the risks posed by reopening will be remediable, and that reopening and economic reacceleration are going to continue pretty smoothly overall, with some local adjustments, but probably without any more broad-based stay-at-home orders.

The Economic Recovery and the Liquidity Barrage

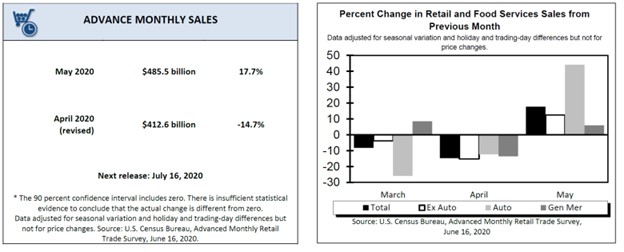

The reacceleration was especially apparent in the strong rebound of consumer spending in May, reported last Tuesday:

On Monday afternoon, the Fed announced that it was inaugurating its previously announced program for the purchase of individual corporate bonds (it had already been buying corporate bond ETFs), leading to a more-than-700-point intraday swing in the Dow.

Equities

To us, the message is clear. The economic recovery is gathering enough steam that it is unlikely to be derailed by a resurgence of Covid or by the reinstatement of some localized lockdowns. Reopening of businesses will continue, with targeted safeguards for vulnerable populations. And as a backdrop to all of this, the Federal Reserve and the Federal government will continue their unprecedented monetary and fiscal support for the U.S. economy. The Fed’s action this past Monday helped to demonstrate its credibility to investors. This will lower spreads between government and corporate debt, and continue to provide an indirect incentive for investment assets to flow into the equity market.

In addition, although we do not know the exact shape or size of further fiscal support from the Federal government, we are sure that it is coming. A trillion dollars remains to be spent from the first stimuli, and a further trillion dollars or more is likely.

Some have said that the powerful, V-shaped stock market rally is irrational. When we do the math on the amount of stimulus added into the economy versus the impact of the lockdown, we believe the market’s rise has been rational. Valuation and earnings-growth forecast methodologies are not the only element at play in stocks’ response to macro events. The change in available liquidity is also of critical importance, particularly when the liquidity injections are of the staggering magnitude that we have seen since late March and early April. The market’s response to this liquidity is eminently “rational,” although it is responding to a new macroeconomic situation. All of which is not to say that we may not also be entering a period of heightened volatility. A more sentiment and liquidity-driven market may be more susceptible to rapid change depending on unpredictable changes in those factors, particularly in the highly charged and contentious run-up to a highly charged and contentious election — a situation which to us more and more seems to “rhyme” with the discontent, radicalization, and reaction of the late 60s and early 70s.

After its large rally, perhaps the market is anticipating more rapid economic improvement and more earnings growth than we are likely to see in the near term. If so, this can lead to some profit-taking. We do expect to see more economic recovery signals, yet we also expect to see more layoffs and setbacks for some industries. In our letters, we have discussed how we believe this period of profound change is creating tremendous opportunities for investors. We see many factors that suggest investors who buy healthy, growing companies on the dips in 2020, and hold on (tolerating the volatility) will look back at those 2020 purchases favorably.

Thanks for listening; we welcome your calls and questions.