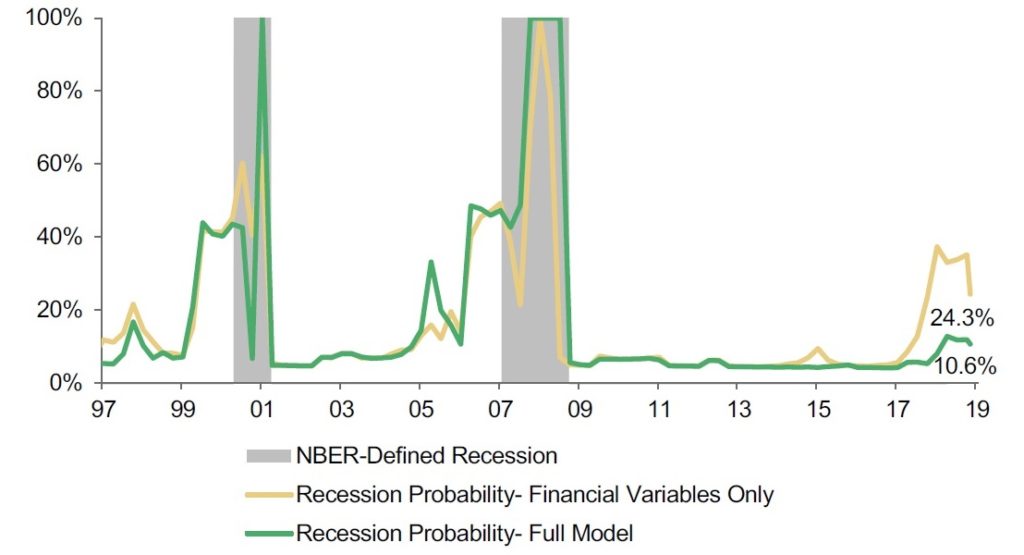

Perceived recession risks continue to tick down, after reaching a flurry over the summer. Morgan Stanley’s recession risk model continues to register lows for the year.

Source: Morgan Stanley Research

They comment:

“Parts of the economy are responding well to the sharp drop in interest rates since January, an indication that insurance cuts are working… For example, we are tracking a positive rebound in residential investment in 3Q19 following six straight quarters of decline. Consumer spending is tracking 2.5% annualized growth in 3Q19, still well above potential, on the back of 4.6% growth in 2Q19. Big-ticket durable goods most sensitive to changes in interest rates are underpinning growth in consumer spending. Growth in these sectors has partially offset weakness in business investment, which has resulted in a more orderly slowdown in the economy as opposed to a sharp drop. These factors and solid readings from the labor market have driven the 12-month recession probability in our models back to even lower levels.”

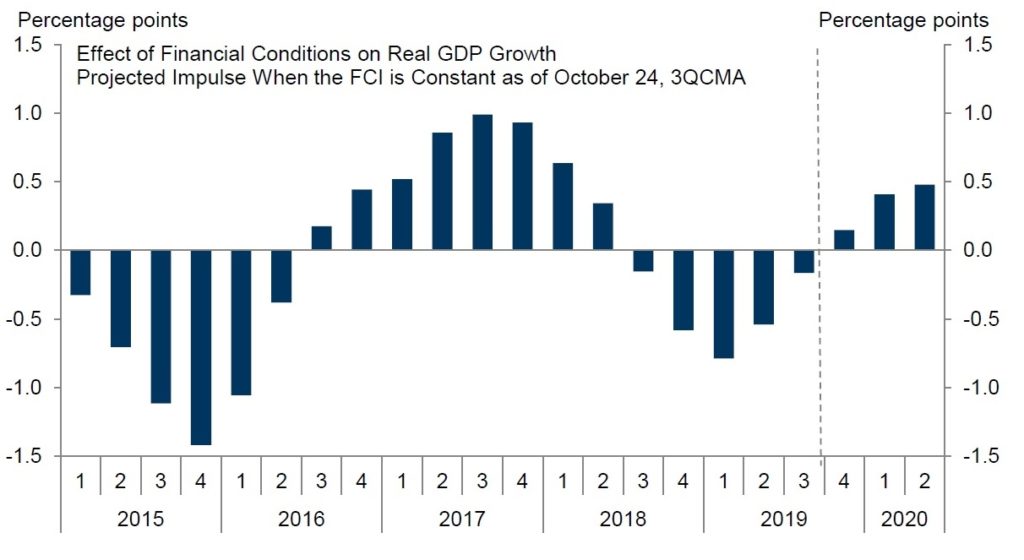

Other positive economic data points have helped allay recession fears: primarily consumer-related, such as September’s employment report, with continued strength and upward revisions for the previous two months. Wage growth was sluggish and inflation expectations muted, but we note that the GDP effects of the Fed’s “mid cycle adjustment” are likely to begin to appear in coming quarters, as reflected in the forward trajectory suggested by Goldman Sachs’ FCI (Financial Conditions Index).

Source: Goldman Sachs Global Investment Research

As Canaccord Genuity analyst Tony Dwyer recently observed, “It is hard to have a full-blown recession with (1) full employment; (2) high small business and consumer confidence; (3) low Household Debt Service Ratios; and (4) a cycle low in Mortgage and Home Equity delinquency rates.” This reasoning is percolating into market psychology.

In our view, the old wisdom of “don’t fight the Fed, don’t fight the tape” is sage counsel at the present juncture. Of course, it’s not just the Fed: globally, central banks are extremely accommodative and telling markets that they’ll remain so. Global PMIs are rising off a trough level of year-over-year positive change. Financial conditions in the U.S. remain unstressed.

There are also a number of positives for U.S. consumers. One medium-term positive we noted last week is the continued growth of the population of Millennials; that demographic group is not yet at its peak size. Millennials will be forming new households and shifting spending patterns to bigger-ticket items in the midst of a period of low interest rates, which will provide a tailwind to consumer spending for years.

Investment implications: Recession fears, while still latent, are out of the headlines. In part this is due to the first signs of improved economic data resulting from the Fed’s interest rate cuts. Many consumer-related data are positive and consumer-oriented companies’ earnings are showing strength (up 6.5% year-over year, even after 2018’s tax-cut boost). We believe investors would be well-served by attention to the resiliency of the U.S. consumer. In general, we believe emerging data suggest that an overly cautious and recession-anxious stance is premature.