European and U.S. Banks: Risks Dampen Investors’ Enthusiasm

As the most cyclical of cyclicals, banks were supposed to benefit from the corner turned in early 2018. Typically, in the mature phase of an economic cycle, as inflation and interest rates are rising, growth is kicking into higher gear, and economic enthusiasm is beginning to move towards exuberance, financials — companies who in various ways facilitate the credit expansion that is the lifeblood of economic growth — should outperform.

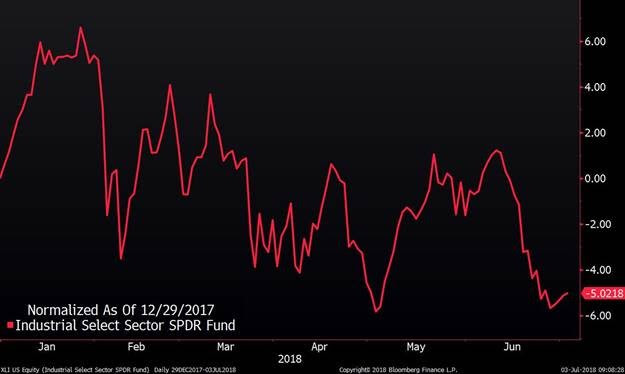

2018 hasn’t worked out as expected in a variety of ways. Investors were optimistic about U.S. industrials early in the year, as they looked forward to a near-term environment of low but slowly rising inflation and a coordinated improvement in economic growth around the world. Instead of following that script, though, U.S. industrials have languished thanks to trade war fears and a strong U.S. dollar. Market anxiety has begun to express the opinion that after nine years, the economic expansion has reached “peak everything” — margins, earnings growth, etc. — and there’s nowhere to go from here except down.

Source: Bloomberg Finance L.P.

The same anxiety has hit financials. In spite of strong earnings growth, regulatory relief, a supportive economic backdrop, and more active and volatile financial markets in which banks’ trading desks could shine, U.S. financials largely disappointed investors during the first half of the year. (The exception was financial technology — companies whose stocks were in demand as the market continued to rotate towards technology growth stocks. We generally regard these companies as a subset of technology stocks, rather than financials.)

Both U.S. financials broadly, and large U.S. banks specifically, have disappointed since the beginning of the year.

Source: Bloomberg Finance L.P.

Many of the same troubles that have afflicted industrials have afflicted financials, but we believe there is another specter at work here — the specter of financial instability risk elsewhere in the world, particularly in Europe and China.

In Europe, there was hope for awhile that the populist tide exemplified by Brexit had run its course, tamed (as populism often is) by stronger economic growth. Back in October we noted signs that this might not be the case — with separatist sentiment in Catalunya and electoral troubles for Germany’s ruling coalition under Angela Merkel. Recently, elections in Italy saw an unlikely coalition of right- and left-wing populists come to power, and the decades-old cooperation between Germany’s two center-right parties is threatening to disintegrate under the pressure of growing support for the populist anti-immigrant challenger party, “Alternative For Germany.” Current polling ahead of elections later this year are suggesting a record showing for the nationalist Sweden Democrats — and this in a country which serves as a byword for Eurocentric, left-leaning policy sentiment in Europe. While many of these upstart parties are primarily focused on immigration, most are also deeply skeptical of giving more power to Brussels. Political chaos in Europe underscores the grave difficulty still faced by Europeans in reforming and recapitalizing the continent’s banks, which remain a key weak link in the global financial system.

The exposure of the U.S. financial system to contagion from potential troubles in Europe is clearly in investors’ minds. We have long noted our belief that Europe remains one potential epicenter of a future global financial crisis. U.S. financials are suffering from investors’ accurate perception that although U.S. banks have “taken their medicine” and are much more prepared for financial turmoil, they are so integrated with the global financial system that they will be far from immune to a crisis originating in Europe.

To a lesser extent, the same is true for the world’s other major source of potential financial risk — China. China’s financial system is of course not as deeply or directly integrated into the global financial system, since in spite of talk about opening, Chinese leaders are loath to give up the levers of economic power that such opening would take away from them. Still, even in the absence of direct contagion, a Chinese financial crisis would have a profound effect on the rest of the global financial system. Current trade-war fears are surely raising investors’ attention to the years-old question of leverage within China’s opaque banking and financial system, and the capacity of the government to cope with stresses.

Investment implications: In spite of the late cycle environment, U.S. banks and financials broadly, outside of innovative, fast-growing financial technology stocks, could continue to underperform even in the face of strong earnings — until some of the overhanging anxieties are addressed. Therefore, at present we are interested primarily in credit card and payment networks, and disruptive, fast-growing financial technology firms.