The Real Source of Wealth

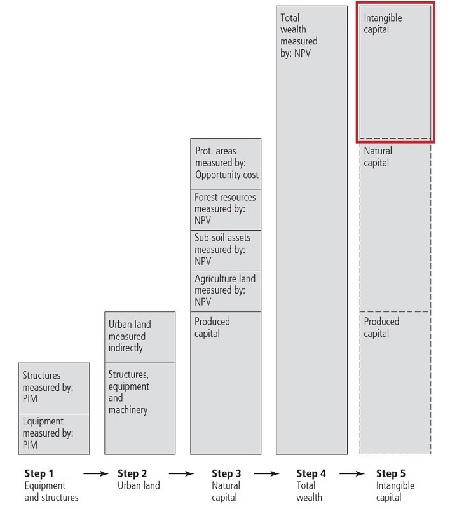

A decade ago, the World Bank published a study exploring the wealth of the world’s nations — specifically, trying to tally that wealth and identify where it resides. (Interested readers can find it here.) In typical World Bank fashion, the authors mined dozens of data-sets. They estimated the present value of the world’s produced capital — buildings, machinery, equipment, and infrastructure — as well as its natural resources, including those that can be exhausted (such as oil) and those that are renewable (such as timber), as well as agricultural land. Together, all those comprise what they called tangible capital, both “natural” and “produced.”

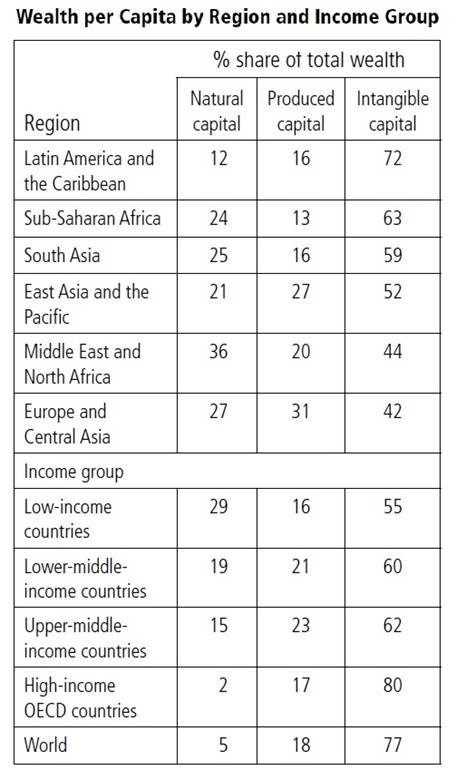

Of course, they knew that the world’s societies also have a great deal of intangible capital — human, institutional, and cultural. The trouble is that there are no good, objective economic tools for measuring this intangible capital. So they hit on a solution: they would measure a country’s total wealth by calculating the net present value of its estimated future consumption. The difference between that total wealth, and the sum of tangible capital they’d already added up, would tell them the elusive value of the country’s intangible capital — how much real wealth is embodied in its store of knowledge, its educational and cultural institutions, its political architecture, and its economic organization.

How The World Bank Calculates Wealth

NPV = net present value; PIM = perpetual inventory method; prot. = protected

Source: World Bank

What they discovered was remarkable and at first blush counter-intuitive — by far the greatest part of the world’s wealth is comprised of this intangible capital. Further, the more developed a country gets, the more of its wealth is intangible.

Source: World Bank

In short, the reason that wealthy countries are wealthy is not because of their endowment of natural resources. Nor is it because of all the built capital constructed by their people over the centuries of their existence — the cities, roads, ports, and factories. It’s mostly because of their human, cultural, and institutional capital — as we are fond of saying in this letter, mostly because of political and economic liberty and the rule of law.

Of course, capital is a critical component in the productivity of an economy’s workers. This is as true for intangible as for tangible capital.

Indeed, the World Bank’s economists did some adroit math — analyzing a range of data-sets to try to decompose the relative influence of different cultural and institutional spheres in accounting for intangible wealth. They found that the rule of law had the strongest effect on intangible capital — so that a one percent increase in their composite rule-of-law index was associated with a 0.83 percent rise in a country’s intangible capital.

In Our View, These Data Prove That Corruption Matters For Developing Economies: Less Corruption Means More Growth; More Corruption Means More Need For Foreign Aid

Per capita intangible capital, for example, is an order of magnitude greater in the United States than in Mexico. That’s why workers are attracted across the border in the face of daunting odds by a seeming force of nature. Just by arriving in the United States, a Mexican worker has enough intangible capital at his or her disposal to out-produce ten Mexican workers who remain at home. This neutral fact could cause discomfort for pro- and anti-immigration pundits alike.

The overwhelming importance of intangible capital has uncomfortable consequences for discussions of development as well. They imply that without the development of political, legal, educational, and cultural institutions, aid to developing countries will not ultimately help them very much — and that with the growth of robust institutions, foreign aid is basically unnecessary.

As investors look around the world — and study trends at home — there is no more important variable affecting wealth and productivity trends in an economy for them to watch.

Investment implications: Trends in the development or deterioration of the rule of law and related political and cultural institutions are the most fundamental component of economic strength or weakness in any country. Such trends are the forest compared with which almost all other indicators are ultimately the trees. Legal and political institutions, as well as economic and regulatory policies, can either enhance or degrade the critical “intangible capital” that makes up most of every country’s wealth, and sets the developed nations of the world apart from the developing. For investors who begin with strategic analysis, an evaluation of trends in this intangible capital in whatever market they are evaluating is a critical foundation for their analysis.