Last week, we discussed the “liquidity supernova” that has helped drive global stock market indices to new highs, even in the face of many potential challenges — new covid variants, dislocated labor markets, supply chain disruptions, ominous geopolitical events, growing cybersecurity risks, uneven growth recovery, fragile internal market technicals, mounting debt from off-the-charts deficit spending, peaking profit margins, prospects of higher taxes, and inflationary pressures that may not be so transitory.

These potential problems among others have had many veteran investors and traders on tenterhooks, waiting for a major correction that has yet to come — and has had many “permabears” decrying the equity market’s run as manipulation and illusion that will inevitably collapse. At any given time, one of the concerns listed above, or any combination of them, could provide the occasion for a correction. Predicting when market psychology will tip into enough worry to precipitate that correction, however, has proven to be nearly impossible. What is possible is to be prepared for it.

We believe that although the liquidity supernova has suppressed volatility, it has not removed the likelihood — and normality — of corrections. However, we believe that those corrections are likely to be sharp and brief; and thus we believe that if investors hold cash, they should do so with an eye to the opportunities that a correction provides.

Preparation to take advantage of a correction is rational. However, we believe that permanent skepticism about risk assets — particularly stocks — on the basis of the concerns mentioned above, or on the basis of the allegedly unprecedented nature of pandemic-era policy, is unwarranted and likely to be very detrimental to an investor’s portfolio.

“Permabears” cite the unprecedented measures implemented in the fiscal and monetary response to the pandemic and see the seeds of disaster. We see seeds as well, but “disaster” is not accurate. We certainly see seeds of change; indeed, they are already germinating. Those changes will be far-reaching and will very likely will periodically induce great volatility. However, to look at those potential changes and see only one possible response — for example, to retreat into precious metals, or into cryptocurrencies, is in our opinion counterproductive, and will cause one to miss profitable opportunities if they are too bearish.

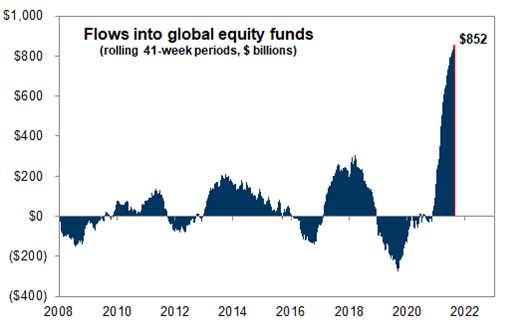

This is a chart from Goldman Sachs’ research that we published in our August 19th letter. To the bears, this might look like an unsustainable spike that portends a collapse. However, data suggest that there remain trillions of dollars in cash on the sidelines and in corporate coffers waiting to be put to work. The flow of money into equities could remain elevated.

A Bubble? Or an Indictment of Fiat?

The permanent skeptics who contemplate a massive “Great Reset” and stock market collapse often focus their argument on the fate of the U.S. dollar. As we noted last week, this is the common denominator of all the extraordinary policies of the pandemic era — and before it, of the years that followed the Great Financial Crisis: those extraordinary policies are nearly universally dollar bearish. Our typical response to such dollar bears is to say, “Yes, but… bearish versus what?” Last week we went through a variety of currency alternatives to the U.S. dollar — the euro, the Chinese yuan, and bitcoin — and noted that none of them is capable of taking the dollar’s place. In the world of fiat currencies, the dollar — for now — remains king.

But let’s take a step back even from that vantage point, and ask the question again — “bearish versus what?” If the dollar is finished, what are the alternatives? We would argue that for the past 12 years — and especially the past 18 months — the prices of many assets (whether real, financial, …or imagined) show quite clearly that there are many alternatives, and the holders of wealth are pursuing them with abandon.

We are not speaking of the U.S. dollar versus other fiat currencies. We are speaking about fiat currencies as a whole versus other assets. Having dollars represents having currency and a medium of exchange, but the U.S. dollar represents a unit of measurement. And that unit of measurement is being systematically debased or devalued along with many other fiat currency units around the globe. The global financial system is quite lubricated with liquidity, and fiat currencies’ use as a medium of exchange remains unimpaired. Their use as a unit of account, and particularly as a store of value is where the question lies.

The asset price inflation we are experiencing means that holders of dollars (and other fiat currencies) have become more and more eager to exchange those dollars for assets. We argue that the eagerness of holders of wealth to seek appreciation and growth (and not care about price or valuation) is an indictment of the fiat system.

So as investors’ wealth is seeking the perceived quality growth and appreciation of the stock market, they have also shown an increasing willingness to spend dollars on some very risky “assets.” The current environment gives many of us seasoned investors pause, and it should remind everyone that when money costs nothing, discipline disappears. However, to just call it undisciplined could be wrong. It could be that dollars spent to buy even more and riskier assets, are signaling even more of an indictment.

One Person’s Bubble, Another Person’s No-Brainer

Frequently we hear that various assets are in bubbles. It has been said of cryptocurrencies and of other novel digital assets, such as NFTs (non-fungible tokens), over the past several years. Often stocks (particularly high-multiple stocks of high-growth companies) are said to be in a bubble by comparison to various historical price metrics; bonds are frequently said to be in a bubble because of suppressed interest rates and the now-explicit backstopping of certain debt and commercial paper markets by central banks such as the Federal Reserve. Housing in various markets is also said to be in a bubble.

It seems there is not “a bubble”; there is a network of connected bubbles. They share a common feature: the prices that fiat holders are willing to pay for them don’t compute with historical valuation models (or, in the case of digital assets, there are no established and accepted valuation models). Who is right — the holders of dollars who are eager to exchange them for other assets, or the historical models? The run-up in price of many asset classes is, again, an indictment of the future buying power of the units of account.

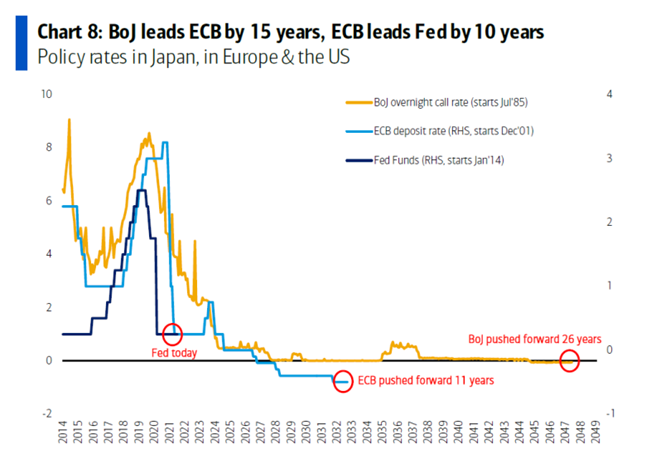

Policymakers Have Told Us the Game Plan

As we noted last week, and as we have often noted in the past, the determination of the managers of fiat currencies to debase those currencies has been well communicated for quite some time. That determination has only been heightened by the debt spree inaugurated by the pandemic, and still ongoing. Their only long-term strategy for coping with that debt, and preventing it from being a crushing burden on economic growth, is to inflate it away in a controlled fashion over a prolonged period. Perhaps we are in the middle of the “Great Reset,” and perhaps the bears should quit waiting for it.

Source: Bank of America Merrill Lynch

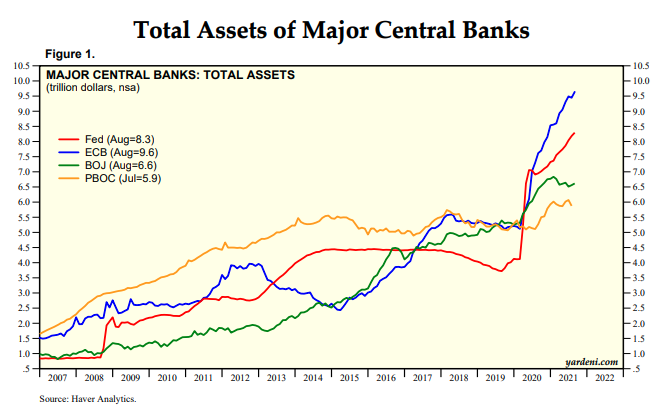

Source: Yardeni Research

So what is one to do? Is this an argument for a single solution on the part of investors who want to survive and thrive under these conditions? By no means. It is an argument for asset management that is open-minded and unconstrained by hard-and-fast rules governing allocations to different asset classes. We believe that legacy asset allocation strategies such as 60/40 portfolios will face significant headwinds in coming years. In different phases of this process, and under different conditions, different asset classes and different asset characteristics will experience more or less demand. Volatility will come from the unwinding of legacy portfolios, and the unfolding of this “new reality” — what we called the “new abnormal” — will be complex, and at times look chaotic. To that end, we recommend staying alert and attentive to your portfolio during this time of great change. Don’t be too rigid in how you believe it will play out. Don’t focus on the manipulation affecting markets as a reason to not invest. As we proceed further, there will be times when precious metals outperform — and times when digital assets outperform — and times when stocks outperform — and there will also even be periods when cash in fiat currency is a good option. Longer-term however, that cash allocation does look challenged in terms of wealth preservation.

What is happening may compromise principles, and look like shenanigans, but we believe that to write off any asset class simply because central banks are using financial and monetary policy to inflate a bubble, is an incorrect course of action. Better to find the bull markets being created. Such as equities. Even in “the new abnormal” in which fiat debasement is proceeding according to plan, stocks have a track record of being an investor’s best friend.

Currency Instability – Not to Be Trifled With

We are painting a very big picture in response to the inchoate feeling many investors have that “valuations are crazy” and that owning equities makes no sense under these conditions. On the contrary: it isn’t merely participation in a mania to own stocks. It is perceiving what we believe is a new acceleration of a highly significant shift in the whole framework of global monetary and fiscal policy.

That being said, we are not saying the process will be smooth. Growing disdain for fiat currencies and an ongoing quest by asset holders to find other vehicles for the storage of their wealth could result in significant volatility among fiat currencies — and that is never a constructive thing, particularly for multinational corporates who have to manage their expenses and income across borders. Foreign exchange moves can profoundly impact corporate profits, and perhaps even more importantly can impact corporations’ or countries’ relative solvency. We do not want to understate the destabilizing effect that the loss of confidence in a particular currency can have. Exchange rates have become geopolitical tools, and we believe we must anticipate the weaponization of currency policy in the future as the Great Reset unfolds.

Investment implications: The Great Reset is not coming; it is already here. Financial authorities worldwide are engaged in subtle and overt forms of financial repression in order to manage excessive debt and devalue fiat currencies in a controlled fashion. The result will be ongoing asset price inflation — the flip side of the debasement of the underlying unit of account. That asset price inflation will benefit different asset classes in different phases of the ongoing transformation. It will call for flexibility and a willingness to allocate according to current conditions and not necessarily according to established, static models. We believe that equities will remain a key component of successful strategies to navigate this epochal change. Investors should not let panic or anxiety keep them from benefitting from the change taking place, but they should definitely pay more attention to the shifting macroeconomic relationships… or seek investment expertise that is paying attention.