Many thanks to those who joined us on our periodic conference call on March 24. We will be editing the call into bite-sized thematic sections and providing the links to you in coming days, to watch or rewatch. If you would like a copy of the slide deck that accompanied the presentation, you can find it here.

In addition, we’ll be making another presentation at 10 AM Pacific on May 5 — the day after the Fed’s May 3–4 Open Market Committee meeting. We’ll be discussing the behavior and fate of the U.S. dollar, in the context of all the crosscurrents that are now affecting it, from inflation, to Fed policy, to geopolitics. To register for this event, please click here.

Many of the questions our listeners had to ask during our recent call centered on the dollar, so we’d like to give some more time to addressing these questions.

Unfolding Events in Russia — and Global Inflation

Yesterday, Russia’s chief negotiator in the ceasefire talks with Ukraine made the following statement:

“[On March 28], for the first time… the authorities in Kiev… handed us on paper the principles of a possible future agreement, which provides for: a rejection of entry into NATO, fixing Ukraine’s bloc-free status, [and] a renunciation of nuclear weapons and other weapons of mass destruction…”

The fog of war and Russia’s penchant for propaganda limit the reliability of this statement, but we think it’s probably in the vicinity of the truth. To listen to the Russians tell it, they’ve almost achieved their goals; to listen to the Ukrainians tell it, they’ve stymied the invaders at every important step.

Markets Have Discounted Ukraine… But What About Sanctions?

What’s significant to us, in any event, is this: markets have clearly taken a sanguine view of events in Ukraine, namely, they have discounted the risk of the war spilling over into a disastrous wider conflict in Europe. However, what is less clear is the resolution of sanctions. The suite of sanctions enacted against Russia by the west — though notably not by India or China — threatens to prolong the inflationary heat added to the global economy by the war, and there is no clear off-ramp for these sanctions, particularly with the level of heated rhetoric emanating from some western capitals. Even if, as we believe, it is likely that the war in Ukraine declines in intensity and reaches an uneasy equilibrium, the inflationary consequences of the sanctions regime are likely to continue.

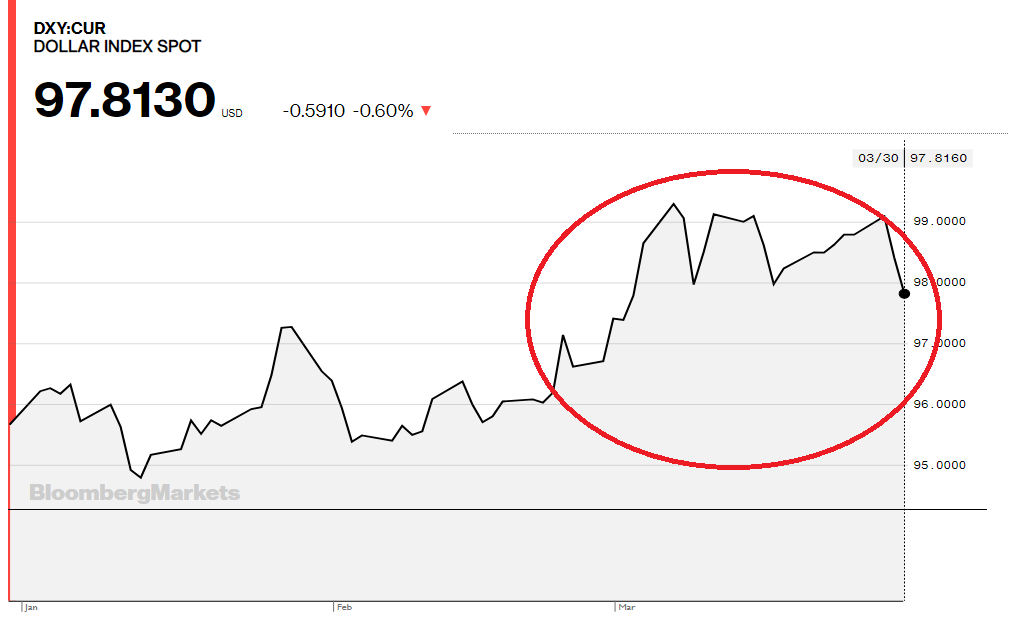

What’s also significant to us is the behavior of the U.S. dollar thus far during the hostilities.

What’s Happening With the U.S. Dollar?

Typically, with existential risks in global investors’ minds, we would anticipate a strong U.S. dollar rally; but since the beginning of the first major European land war since 1945 — one that poses the small but real risk of nuclear confrontation — the U.S. dollar DXY index has managed a rally of only about 1.7%.

Source: Bloomberg, LLP

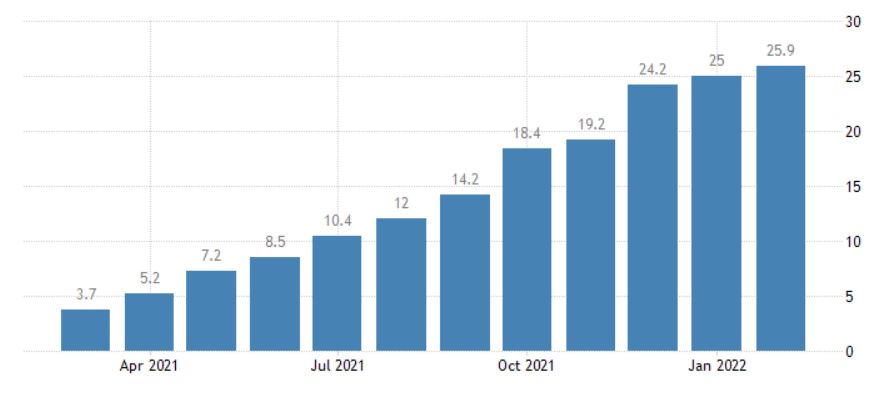

At the same time, U.S. inflation has continued to accelerate, and German inflation is accelerating even more rapidly, hitting a 40-year high at its most recent reading. Producer-price inflation in Germany just hit a jaw-dropping 25.9%.

Source: tradingeconomics.com

Europe’s industrial heartland remains highly dependent on Russian gas, and a standoff has emerged, with Russia demanding gas payments in rubles, and Germany refusing. A German labor leader commented, “Exploding energy prices, but above all a possible gas embargo, would hit energy-intensive industry — the mother of the industrial network — hard… The consequences would not only be reduced work hours and job losses, but also the rapid collapse of the industrial production chains in Europe — with worldwide consequences.”

In this context — one of a very likely European recession, regardless of the cessation of hostilities in Ukraine — we would expect the U.S. dollar to stage a stronger rally, particularly against the euro. Why isn’t it? And perhaps a question equally as sharp: If this is the best the dollar can manage under conditions that we’d imagine are so favorable to it, how could it behave under unfavorable conditions?

It’s apparent that inflation in the U.S. — particularly food inflation — is causing inflation expectations to become unanchored. Food inflation has a particular tendency to have this effect, due to its existential significance for lower-income consumers. Those consumers are seeing their real purchasing power sharply eroded as the cost of necessities sharply outstrips wage growth.

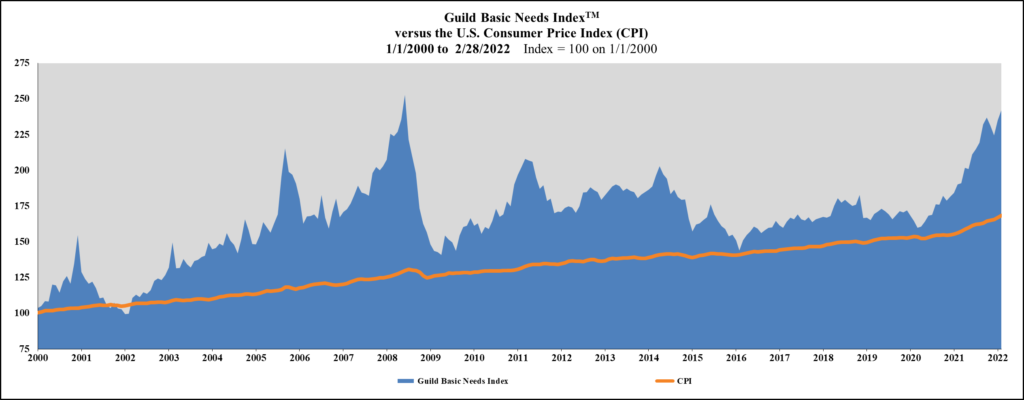

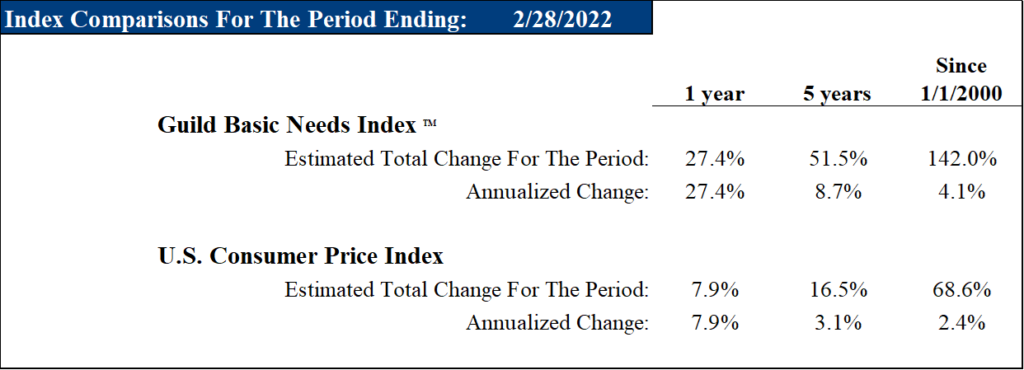

Our regular readers will know that our in-house real-world inflation gauge, the Guild Basic Needs Index [GBNI] has been registering elevated readings — and this is precisely the kind of inflation that’s stripped out of CPI numbers but that confronts ordinary Americans as they procure the food, shelter, clothing, and transporation they need in their daily life.

Note that the current 27.4% reading on the GBNI does not include March’s scorching numbers for gasoline, natural gas, and wheat — we will update the chart with those data next week.

Further, the fundamental argument underlying the argument for long-term dollar strength is the conviction in the dollar’s enduring long-term role as the world’s unchallenged reserve currency.

While we agree with this conviction, there is no doubt that current events are converging to sow seeds of doubt in the market hive mind. Much depends on the willingness of the Federal Reserve to stay the course of its telegraphed rate rises and liquidity withdrawal — even if it finds itself tightening into the teeth of market turbulence or a recession. It may be that market participants are less than certain that the Fed won’t blink.

Large-Scale Historical Shifts

Further, current events also suggest that longer-term, more tectonic processes may be at work. We noted above that China and India have both demurred from joining the western sanctions regime against Russia; the same is true for economically significant African and Middle Eastern countries.

The U.S.’ action in weaponizing Russia’s foreign exchange reserves an important early shot fired in a different kind of war — one that far eclipses Ukraine in long-term significance. That shot has sharply accelerated the fracture of the world’s financial and monetary systems into a new multipolar framework. This process has been underway for some time — but it has been given a new impetus, and the pressure of circumstances is forcing its rapid evolution.

We are still very far from a “petroyuan” dethroning the “petrodollar” — but the window of acceptable mainstream opinion has decisively shifted towards awareness of these long-term concerns. The mainstream institutional media is far behind the curve in perceiving the impact, and is always late in picking up on such things — but it is finally beginning to do so.

Crypto and Gold

Of course, crypto has been front and center in this discussion. One questioner during our call asked whether we see the probable rise of gold-backed cryptos. This is a different question than one we often hear — “do we think any currency will return to the gold standard” — to which our answer is a convinced “it’s very unlikely.” Nation states are eager to use their currencies to pursue control of their own economy and greater hegemony in trade — and a gold standard would hinder them in those goals.

Gold-backed cryptos, however, already exist, the most prominent being the Ethereum-based Paxos Gold token, PAXG, which is backed by audited gold reserves in London. PAXG can be bought 24/7 from the comfort of wherever you sit with your smartphone. More such instruments will certainly be created at an accelerating rate in coming months and years. They will be blockchain-based tokens tied to various hard assets — real estate, land, collectibles, and more. In a world that seems to have turned the corner into a new inflationary era, in which the traditional indexed 60/40 portfolio looks increasingly challenged if not irretrievably broken, DeFi (decentralized finance) will offer individual investors simple access to a world of alternative investments — with all the attendant risks and opportunities.

We look forward to discussing all these topics in greater depth during our May 5 call, and hope to see you there.