Reading time: 3 minutes

For many years, Guild has compiled and tracked a neutral inflation index which we call the Guild Basic Needs Index™ (GBNI). We designed it to be a simple analysis of the real state of the inflation experienced by consumers — an unchanging basket, unmanipulated by rebalancings, “hedonic adjustments,” and other statistical and theoretical jiggery-pokery — keeping consistent weightings of items such as milk, beef, wheat, cotton, retail gasoline, natural gas, rent, and home prices.

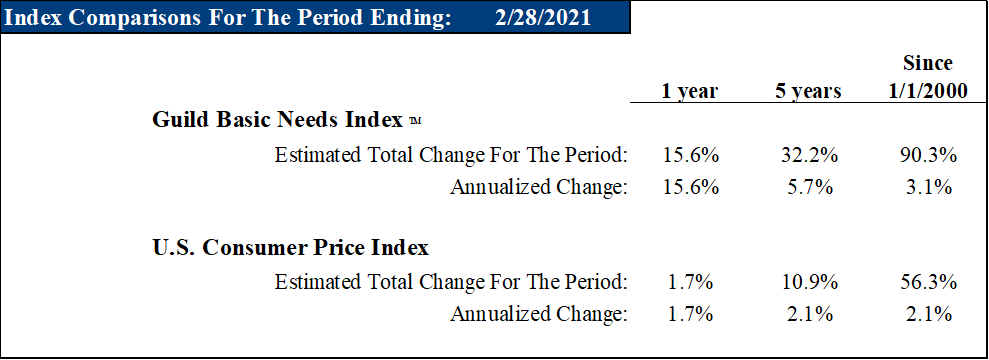

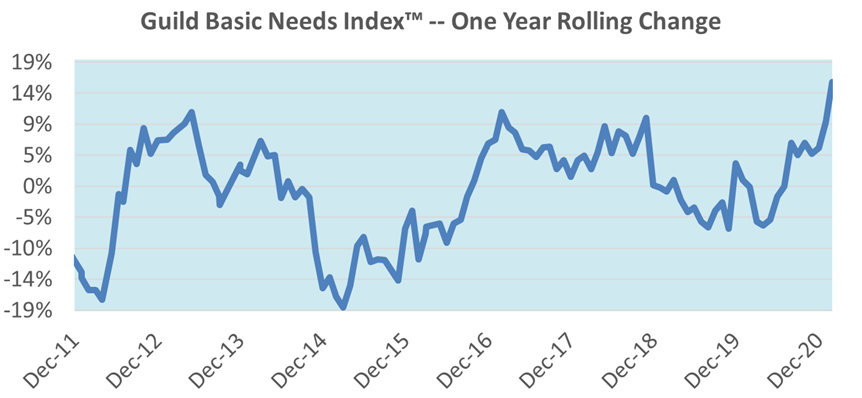

As you could expect, this index has been advancing quite rapidly recently, as of the end of February registering a 15.6% year-over-year rise, compared to the 1.7% rise in the U.S. Consumer Price Index over the same period. Over the last five years, the GBNI has risen at an annualized rate almost three times that of the Consumer Price Index.

That year over year rise is the fastest uptick in nearly a decade — although there was another rapid acceleration in the expansionary period that began in mid-2016.

While this is not unexpected, we note that the past-year data begin in February, 2020, and it will not be until next month that they include the beginning of the pandemic crisis. So we can be sure that the year-over-year rise in the Index will increase sharply as the last-year inception progresses further into 2020.

After all, we still have to lap that remarkable day last April 20 when crude oil traded at negative $39.70 per barrel — an occasion extraordinary enough that we captured a live screenshot:

About the Guild Basic Needs Index

Guild Investment Management has long believed that the existing indices used to measure cost of living changes in the United States are inadequate and misleading.

For instance, the widely quoted inflation index, the Consumer Price Index, is currently based on data collected from spending surveys given by the U.S. Bureau of Labor Statistics from approximately 14,500 urban families. In addition to basic needs, the CPI includes other expenditures, such as insurance and taxes. However, it also includes discretionary spending items such as personal care services and entertainment purchases such as the latest flat screen televisions and consumer electronics.

Another point about the CPI is that the Bureau of Labor Statistics periodically alters its content, making adjustments to the weighting of the components, and smoothing seasonal patterns. Such tinkering with data, as we have mentioned over the years, usually results in an understatement of the inflation rate and creates an unreliable, misleading cost of living index.

We believe a simpler index is necessary for tracking the price changes of basic needs. No such index existed, so we created one: the Guild Basic Needs Index (GBNI). The GBNI will not reflect spending patterns of one segment of the population. Rather, it will measure the changing prices of essential living expenditures. Another key differentiator between the GBNI and the government’s measures is that the components of the GBNI do not change. They are not adjusted, statistically smoothed or manipulated.

The GBNI concentrates on four fixed categories of primary and essential living needs. Each category is assigned a specific percentage of the overall index:

- Food 30%

- Clothing 10%

- Shelter 30%

- Energy 30%

Food, clothing, and shelter are self-explanatory, and energy is needed for basic heating, electricity, cooking, and transportation. The categories and their values within the GBNI are fixed, unlike the government indices. There is no tampering — no seasonal adjusting, smoothing, or replacing of components.

Investment implications: While official inflation statistics continue to show subdued inflation, the Guild Basic Needs Index — which is constructed to avoid the kind of manipulation that characterizes many of those official statistics — shows that consumers are experiencing real inflation already. In short… inflation is not coming; it has already arrived, and it will be going higher. We will resume updating you on the Guild Basic Needs Index on a regular basis.