After a brief moment of optimism (intoxication?) after Fed Chair Powell took 75-basis-point rises in the Fed funds rate off the table, stock markets accelerated their decline.

The damage to stocks is more evident internally than externally. On the surface, the correction has only started getting to the broad indices. Under the hood, the damage is deeper: 70% of S&P 500 stocks, and 85% of NASDAQ stocks, are below their 200-day moving averages. A lot of pain has already happened.

There are some external factors at work here, and these may be ushering in some structural changes to global finance and economics that are important to pay attention to: the reversal of economic and financial globalization; the replacement of just-in-time inventory systems with a just-in-case system (i.e., make sure the inventory is here on time by reorganizing our supply chain to be dependable, although more costly); volatility exacerbated by the suddenness and size of pandemic policy responses; ominous geopolitical developments in Europe and Asia; the long-term consequences of over-indebtedness among companies and countries.

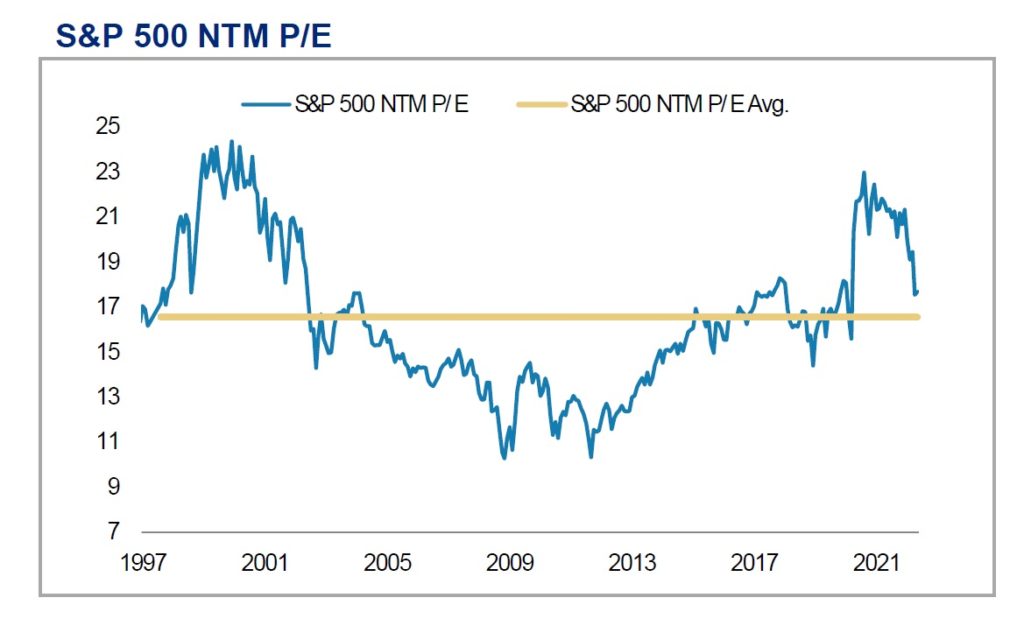

But still, what is happening right now is altogether simpler, and in a way, that’s comforting. The Fed is raising rates and reducing liquidity by allowing assets on its balance sheet to roll off. Interest rates — the “cost of money” — are the fundamental market-wide variable governing how much investors are willing to pay for a company on the basis of its earnings (that is, the P/E ratio, or price-to-earnings multiple). As interest rates rise, that number, for the stock market taken as a whole, will fall. We believe it will fall back towards historical norms, indeed, it already is doing so. Layer in the anticipation of decelerating earnings or a potential recession, and the price contraction is even sharper.

Source: Morgan Stanley Research

The central message to investors is this: what is happening is not outlandish; it is normal and expected. Indeed, it is actually creating opportunities to buy high-quality assets when their prices have declined to sane levels in accord with historical norms and prevailing industry conditions. Many high-quality assets will see their prices decline below those sane levels, presenting particularly appealing opportunities.

We have been expecting and preparing for an environment of “rationalization” by markets since we determined in early 2021 that the disinflationary trend of the past two decades was likely to be replaced by a new inflationary trend. We have focused on companies with strong balance sheets, real growth prospects, and strong thematic positioning — neither “giving up” on the tech innovation that will continue to drive value in coming years, nor ignoring the signs of the times that suggested raising cash and commodity positions to meet coming inflation and volatility. We have also increased cash for clients’ accounts. This cash provides some protection from depreciation of assets and provides a source of funds to buy when prices become extremely attractive.

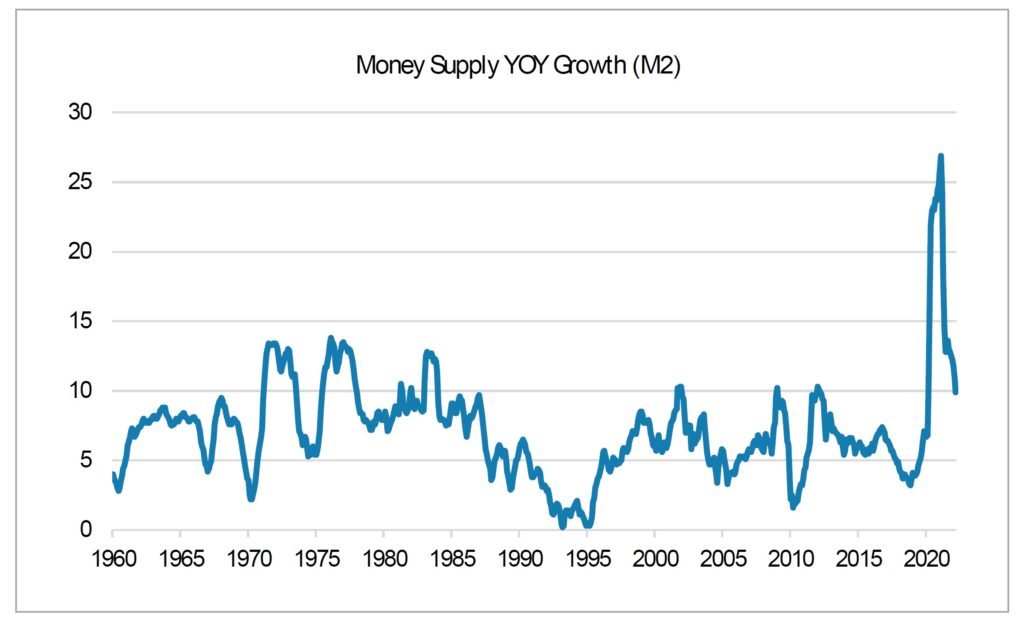

What’s happening is simply the result of a hangover. Extraordinary monetary policy made the financial system flush with liquidity, which was used to bid up stock prices — and in the last stages of this process, all sense of proportion, caution, and historical norms was cast aside. We saw a humorous clip from financial TV in which a hedge fund manager who was being interviewed about a particular stock was caught flat-footed by the interviewer’s question, What does this company do? — a question to which he had no answer at all. This sort of thing happens at the peak of a market mania driven by abundant, artificially cheap liquidity. As usual, what matters most is the second derivative, the deceleration of money-supply growth, and that has been dramatic… and the drama is set to continue.

Source: Morgan Stanley Research

Now the punch bowl is being taken away from the party, sirens can be heard faintly in the background, and sobriety is beginning to set in. Note the word beginning. Our firm has an institutional memory of the inflation-driven bear market of the 1970s. We believe that a market-level bottom still needs to be found — simply because more pain remains to be inflicted on some industries by rising rates if the Fed is even going to approach making good on its stated intention to deal with inflation.

And while inflation is likely peaking now, we believe, as we have said for some time, that it will not return to the pre-pandemic 1–2% norm for many years. If inflation is indeed peaking, it is happening more slowly than some had hoped — Wednesday’s 8.3% year-over-year inflation print is uncomfortably close to last month’s 8.5% pace, and removes the immediate prospect of a shift of the Fed stance to “good cop” mode.

The “Fed put” — when the Fed blinks and stops tightening because of market chaos or fear of job losses — still exists, but it is likely lower than many assume; not gone, but indefinitely delayed. The more relevant “Fed put” is likely connected to the stability of credit and job markets — and a dislocation there would probably elicit a more rapid Fed response.

A Bear-Market Strategy

Patience is the watch-word. The P/E chart above shows the extent to which valuations have already declined. However, it’s important to bear in mind that this is a market-wide chart, concealing wide variation among industries and individual companies about what constitutes an attractive valuation.

The sharp decline in market-level valuations points out a notable characteristic of contemporary markets: the prominence of passive investing, which now comprises most of market flows, means that in a period of liquidation such as we are now experiencing, good companies will get sold off indiscriminately with bad. After the dust settles, Mr Market will get sober and realize that certain companies were pushed down with the broad market to valuation levels too low for their fundamentals. Our job is to find these opportunities before Mr Market’s moment of sobriety, and we are already identifying them.

Innovation and Mean-Reversion

The current swoon may be setting up a once-in-a-decade opportunity. We have seen this movie before, and it is not fun to watch — but value is being created. We do not favor moving portfolios totally to cash, because we believe that there will still be tactical opportunities and worthwhile long-term defensible holds even in the midst of a general liquidation. Further, in an inflationary environment, holding cash is in itself risky and costly.

Reversion to the mean is a reality. We mean no disrespect to ARK Invest and its management when we point out that on a five-year basis, the performance of the ARK Innovation Fund, a flagship of the most prominent tech innovators and disruptors, has now fallen below the S&P 500:

That chart is itself a perfect visual representation of mean reversion. However, it’s important to remember that the market is not the economy; and the economy is not the current stage of the economic cycle. Just as in the Dot Com bust — perhaps even more so — among the present-day stock-market wreckage of decimated innovators, there remain companies that are at the forefront of the technological transformation of the world through networking, digitization, automation, and artificial intelligence. Many of these are components of ARK’s funds, and will become new Amazons and Googles in their respective industries — but not before they’ve endured more exile in the wilderness.

A Quick Note On Crypto

We have watched the implosion of LUNA and UST with interest. LUNA is the native token of the Terra network, a decentralized finance ecosystem and home of the third-largest stablecoin, UST — a stablecoin allegedly pegged to the US dollar. At this writing, it is trading at about 62 cents, having fallen a few days ago to 30 cents. It may yet go to zero. UST is an “algorithmic” stablecoin — backed not by fiat reserves, but by a mechanism which creates arbitrage incentives between UST and LUNA as a way to maintain parity with the dollar. Needless to say, that mechanism failed. You can be sure that regulators are watching closely and drawing two conclusions: first, that they can’t let things like this assume structural importance in the US financial system; and second, that they need to regulate stablecoin issuers as quickly as possible. To us, the takeaway is simple: the wild west days of crypto are ending, and the regulators are coming. As we have said for years, we believe this is a good thing. Regulators aren’t perfect, but they are necessary, and financial history shows the disasters that can unfold in their absence.

Investment implications: Multiple contraction alone on the basis of rising rates suggests a 3800 target for the S&P 500, approximately a 5% further decline. However, should earnings disappoint, or more signs of recession appear, a deeper market-wide decline would likely be in the cards. It is not yet time to sound the “all clear.” We could have a choppy or lower market with some rallies and declines until later this year, when the market has had a chance to see how much corporate profits will be impacted by the ongoing inflation, and which industries will be hurt and helped by inflation. It will gradually become clear whether we’re entering a multiyear bear market, or simply enduring a deep correction within the market’s many-decade upward trajectory.

Identify the forces that are inducing the bear-market action — and avoid the areas most exposed (Europe; China; participants in the economy who don’t have pricing power and who are suffering from rapidly rising costs). Work your way outward from there; as you get further beyond the darkest danger spots, you’ll find “opportunity zones” that can endure the bear cycle, and even some that will benefit. If you haven’t seen our video from last week, we discuss these areas. Of course, there are times when NOTHING works, even if you avoid the riskiest areas — which is why cash in your allocation has utility.

The reason you have to maintain some optimism is that the movement of fear and negative sentiment from high to neutral can seemarkets rally a lot, long before sentiment is actually bullish. On the positive side, as we have noted, some real bargains are starting to appear and we are refining our buy list of companies we believe have strong long-term prospects.

However, the coming bull market, when it emerges, is unlikely to be a QE-driven bull market like what prevailed from 2009 to 2021. Because it will be based more on economic, revenue, and earnings growth, it will be choppier, more volatile, and more company-, sector-, and industry-specific than the previous bull market. We believe elements of the commodity complex, such as food and battery minerals, will be attractive. Once they bottom, gold and bitcoin will remind people that their fiat currencies have political importance, but little real economic discipline underpinning their value.

Future growth areas — all under the rubric of “growth at a reasonable price” — will include software, disruptive technologies, semiconductors, fintech and defi, and cybersecurity, among others. When investing in innovation, focus on influential, substantive innovations — innovations that most deeply affect standards of living, and are important to further real-world technological and economic progress. In short, not mere novelty items; this is where patience might be required.

Moving forward, strong margins and balance sheets are likely to draw more attention than they did in an era where investors focused somewhat myopically on revenue growth.

We believe high inflation in food, clothing, shelter, fuel, and other consumer necessities, combined with wages not keeping pace with inflation, will weaken discretionary consumer spending. Supply chains will remain a point of difficulty and concern, and the process of reshoring and the transition will continue for years.

Thanks for listening; we are hard at work to find the best positioning for the future, and welcome your calls and questions.