If you are a market participant who can’t shake the feeling that you have lost your touch for anticipating market behavior, you are not alone. We have taken to simply reminding investors that corrections can come at any time, which has always been true but has never been more important to remember.

The 18 months since the bottom of the pandemic crash have seen an extraordinary market advance, and every step along the way, veteran traders have sensed that a major correction was around the corner — whether on the basis of technicals, fundamentals, or old-fashioned tape watching.

Last week was a case in point, with a wobble in the early part of the week suggesting to many that the market’s anticipation of a taper announcement from Jackson Hole was about to cause the long-awaited correction. Instead, the wobble stabilized and the market’s advance resumed. A monthly chart of the SPDR S&P 500 Index Fund [SPY] shows how the pre-pandemic trend has inflected upwards in the wake of pandemic monetary and fiscal policies.

Source: Finviz

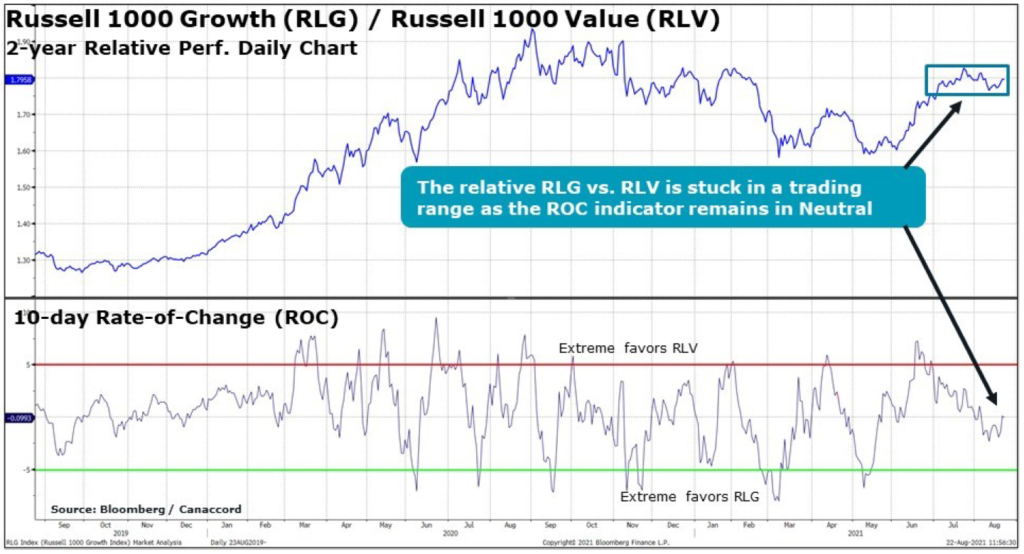

The broad market’s advance has seemed irrepressible, in spite of ongoing challenges. It has of course concealed significant intra-market volatility and sector rotation. Sentiment has moved back and forth especially between pandemic beneficiaries such as mega-cap tech stocks and digitization beneficiaries, and cyclical stocks which would benefit from more-than-transitory inflation. This tug of war continues, as illustrated by the current sideways action of the following chart, which measures the relative performance of the Russell 1000 Growth and Russell 1000 Value indices:

Source: Canaccord Genuity

Now, the long-awaited Fed meeting at Jackson Hole is upon us; Chair Powell will be speaking on Friday, and indicating (or not) the Fed’s intention to taper asset purchases (or not). Our guess is that while the event may occasion volatility, it will not be a catastrophe.

Indeed, as we noted in recent weeks, the Fed has been engaged in other technical activities to manage the liquidity in the U.S. financial system that are below the radar of many market participants who are narrowly focused on the most superficial and “newsworthy” policy actions. Usually those policies are deemed newsworthy and get the most attention because they are generally understandable, whereas other technical policies are more difficult to compress into a news article that can be read and understood in two minutes. As we have been saying for some time, liquidity growth has already peaked and has begun to decline, in spite of the Fed’s ongoing asset purchase program.

Further, there are many other factors at work in the chaotic system of U.S. financial markets and policy. (And we mean “chaotic system” not in a pejorative but in a mathematical sense, as it is a system where a slight change in inputs can result in an unpredictable change in outputs.)

For example, in the run-up to the conflict that seems likely to occur over the raising of the debt ceiling, the Treasury has been spending down its “rainy day” fund, and will need to replenish it after that conflict has run its course (which it surely will). That replenishment could have consequences. As London asset manager Man Group noted on August 17:

“If private sector market participants still have any ability to anticipate future developments, then we are likely near the point where investors begin to reduce their rates positions to make room for the increased issuance that would take place the moment the debt ceiling rollover happens. In due time, this should have an impact asset prices that depend on long-term yields.”

“Asset prices that depend on long-term yields” is a rather large set. It includes everything from cryptos and highly appreciated growth stocks, to the value of the gold underground that won’t be mined for a decade, to the value of your house.

All of this is to say simply that the extraordinary transformation of fiscal and monetary policy ushered in by the pandemic has made it more important than ever to follow the data — as Sergeant Friday said at the top of this article, “Just the facts.” But which facts? That is the question.

As we suggested above, there are many facts which, in a chaotic system, can have significant consequences. However, there are overarching themes which remain relevant and condition the market’s chaotic responses to changing inputs.

We wrote last week about the market’s lack of response to the geopolitically critical unfolding chaos in Afghanistan, and pointed out the massive inflows into U.S. stocks — fueled by monetary and fiscal policy, at a pace far outstripping the trend of the past two decades. We noted the deep conditioning of market participants to buy every dip, predicated on their perception that policymakers are committed to the support of asset prices. This theme is deeply entrenched; indeed, it is existential for U.S. policymakers.

Eventually, something will happen to break the conditioning of market participants; however, we don’t believe that “something” is imminent.

What is it likely to be? In our view, as we wrote last week, the likely culprit will be the erosion of global reserve status for the U.S. dollar, driven ultimately by fiscal irresponsibility at home, and loss of U.S. military hegemony abroad. However, as we also noted last week, our constant question remains, “What could dethrone the dollar?”

The simple truth is that there is no currently viable alternative — not another national currency, not a central bank digital currency, not a private-sector digital currency, not a decentralized cryptocurrency. The expression “TINA” — “there is no alternative” — is often applied to stocks in an era of repressed interest rates. Perhaps it is more aptly applied to the U.S. dollar.

Next week, we’ll do a deeper dive about potential dollar challenges, what the risks are, and what we’re watching for as we continue into uncharted seas — and where investors should begin to look for shelter when trouble gets closer.

Investment implications: There are, and for 18 months have been, countless reasons for the market to go down, and many brief periods of weakness followed by continuing strength. Market leadership has rotated through different thematic and sectoral groups. Throughout this time, the overwhelmingly significant reality has been the inflows to U.S. stocks facilitated by pandemic policy driven liquidity. Many investors are becoming increasingly anxious about the likelihood of a coming correction, created by a Fed policy announcement or action, a geopolitical event, or simply as a result of technical excesses. Of course, as has always been the case, a correction can occur at any time. We believe that under current conditions, corrections are likely to be sharp and briefer than has normally been the case. We believe policymakers remain committed to supporting asset prices, and the long-learned habit of investors to “buy the dip” remains a sound one.