As we enjoy the Thanksgiving holiday and the usually quiet half-day of trading that follows on Friday, a few notes on current events of potential significance that we are watching.

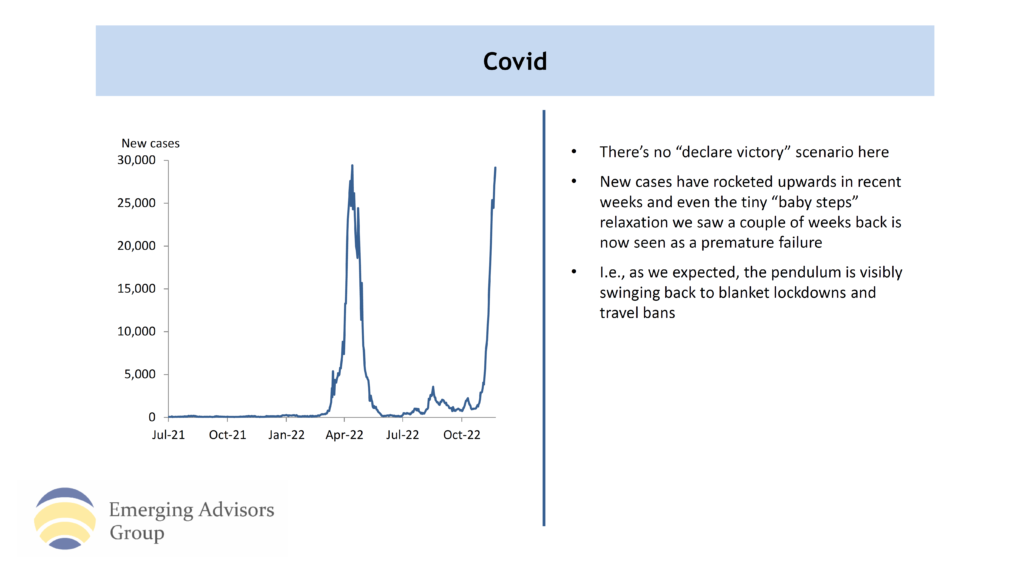

First, China. Due to China’s central role as an engine of global commodity demand, sentiment in world stock markets can ebb and flow with news and rumors about the status of the country’s “covid zero” policy. Even a hint of that policy being tweaked, or of an unexpected flare-up of covid cases in a major city, can cause ripples.

Source: Emerging Advisors Group

We would caution observes not to put too much hope in a rapid rollback of restrictive policies. From what we have been able to learn, the Chinese regime views its covid policy as a resounding success, and routinely trumpets how much better it has been than most of the rest of the world — attributing millions of saved lives to its draconian measures.

We have a number of thoughts about this; while it does not seem to be pure propaganda — that is, it seems that many in China’s ruling elite really believe in the superiority of their approach — it certainly is coherent with the general trend visible in China of regime retrenchment, centralization of power, and suppression of the country’s billionaire tech and property class. The priority of China’s rulers no longer seems to be to pursue growth, but to ensure that those who have been able to secure vast wealth in the go-go years of “capitalism with Chinese characteristics” have their wings clipped. We would not get too excited about an imminent end of “covid zero” and view real relaxation as unlikely until later in 2023 — though of course we could be wrong. The unfolding of this process will have a profound impact on the global commodity complex and on the U.S. dollar; world stock markets will also respond to every soundbite of news about the state of covid in China (rising cases, changes in policy, etc). We’ll bring you news as we hear it.

Second, Vietnam. Increasingly, we believe attention is due to Vietnam as a manufacturing hub proximate to China, and close to Asian tech supply chains — still run by authoritarians, but more congenial to foreign capital and enterprises who are looking for opportunities beyond China’s increasingly hostile and inward-focused political stance. Many manufacturers have set up operations in Vietnam in the years since relations between China and the west began to cool. Despite Vietnam’s communist government, recourse to the country, we believe, counts as a form of “friendshoring” — locating capacity in more reliable jurisdictions. It is worth paying attention to.

Third, the renaissance of industry in the United States. The corollary of friendshoring is reshoring, of course. Recently we noted a comment that over the past two decades, manufacturing as a portion of U.S. GDP has fallen from 27% to 12%. Until a few years ago, the conventional wisdom was that this was an inexorable and irreversible structural change in the U.S. economy — but now that conventional wisdom is no longer obvious. Instead, geopolitical events, an increasingly aggressive geopolitical stance from China, and its internal shift away from the post-Mao embrace of free markets, are all pointing towards a renaissance of U.S. manufacturing. Globalization and offshoring were deflationary; relocalization and reshoring will be inflationary. This will be one more macro element leading to higher inflation in coming years.

This process could become a multi-year tailwind for smaller regional builders and infrastructure contractors who enable the expansion of domestic manufacturing. (We would steer towards regionals — for example, those who build warehousing and light- and medium-industrial capacity — rather than multinationals; smaller firms will tend to experience less competition with large government projects.) The benefit will accrue primarily in business-friendly jurisdictions within the United States.

Thanks for listening; we welcome your calls and questions.